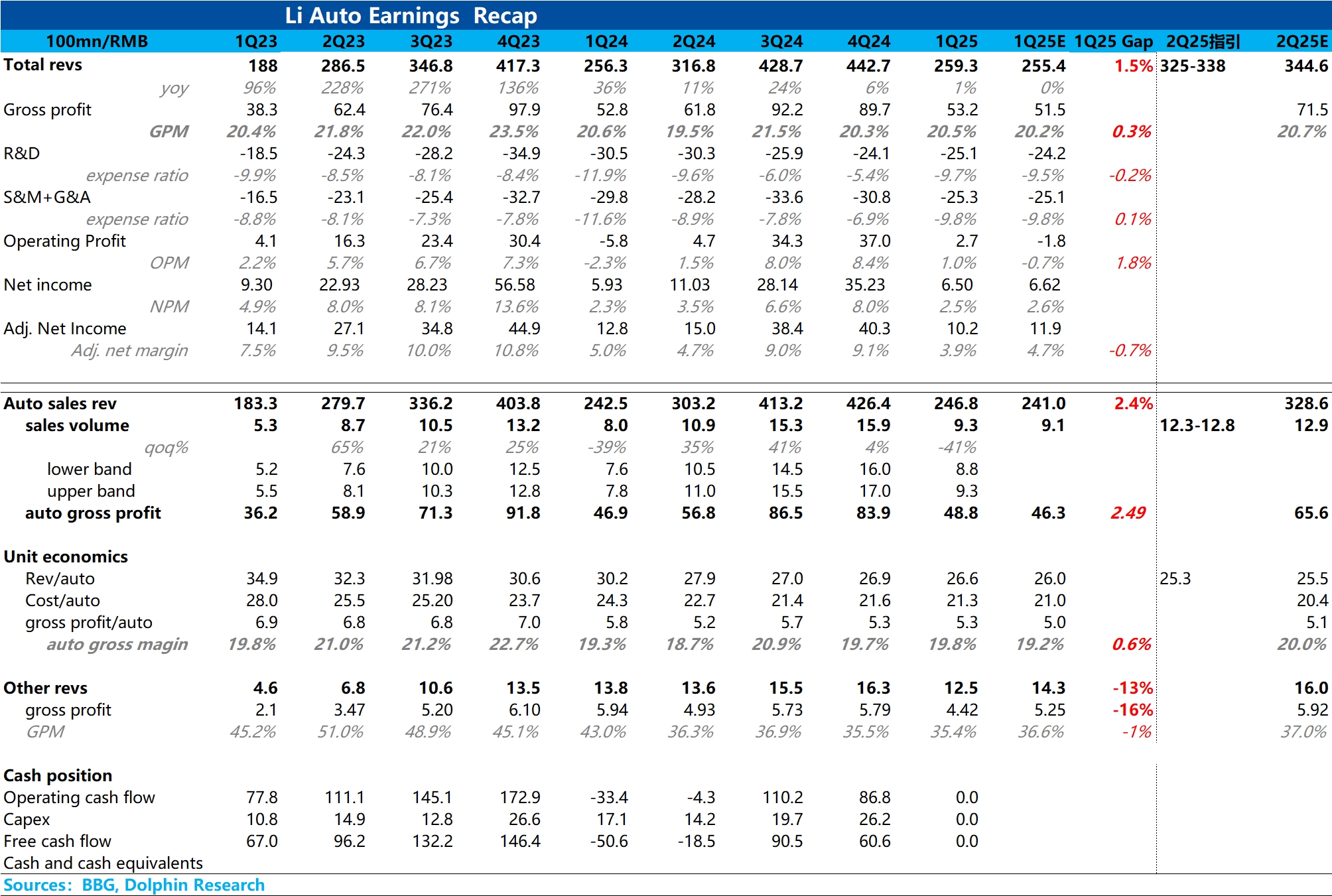

Li Auto 1Q25 Quick Interpretation: This earnings report can be divided into two aspects: ① First quarter performance itself, ② Second quarter guidance. The market is more concerned about the second quarter guidance. Specifically:

① The first quarter performance was okay, slightly beat market expectations, but it was actually within Dolphin Research's expectations.

Starting with the car sales business that the market is most concerned about, the car sales gross margin performance was okay, reaching 19.8%, which actually exceeded Li Auto's previous quarter's guidance of 19% for this quarter's gross margin.

However, Dolphin Research saw that major banks had expected this quarter's gross margin to be around 20%. Although this quarter's 19.8% car sales gross margin seems to have not dropped much compared to the previous quarter's peak season (19.7%), there was a provision for a procurement contract loss in the previous quarter, and the actual car sales gross margin was 20.7%. So, the actual car sales gross margin this quarter fell by about 1 point compared to the previous quarter.

Although Dolphin Research understands that the low-priced L6 has a certain adverse impact on the model structure, lowering the single car ASP (but the actual single car ASP exceeded expectations), this cost reduction is obviously not enough, especially in this year's competitive environment where cost performance is particularly critical.

② The second quarter guidance is too poor, making the market feel that achieving 600,000 sales this year is difficult.

From the second quarter guidance, both revenue and sales missed market expectations, and the car sales price corresponding to this revenue has dropped to 253,000 yuan (a decrease of 13,000 yuan compared to the first quarter), but the new L series was already launched on May 8 (the launch price is more expensive than the current old model price), and logically, with nearly two months of full delivery months, it is still declining.

And the delivery guidance of 123,000-128,000 is also lower than the market's expectation of 129,000 (the market expects deliveries of 34,000/45,000/50,000 in April/May/June), it is very clear that the order for this L series facelift is not as expected, implying an average monthly sales of 45,000-47,000 in May/June, making it very difficult to achieve 600,000 sales, which is very below expectations, especially as the competition for extended range vehicles has significantly increased this year, and the extended range dividend is quickly being exhausted. $Li Auto(LI.US) $LI AUTO-W(02015.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.