Nvidia: Don't question it, still the number one stock in the universe!

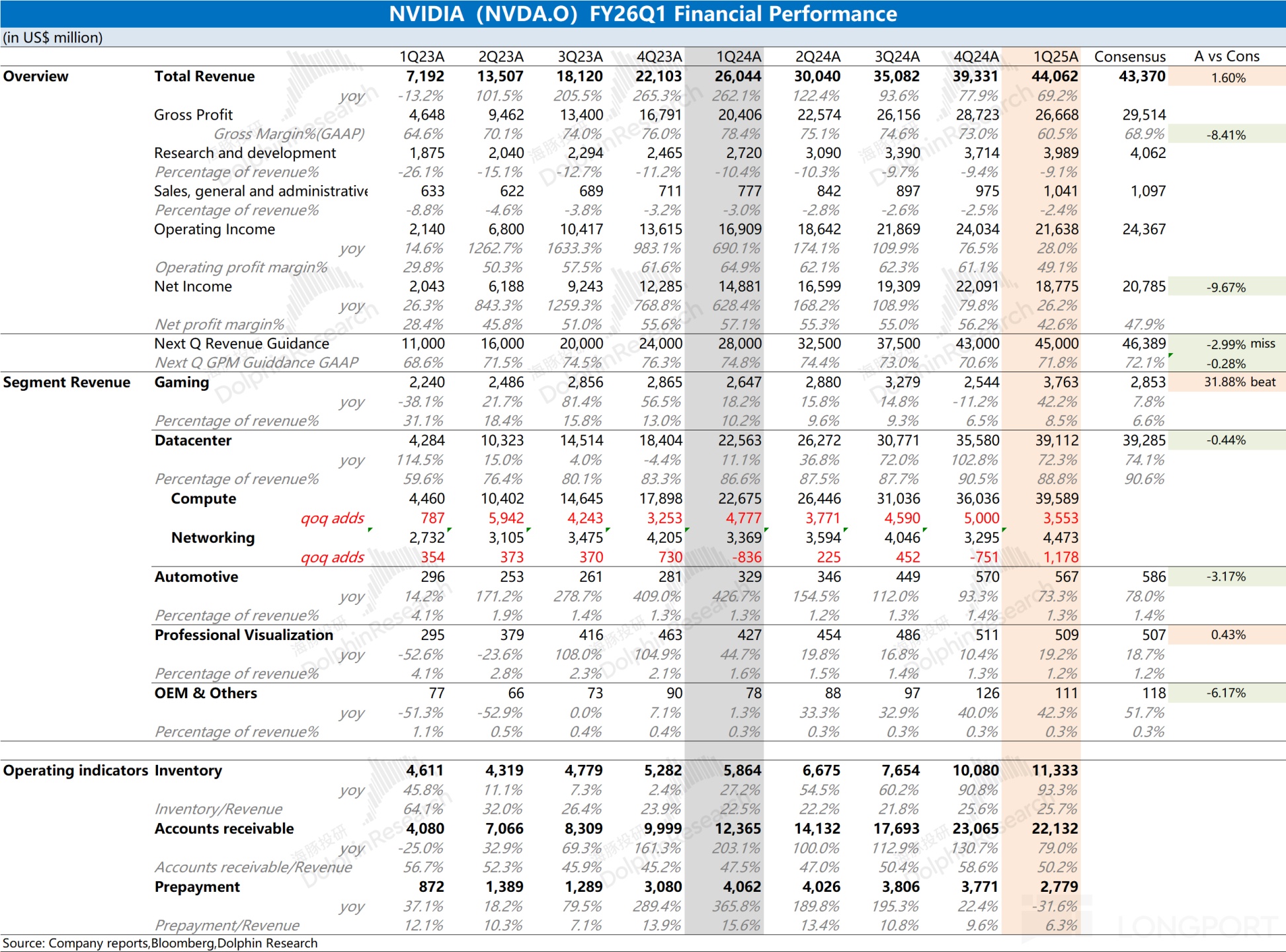

NVIDIA (NVDA.O) released its Q1 FY2026 earnings report (as of April 2025) after the U.S. market closed on May 29 Beijing time. Key details are as follows:

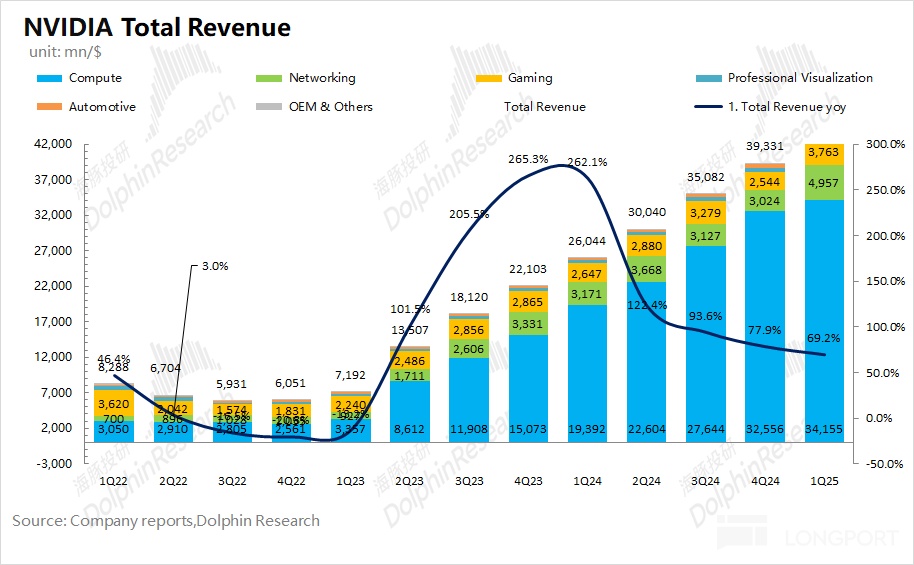

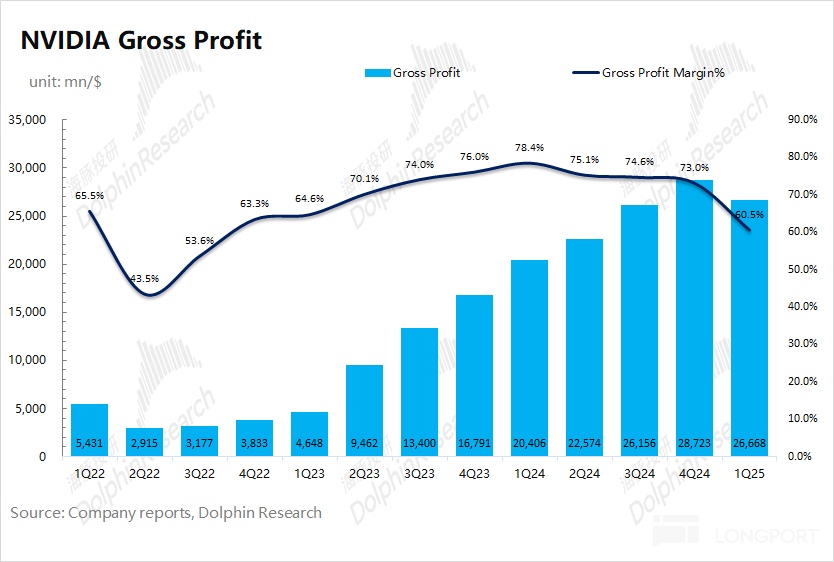

1. Core Operating Metrics: Revenue of $44.06 billion, in line with expectations ($43.37 billion), with a quarterly increase of $4.7 billion driven by data center and gaming segments. Gross margin was 60.5%, below expectations (68.9%), primarily due to a $4.5 billion inventory write-down related to H20 chips. Excluding this one-time event, the gross margin would have rebounded to around 71%.

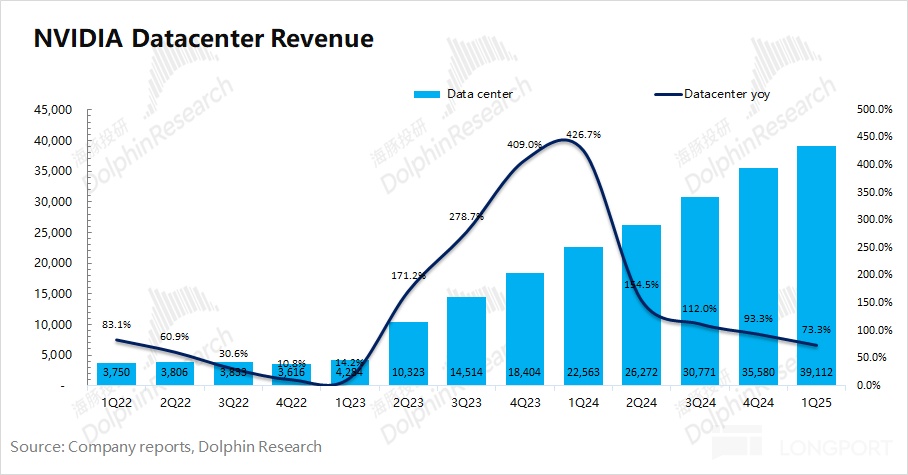

2. Data Center: $39.11 billion, up 72% YoY. The H20 incident only affected revenue in the last two weeks of the quarter, with minimal overall impact. The revenue impact will be more pronounced in the next two quarters.

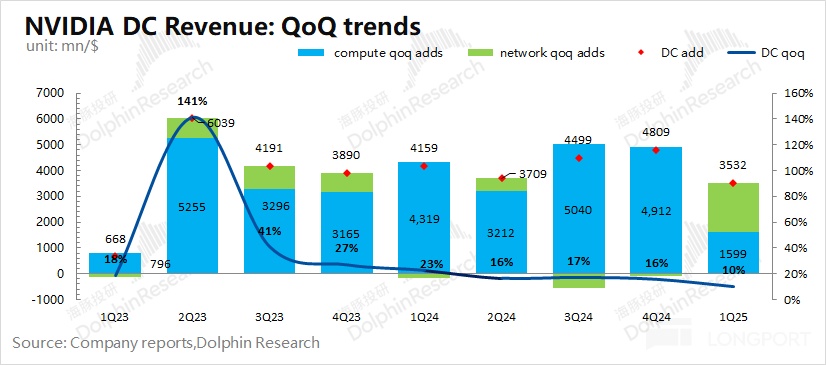

Breakdown: Compute revenue was $39.6 billion, while networking revenue was $4.5 billion. Quarterly growth in compute revenue slowed as some downstream clients adjusted capital expenditure timelines in anticipation of the upcoming mass production of GB300 products.

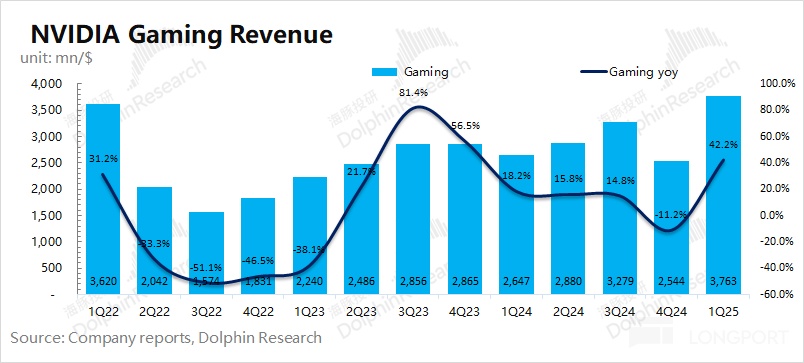

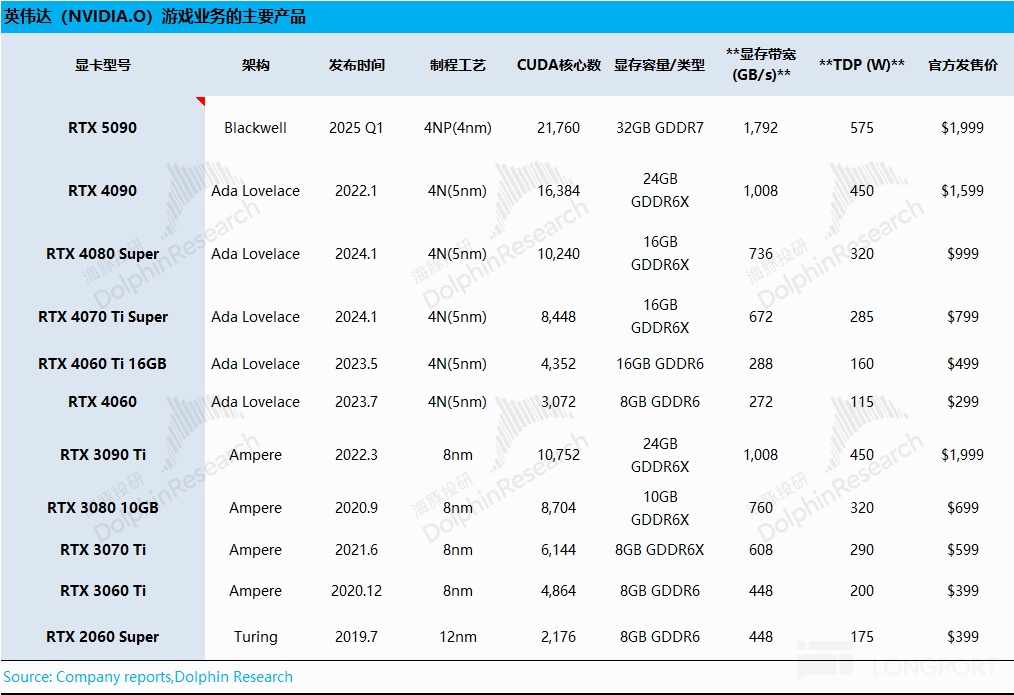

3. Gaming: $3.76 billion, up 42% YoY, the standout segment this quarter. Driven by the launch of the RTX50 series by $NVIDIA(NVDA.US), NVIDIA further expanded its market share in discrete GPUs amid AMD's declining gaming revenue.

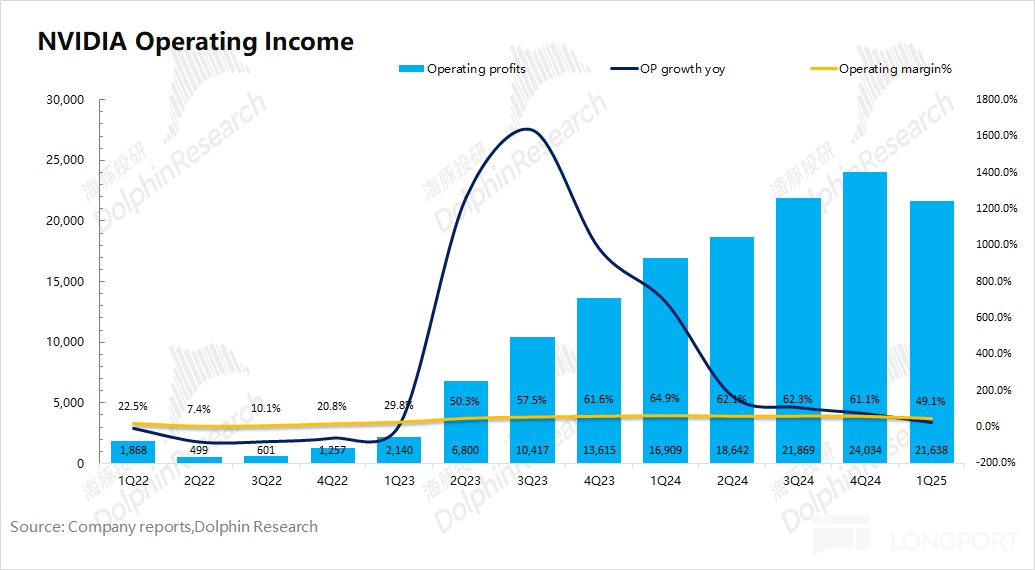

4. Profit: Core operating profit was $21.6 billion, up 28% YoY. Core operating margin fell to 49.1%, mainly due to the $4.5 billion H20 inventory write-down.

5. Guidance: Next quarter revenue is projected at $45 billion, up $1 billion QoQ; GAAP gross margin is expected at 71.8%, up 11.3 ppts. The rebound to ~72% gross margin indicates the company has largely completed H20-related write-downs this quarter.

Dolphin Research's View: Solid overall, with more confident guidance.

Revenue met expectations, while the gross margin plunge was mainly due to the $4.5 billion H20-related write-down. Excluding this, gross margin would have been ~71%.

Gaming was the standout, up 42% YoY, fueled by RTX50 series shipments. For the data center segment, the H20 impact will be more visible in Q2-Q3, with minimal effect this quarter (~1-2 weeks). Slower QoQ compute growth ($5B → $3.5B) reflects both $2.5B revenue loss from H20 export restrictions and clients delaying purchases for GB300.

Guidance is more telling: NVIDIA expects $45B next-quarter revenue, implying just $1B QoQ growth but already factoring in ~$8B H20 impact. Without H20, growth could have been $9B QoQ—a strong signal of Blackwell demand, surpassing NVIDIA's prior record of $5B quarterly growth.

Short-term, U.S. H20 bans will weigh on earnings, but customized China products may offset losses. With write-downs mostly done, margins are set to recover. The $1B growth amid $8B H20 headwinds underscores robust Blackwell demand.

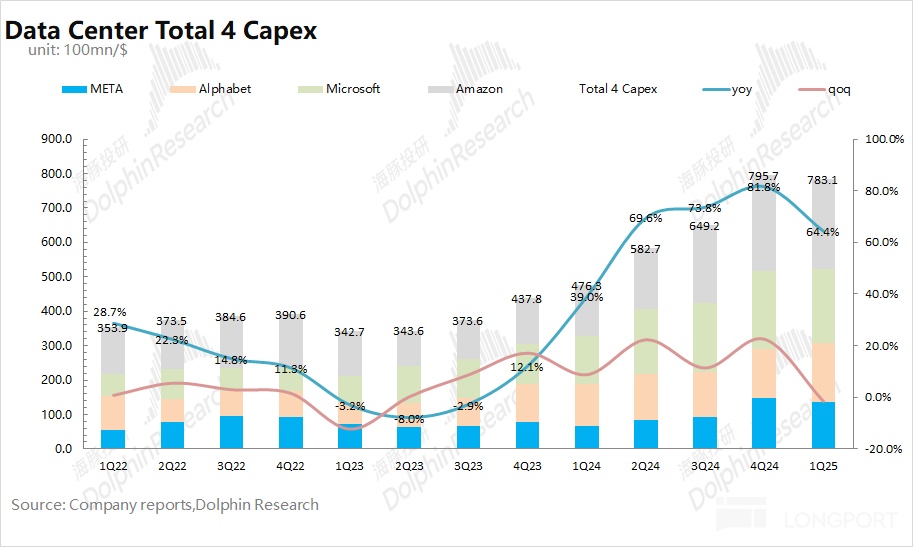

Based on cloud capex trends, Dolphin Research expects 2025 capex for top 4 cloud providers to hit $346B (+38% YoY). Valuing NVIDIA at 26x PE (based on H2 FY2026 net profit ×2, assuming +55% revenue and -0.5ppt gross margin YoY) implies a $3.3T market cap.

As Blackwell ramps, H20's impact will fade. Future China-specific products could further mitigate losses. Guidance reflects strong Blackwell demand, with NVIDIA gaining share in data center chips amid rising cloud capex.

For analysis on H20's disruption and Blackwell's implied growth, see Longbridge's quick take: Click here.

Dolphin Research's full NVIDIA analysis:

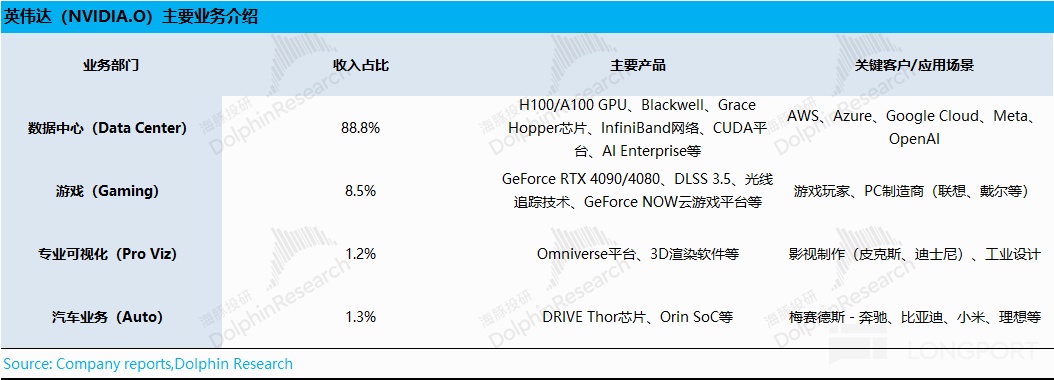

I. Business Overview

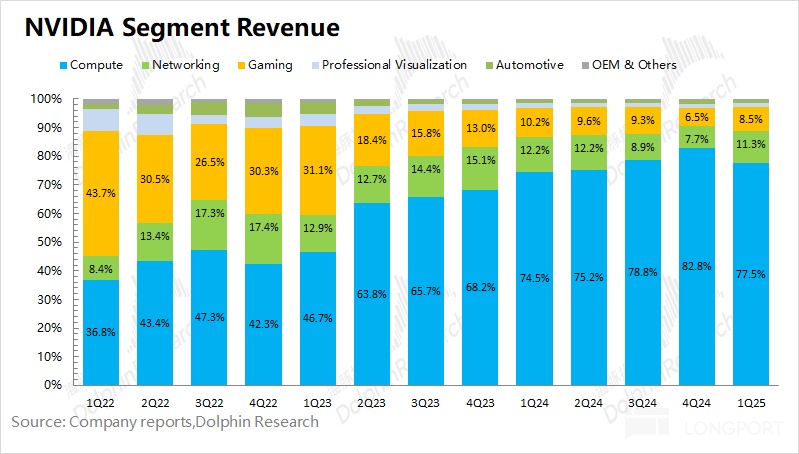

Data center now dominates (~90% of revenue), while gaming (~10%) has shrunk.

Segments:

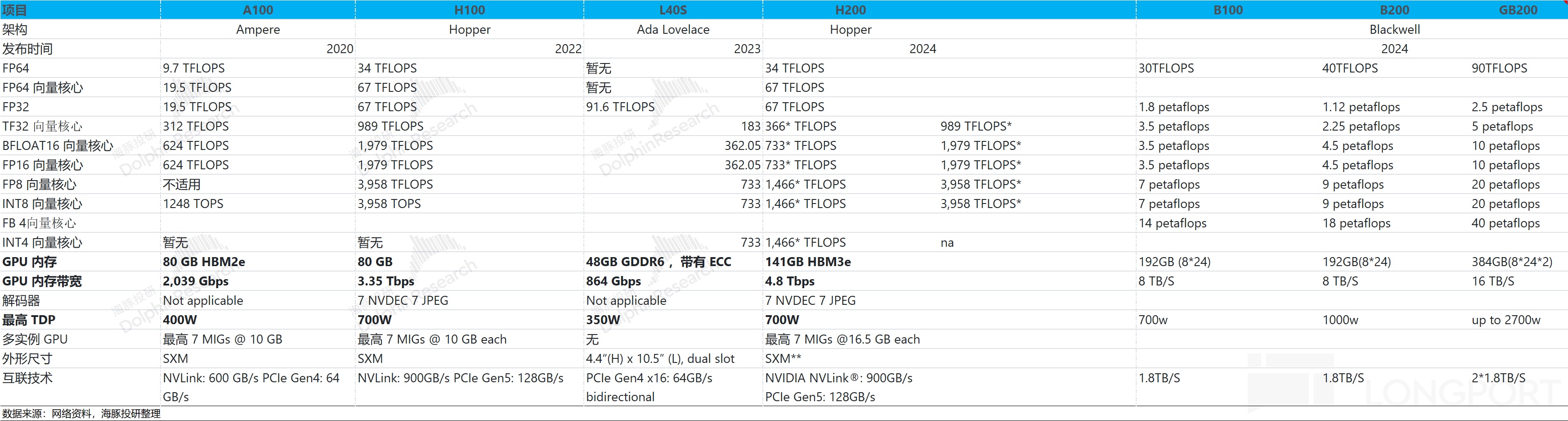

1) Data Center: H100, A100, Blackwell for AI/ML; clients include AWS, Azure, Google Cloud.

2) Gaming: RTX40/50 series for gamers/PC OEMs.

3) Pro Viz/Auto: ~1-2% each; clients include Pixar (viz) and BYD/Xiaomi/Li Auto (Orin/Thor chips).

II. Key Metrics: H20 Write-Down Largely Resolved

2.1 Revenue: $44.06B (+69.2% YoY). Gaming outperformed; data center met expectations as clients awaited GB300.

Guidance of $45B next quarter factors in ~$8B H20 impact. Excluding this, growth would be $9B QoQ—driven by Blackwell/RTX50.

2.2 Gross Margin (GAAP): 60.5% (vs. 68.9% expected). The $4.5B H20 write-down caused the drop. Adjusted gross margin would be ~71%, with the QoQ decline (73%→71%) reflecting Blackwell ramp costs.

Next-quarter guidance of 71.8% GAAP gross margin suggests H20 charges are mostly behind. Further recovery expected as Blackwell scales.

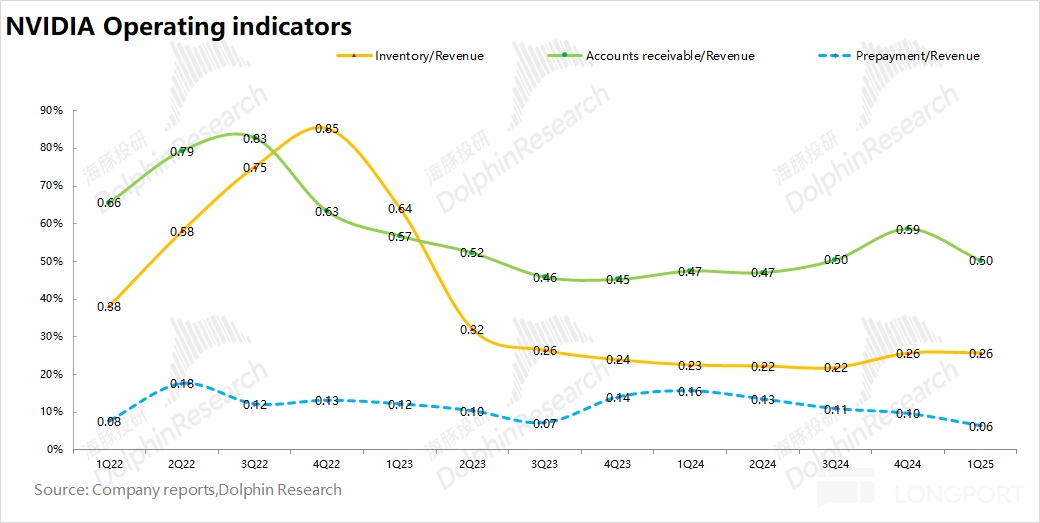

2.3 Operating Metrics

1) Inventory/Revenue: 0.26, flat QoQ. Inventory rose to $11.3B (Blackwell prep), but high growth keeps ratios low.

2) Receivables/Revenue: 0.5, down again. High revenue growth diluted receivables.

III. Segment Trends: Gaining Share

Data center (Compute + Networking) is ~90% of revenue; gaming below 10%.

3.1 Data Center: $39.11B (+73.3% YoY). Blackwell drove growth for LLM/recommendation/genAI training/inference.

Breakdown: Compute revenue $34.1B (+76.1% YoY); Networking $4.96B (+56.3% YoY).

QoQ compute slowed to $1.6B growth (vs. $5B prior) as clients paused for GB300; networking accelerated to $1.93B.

H20's $4.5B write-down and ~$8B next-quarter revenue impact are short-term headwinds. The $45B guidance (implying $9B ex-H20 growth) signals strong Blackwell demand—surpassing NVIDIA's $5B prior record.

Top 4 cloud providers' Q1 2025 capex hit $78.3B (+64.4% YoY). With data center growing 73.3% YoY, NVIDIA is gaining share. Dolphin Research expects 2025 cloud capex to reach $346B (+38% YoY), supporting future growth.

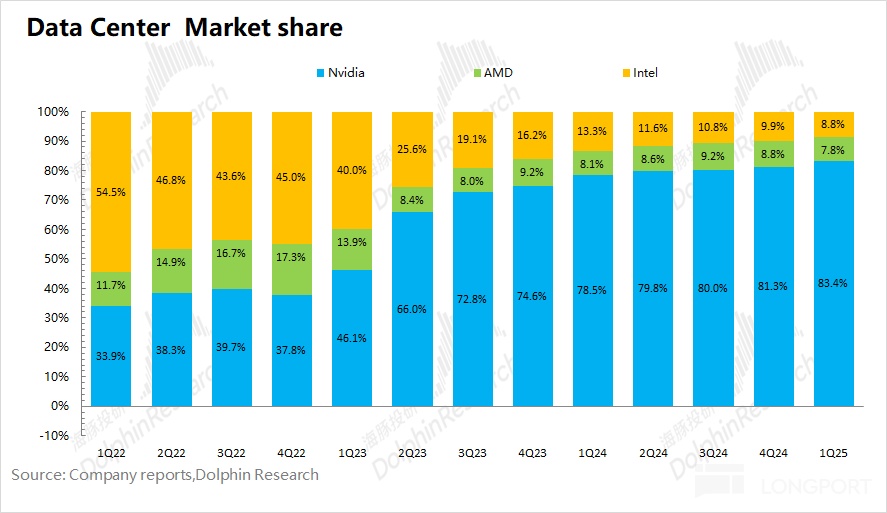

vs. AMD/Intel, NVIDIA continues to dominate data center chips, favored by cloud providers.

H20 is a near-term drag, but China-customized products and robust cloud capex offer offsets.

3.2 Gaming: $3.76B (+42.2% YoY). RTX50 series drove share gains as AMD's gaming revenue fell 29.8% to $650M.

IV. Financials: Steady OpEx

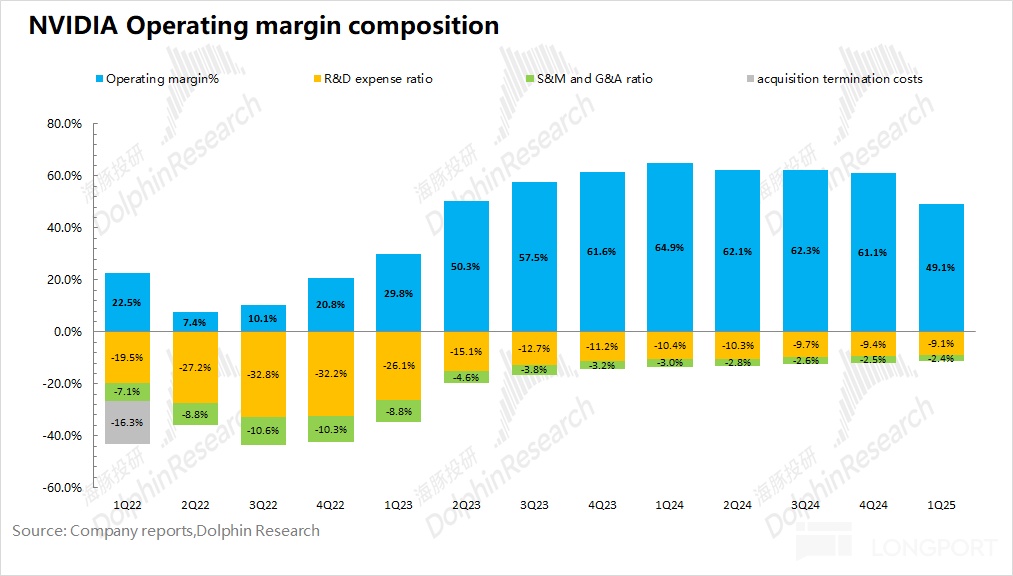

4.1 Core Operating Margin

49.1% (-YoY), pressured by H20 write-downs.

Components:

Operating Margin = Gross Margin - R&D - SG&A

1) Gross Margin: 60.5% (71% ex-H20; QoQ dip from Blackwell ramp).

2) R&D: 9.1% ($2.7B QoQ increase, but diluted by revenue).

3) SG&A: 2.4% (also diluted).

Next-quarter opEx guidance of $5.7B implies 12.7% opEx ratio—still healthy.

4.2 Core Operating Profit

Net profit: $18.78B (+26.2% YoY); net margin 42.6%.

Core operating profit: $21.64B (+28% YoY); margin 49.1% ($4.5B H20 impact).

<End>

Dolphin Research's NVIDIA archive:

Earnings Season

2025-02-27 Call: NVIDIA (Transcript): China Shipments Unchanged

2025-02-27 Report: NVIDIA: Did Deepseek Puncture Jensen's "Leather Jacket"?

2024-11-21 Call: NVIDIA: Blackwell Deliveries to Exceed Expectations (FY25Q3 Call)

2024-11-21 Report: NVIDIA: Still the Backbone, But Peak Firepower Near?

2024-08-29 Call: NVIDIA: Blackwell Ships in Q4 (FY25Q2 Call)

2024-08-29 Report: NVIDIA: When AI Faith Cracks, Does Nectar Turn Poison?

2024-05-23 Call: NVIDIA: Sovereign AI to Generate Billions (FY25Q1 Call)

2024-05-23 Report: NVIDIA: The Universe's Hottest Stock, Gifts Keep Exploding

2024-02-22 Call: Accelerated Computing: Global Data Centers to Double (NVIDIA 4QFY24 Transcript)

2024-02-22 Report: NVIDIA: AI's Undisputed King

2023-11-22 Call: The First Wave of AI (NVIDIA 3QFY24 Call)

2023-11-22 Report: NVIDIA: Full Throttle Compute Emperor? "Faux Fire" Flickers

2023-08-24 Call: The AI-Named Computing Revolution (NVIDIA FY2Q24 Call)

2023-08-24 Report: NVIDIA: Another Blowout, AI King's "One-Man Show"

2023-05-25 Call: Out of the Trough, Embracing the AI Era (NVIDIA FY24Q1 Call)

2023-05-25 Report: NVIDIA's Blowout: The AI Future Has Arrived

2023-02-23 Call: Earnings Bottoming, AI the New Focus (NVIDIA FY23Q4 Call)

2023-02-23 Report: Surviving the Cycle, ChatGPT Revives NVIDIA's Faith

2022-11-18 Call: Rising Inventory: Will Q4 Digest It? (NVIDIA FY2023Q3 Call)

2022-11-18 Report: NVIDIA: Profits Slashed, When's the Turnaround?

2022-08-25 Call: How Does Mgmt Explain the "Flash Crash" Gross Margin? (NVIDIA FY2023Q2 Call)

2022-08-25 Report: NVIDIA in the Mire: 2018 Redux?

2022-08-08 Preview: Thunderstruck, NVIDIA's Earnings in "Free Fall"

2022-05-26 Call: COVID + Lockdowns, Gaming Drags Down Q2 (NVIDIA Call)

2022-05-26 Report: "COVID Fat" Gone, NVIDIA's Looks Fade

2022-02-17 Call: NVIDIA: Multi-Chip Push, Data Center in Focus (Transcript)

2022-02-17 Report: NVIDIA: Hidden Risks Behind Beat | Earnings Dive

2021-11-18 Call: How NVIDIA Builds the Metaverse? Mgmt: Focus on Omniverse (NVIDIA Call)

2021-11-18 Report: Compute Prints Money, Metaverse Boosts—Can NVIDIA Stay Bullish?

Deep Dives

2022-06-06: U.S. Stocks Quake: Are Apple, Tesla, NVIDIA Misjudged?

2022-02-28: NVIDIA: Growth Real, But Valuation Stretches

2021-12-06: NVIDIA: Valuations Can't Rely on Dreams Alone

2021-09-16: NVIDIA (Part 1): How a 20x Chip Giant Was Forged

2021-09-28: NVIDIA (Part 2): Dual Engines Stall, Time for a Double Kill?

Disclosures: Dolphin Research Disclaimer

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.