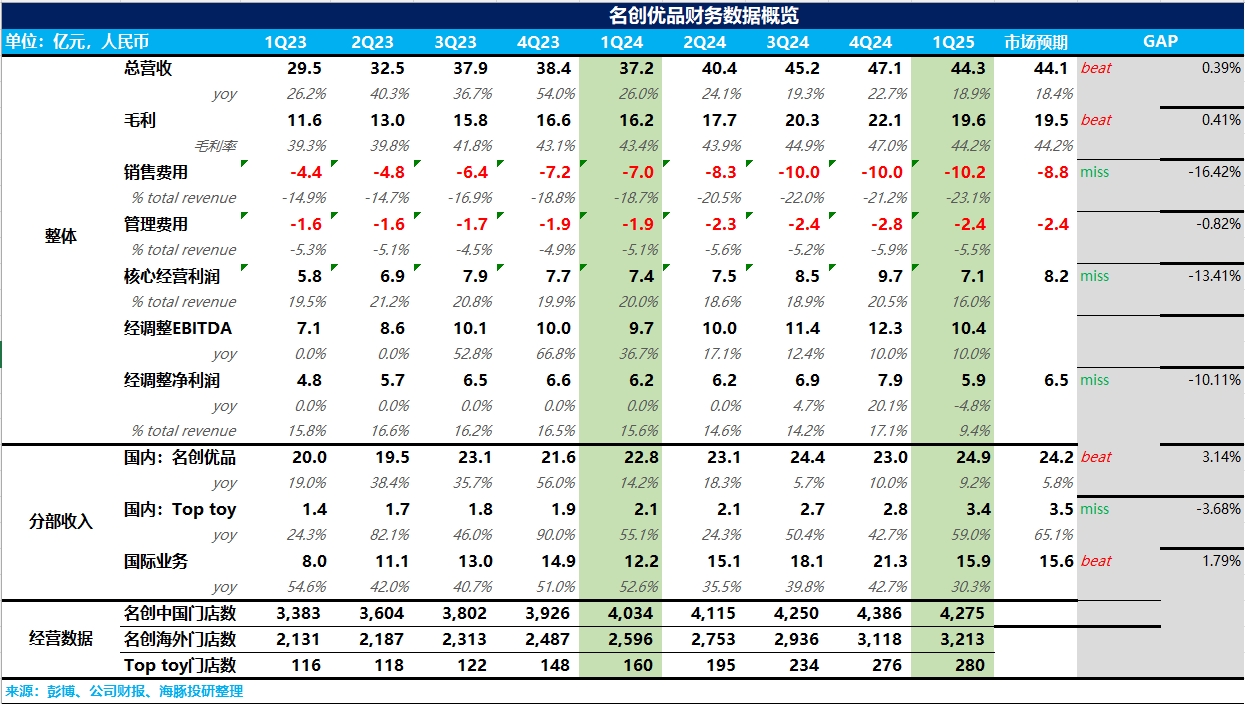

MINISO 1Q25 Quick Interpretation: Although the revenue for the first quarter generally met expectations, the biggest issue was the significant increase in marketing expenses due to higher IP licensing costs and a sharp rise in rental expenses for overseas directly operated stores, leading to core operating profits falling short of expectations. Additionally, under the company's strategy of 'closing small stores and opening large stores,' the total number of domestic stores began to decline this quarter.

1. Revenue Met Expectations: Despite a noticeable slowdown in the number of new domestic stores and the closure of some inefficient small stores, the overall domestic revenue growth did not drop significantly. This at least indicates that MINISO's core 'large-store strategy,' implemented since last year, has been relatively effective. The key driver remains the improvement in domestic single-store efficiency. Overseas, despite the rapid store expansion last year, growth slowed from over 40% to 30%, falling short of Dolphin Research's expectations.

2. Total Store Count Begins to Decline: In terms of store operations, MINISO closed a large number of low-efficiency stores in lower-tier cities in the first quarter, leading to a decline in the total number of domestic stores. Meanwhile, the number of overseas stores continued to grow, increasing from 41% to 43%, though the overall growth rate slowed due to the impact of trade wars. From a same-store growth perspective, the domestic decline narrowed from double digits last quarter to mid-single digits. According to Dolphin Research, overseas single-store revenue showed almost no growth compared to the same period last year.

3. Core Operating Profits Fell Short of Expectations: Gross margins remained stable, but the significant increase in IP licensing costs and overseas rental expenses led to higher marketing expenses, resulting in core operating profits falling short of expectations. $Miniso(MNSO.US) $MNSO(09896.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.