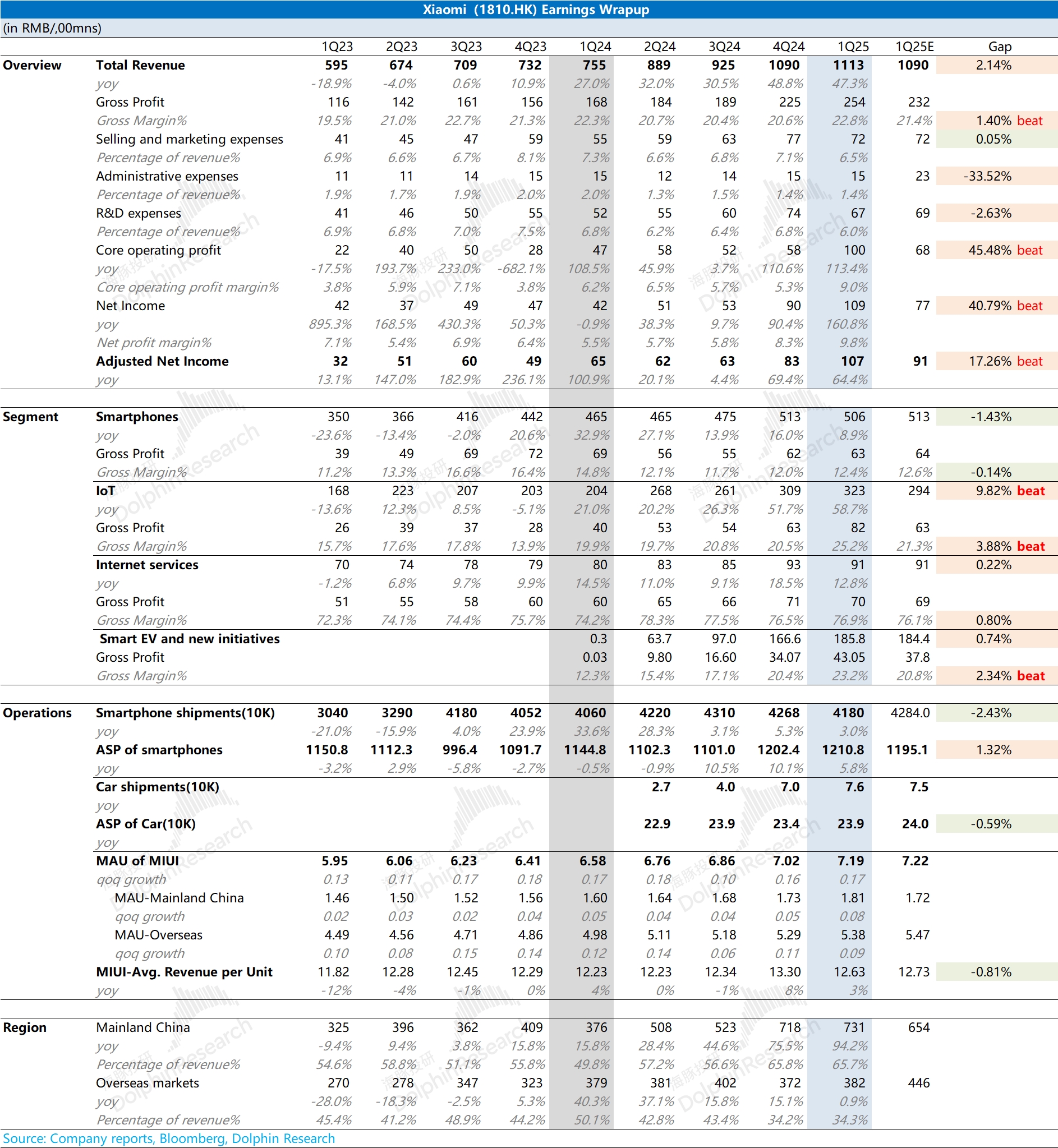

Xiaomi 1Q25 Quick Interpretation: The company's performance in the first quarter was generally better than market expectations. Although the smartphone business performed modestly, the IoT business saw a year-on-year growth of 58.7%, becoming the main contributor to the revenue exceeding expectations. Additionally, the gross margin of the automotive business also improved beyond expectations this quarter, directly driving accelerated profit growth.

This quarter, the market mainly focused on the impact of national subsidy policies and the performance of the automotive business:

1. National Subsidy Policy: The impact on the company's traditional hardware business varied significantly. While the smartphone business saw a decline in growth this quarter, the IoT business benefited noticeably from the national subsidy policy, with both revenue and gross margin showing significant improvement. This indicates that the subsidy can stimulate demand for IoT products, while the demand for smartphone upgrades remains sluggish.

2. Automotive Business: The YU7 will start generating revenue after the third quarter, with first-quarter revenue mainly coming from the SU7. The reduction in losses for the automotive business was significantly better than market expectations, with the gross margin reaching 23.2% this quarter, primarily driven by improved capacity utilization. The average monthly delivery volume for the automotive business in the first quarter reached 25,300 units, already matching the designed capacity of the first-phase factory. Since the second-phase factory will only commence operations in the second half of the year, the current monthly sales have reached around 29,000 units, and the gross margin for the automotive business is expected to further increase in the second quarter.

Although sales and R&D expenses increased steadily year-on-year, the core expense ratio continued to decline. With revenue and gross margin growth, the core operating profit for the quarter reached 10 billion yuan.

Overall, Xiaomi's quarterly financial results were quite positive. For detailed information, please refer to Dolphin Research's follow-up analysis and meeting minutes.

$XIAOMI-W(01810.HK) $Xiaomi Corporation(XIACY.US)The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.