Kuaishou 1Q25 Quick Interpretation: The quarterly report was unremarkable, overall it was a performance with fully managed expectations (basically in line with the official preview), so the short-term focus remains on advertising and e-commerce guidance (competition & macro). In terms of investment logic, industry competition has not slowed down, and the medium- to long-term outlook remains unclear. However, given the current valuation of less than 10x P/E, as long as management's subsequent guidance is not unexpectedly poor, short-term investors can wait for potential speculative opportunities with Kling.

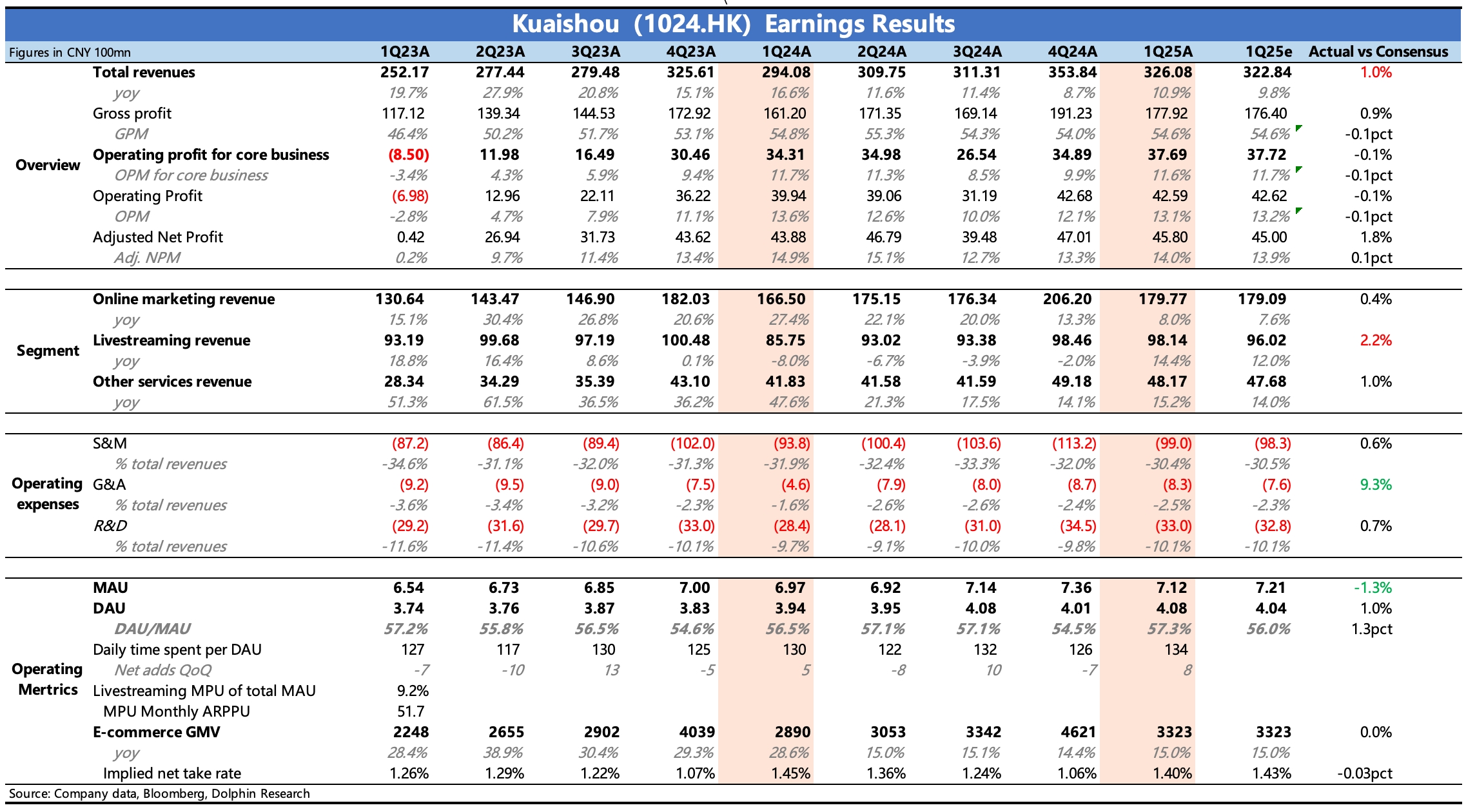

Here are some key metrics:

1. User growth slowed slightly. Kuaishou's off-peak and peak seasons now align with e-commerce, and the growth rate of promotional expenses slowed in Q1. The year-on-year growth in user numbers was slightly lower, and the seasonal churn between Q4 and Q1 was higher compared to the same period last year, reflecting that Kuaishou's natural traffic advantage is no longer strong.

2. Advertising slowed significantly. Last year's Q1 saw fierce competition between Danzai and Yuanmeng, and short dramas were at their peak, resulting in a high base. It is expected that Q2 will see a return to around 15% growth driven by the e-commerce festival.

3. E-commerce growth was steady. However, industry competition remains intense, with WeChat Channels seemingly gearing up for a big push this year, adding significant pressure. The company's current goal is to maintain GMV, adopting a content e-commerce strategy that integrates live streaming, short videos, and product shelves, with short-term sacrifice in take rate.

4. Live streaming recovered well. Over the past year during the rectification period, Kuaishou continued to introduce guilds and sign high-quality streamers, particularly focusing on expanding the game live streaming sector.

5. Kling's Q1 revenue was 150 million, on track to comfortably exceed the annual target of 450 million. Kling 2.0 was released in April and received positive feedback. In May, Google's Veo 3 took the lead in some text-to-video technologies, posing a risk of disruption to all vertical platforms. Investors should pay attention to management's comments.

6. Expenses slightly exceeded expectations. Gross margin declined slightly year-on-year, mainly due to the increased proportion of live streaming revenue and AI computing costs. The absolute values of the three operating expenses all exceeded guidance to varying degrees, with the overall expense ratio flat year-on-year.$KUAISHOU-W(01024.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.