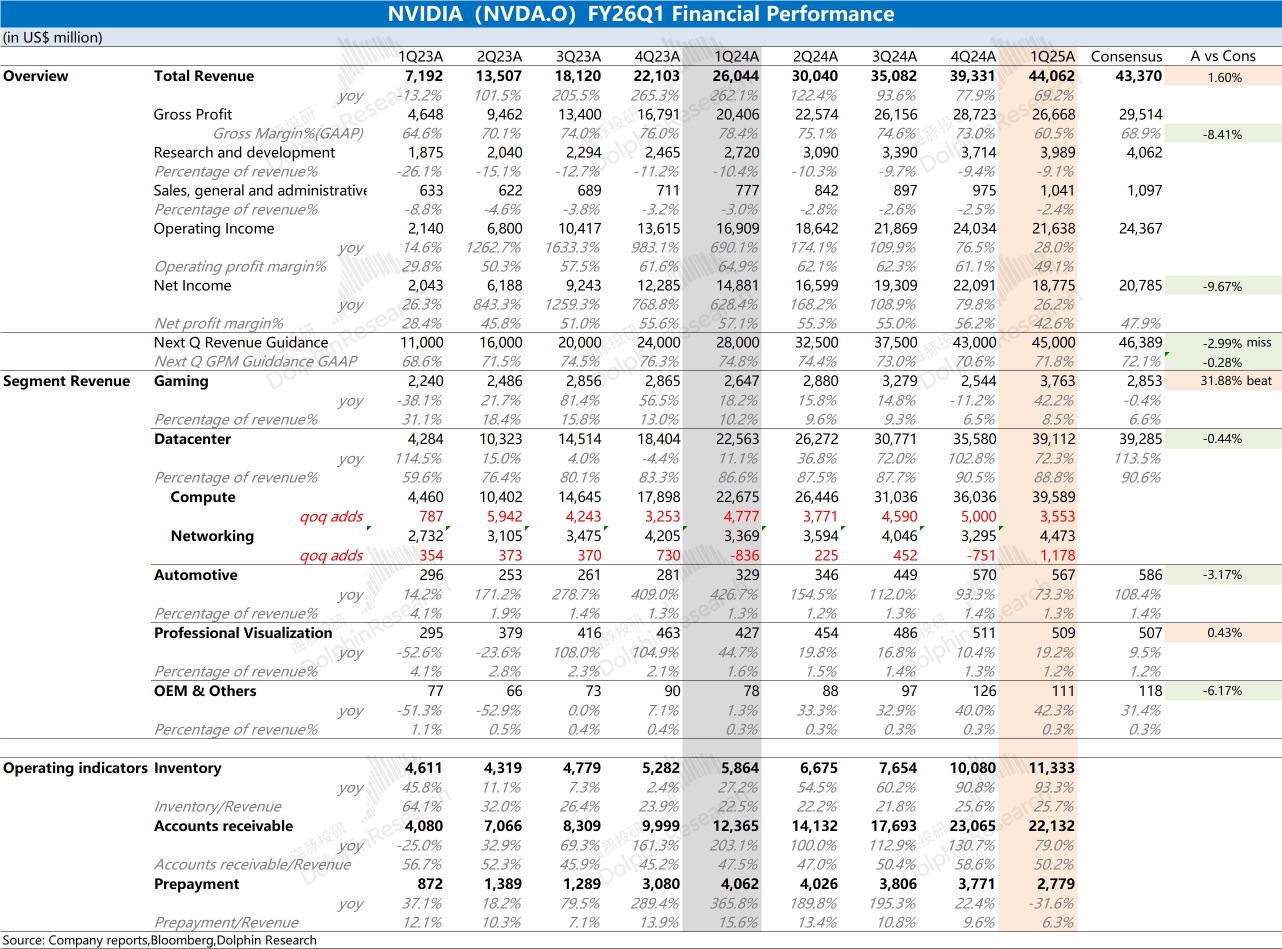

NVIDIA 1Q25 Quick Interpretation: The company's revenue performance this quarter was largely in line with expectations, while gross margin declined significantly, primarily due to the H20 ban this quarter, which resulted in approximately $4.5 billion in inventory impairment and related expenses. Excluding this factor, the company's gross margin would have returned to around 71%.

Specifically, the company's gaming business was the most outstanding this quarter, with a year-on-year increase of 42%, mainly driven by shipments of the newly released RTX50 series graphics cards. The data center business, which the market is closely watching, performed moderately, as the GB300 is expected to enter mass production in Q2, making the market more optimistic about this product. As for the impact of the H20 incident, it had little effect on revenue this quarter, with the main impact expected in Q2 and Q3. The company's R&D expenses, sales, and administrative expenses remained stable or increased slightly, but overall expense ratios continued to decline due to strong revenue growth.

Looking at the guidance for the next quarter, the company expects revenue of $45 billion, with a gross margin of 71.8%. The revenue is expected to be impacted by the H20 ban by approximately $8 billion, while the gross margin returning to around 72% indicates that inventory impairment has largely been completed this quarter.

For detailed earnings analysis and discussion notes, stay tuned for updates from Dolphin Research.$NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.