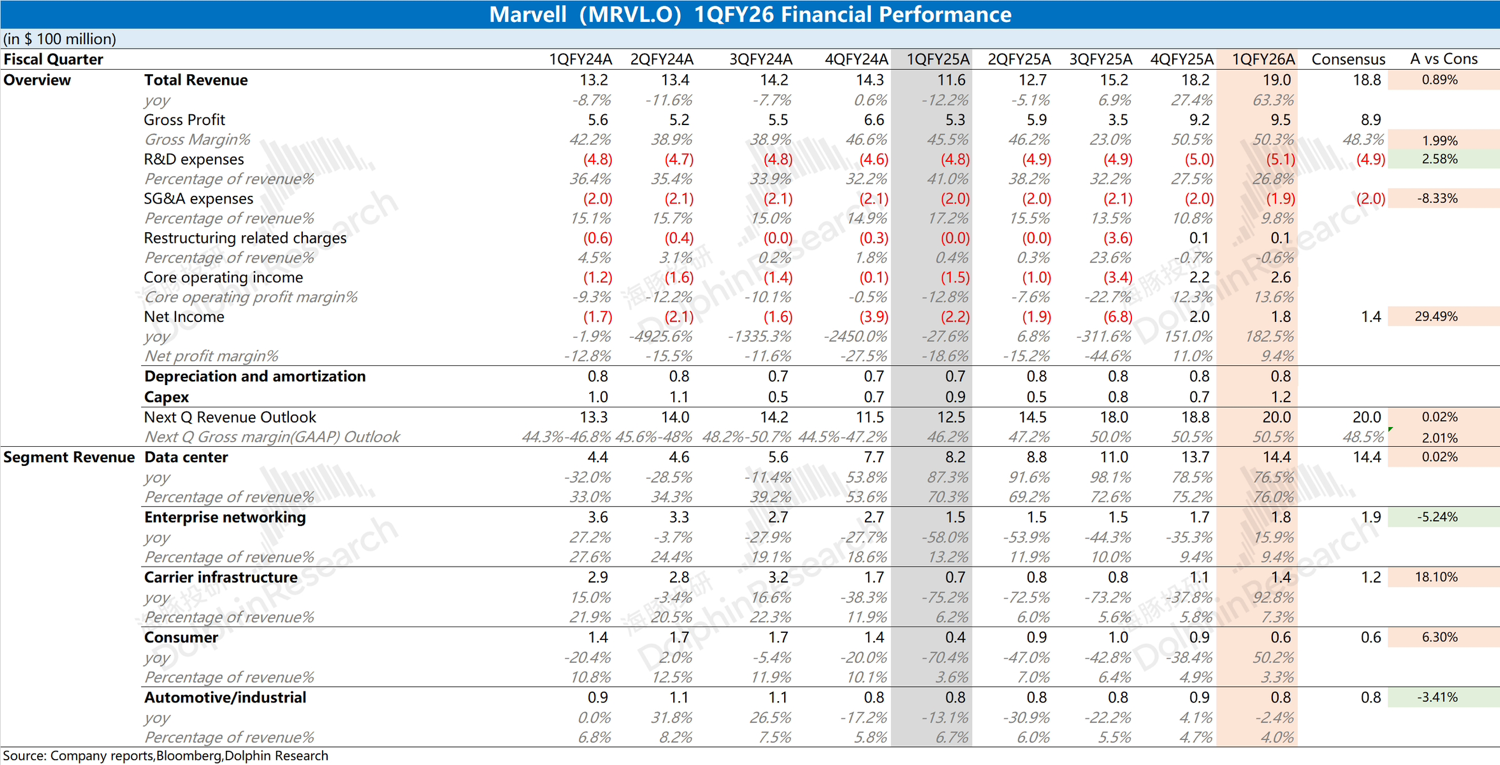

Marvell 1QF26 Quick Interpretation: The company's revenue performance this quarter met expectations, with growth primarily driven by the data center business and a recovery in the operator infrastructure business. The gross margin appeared to exceed market expectations, but was significantly impacted by the amortization of acquired assets under GAAP. After adjusting for acquisition-related amortization, the adjusted gross margin was 59.2%, down 0.3 percentage points sequentially, which was also largely in line with expectations (for details, see Dolphin Research's follow-up content).

The company's guidance for the next quarter is moderate. It expects revenue of $2 billion, up 5% sequentially, in line with market expectations. As current revenue growth is mainly driven by the data center business, the AI business does not show any unexpected improvement based on the growth rate for the next quarter.

For Marvell, the focus is on the performance of its AI business and its operations in China:

1) Most of the data center business revenue currently comes from AI, mainly including custom ASIC chips and optical module chips. This revenue is primarily benefiting from the mass production ramp-up of Amazon's Trainium 2 chips. Dolphin Research estimates the company's AI revenue this quarter at around $830 million, largely in line with previous expectations.

2) Due to U.S.-China tensions, the market is also concerned about the company's business in China. China remains the company's largest revenue source, accounting for 40% of total revenue. The current financial report does not disclose specific details about the China region, so further attention will be paid to management's communications.

$Marvell Tech(MRVL.US)The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.