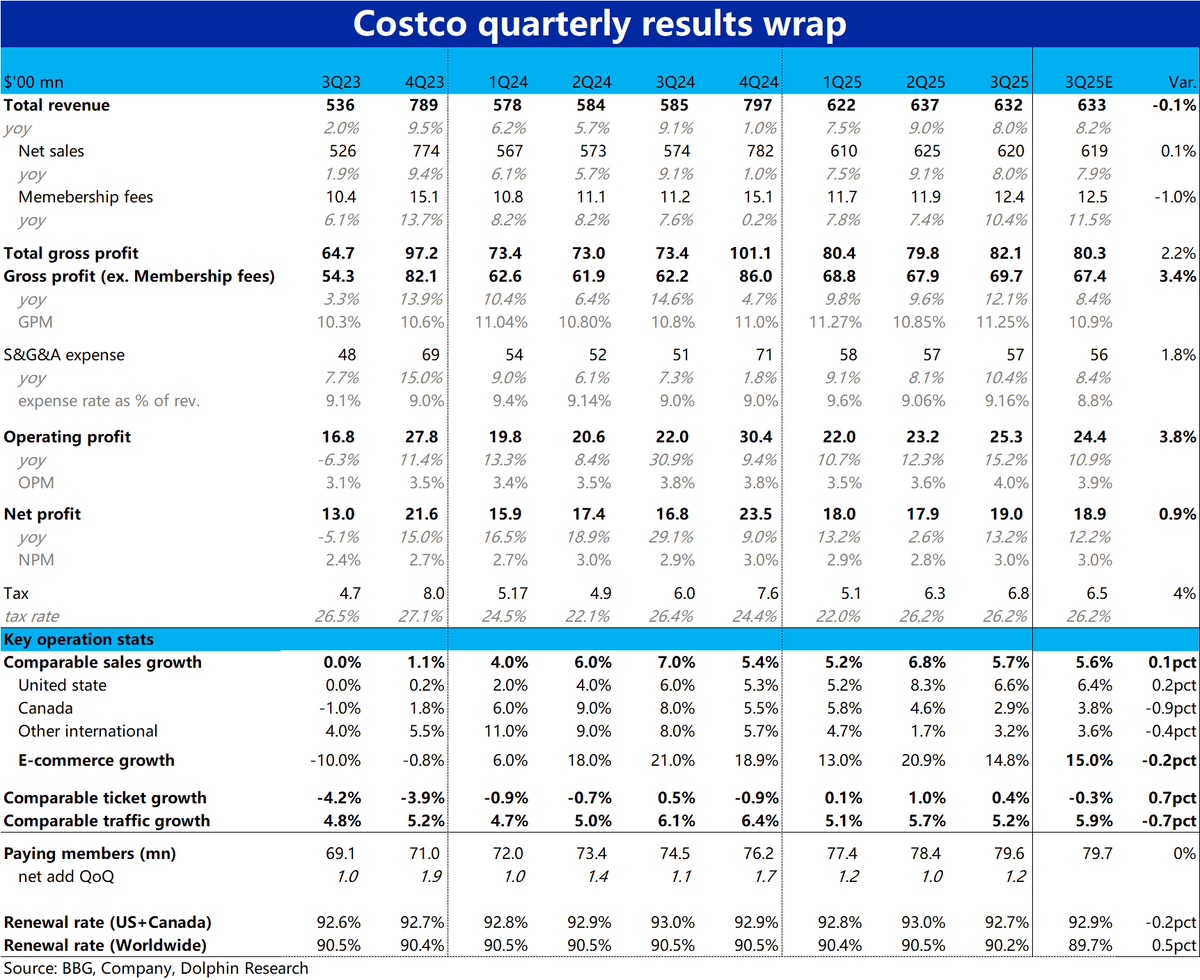

Costco 3QF25 Quick Interpretation: The company's Q3 results as of May 11 were released, showing a steady performance as usual. From the perspective of expectation gaps, since the company releases monthly sales data, revenue is unlikely to deviate significantly. The focus is on the differences in gross margin and expenses. This quarter, both gross margin and expenses were higher than expected, but the gross margin beat expectations by a larger margin, resulting in overall favorable profits.

Specifically, the gross margin reached 11.25%, 36bps higher than expected. According to the company's explanation, the key factors for the higher-than-expected gross margin are:

1) The gross margin of the company's core business widened by 36bps quarter-on-quarter, driven by factors such as consumers in Europe and the U.S. engaging in early purchases, especially for durable goods (higher unit prices). This also reflects the company's excellent pricing and supply chain management capabilities.

2) However, due to the company's use of the LIFO cost recognition method, this dragged the gross margin down by 23bps. This shows that recent inflation and tariffs have indeed led to higher procurement and operating costs for the company.$Costco Wholesale(COST.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.