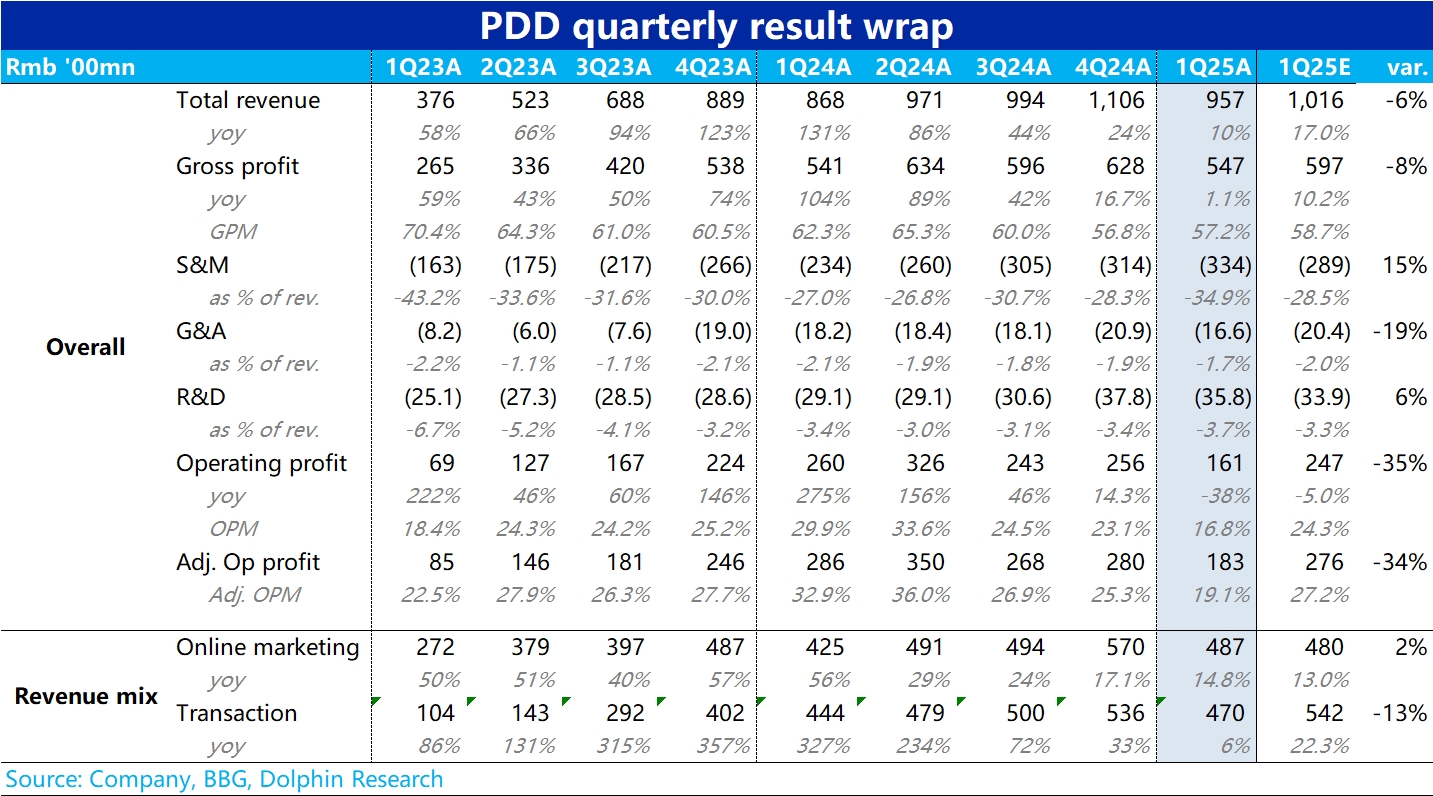

Pinduoduo 1Q25 Quick Interpretation: This quarter's results can only be described as an 'avalanche'! As a company that generates 120 billion in annual profits, the market's profit expectations for the company, regardless of seasonality, are generally between 25-35 billion.

Although the first quarter is typically a slow season, the market's operating profit expectation was still around 25 billion. However, what's jaw-dropping is that the actual operating profit for the first quarter was only 16.1 billion, a direct 38% drop year-over-year! Especially when, from a revenue perspective, Pinduoduo's high-margin ad revenue still saw nearly 15% year-over-year growth. This contrast suggests that marketing expenses in Q1 were severely over budget!

Q1 marketing expenses are usually lower than Q4. But this quarter's marketing expenses hit 33.4 billion, even higher than during the Q4 e-commerce peak season—something unprecedented even during Pinduoduo's high-growth periods. Moreover, with transaction-based revenue falling far short of expectations, it suggests Temu may not be the key drag on profits.

Dolphin Research can only explain this by noting that during the Q1 consumer electronics subsidy season, JD.com and Alibaba relied on government subsidies, while Pinduoduo was truly spending its own money. Compared to returning profits to shareholders amid slowing growth, Pinduoduo clearly prefers reinvesting its ad revenue back into users.

If Pinduoduo keeps this up, it's practically digging its own grave!

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.