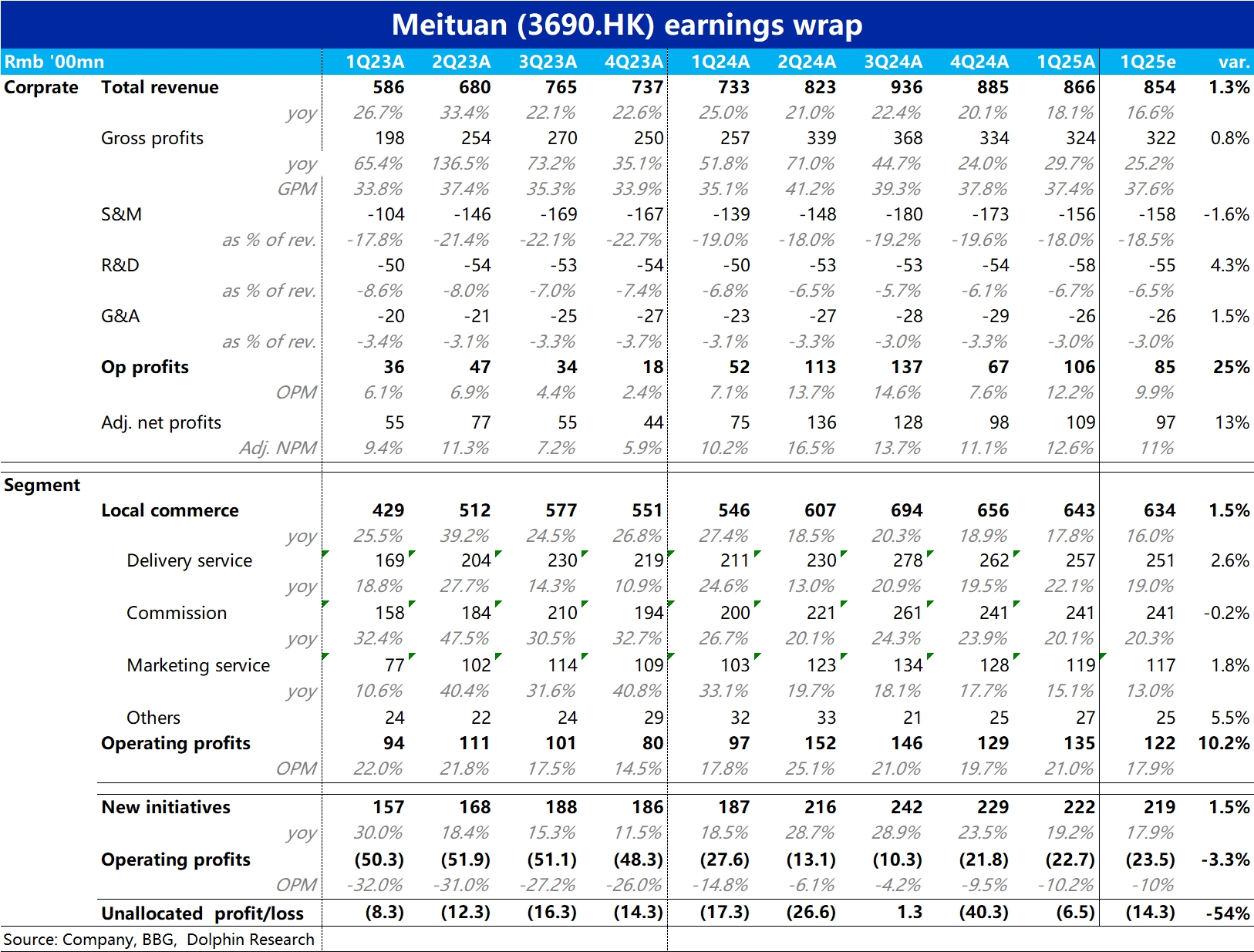

Meituan 1Q25 Quick Interpretation: Overall, Meituan's performance this quarter was good. In terms of the big numbers, both total revenue and adjusted net profit were about 1 billion higher than expected.

Specifically, the biggest contributor to the revenue beat was the delivery income from the core local commerce segment, accounting for about 600 million of the revenue beat. According to the company, this was mainly due to reduced delivery fee subsidies, which are a revenue offset. Other sub-segments also contributed 200-300 million each in revenue beats. The performance was relatively balanced, with no drags but also no standout highlights.

In terms of profit, the operating profit beat was on the order of 2 billion, but this included about 1 billion from investment income (which is non-operating). Therefore, the actual profit beat was around 1 billion (refer to adjusted net profit). Compared to expectations, there were no significant differences in gross margin and expenses, so the additional profit was almost entirely driven by the additional revenue.

It's worth noting that the impact of the Q1 food delivery war has yet to materialize, and Meituan's performance this quarter wasn't particularly outstanding (the magnitude of the beat wasn't stronger than JD.com's). Although the quarter's performance was indeed good, the guidance for the next quarter and the full year in the upcoming earnings call will be more important. $MEITUAN(03690.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.