Boss Zhipin (Minutes): Growth expected to bottom out in Q2, recovery trend emerging

The following is the$Kanzhun(BZ.US) earnings call minutes for FY25Q1. For earnings analysis, please refer to《BOSS Zhipin: Small Leader Firmly in the 'Boss' Position, But the Cycle is Too Tough》

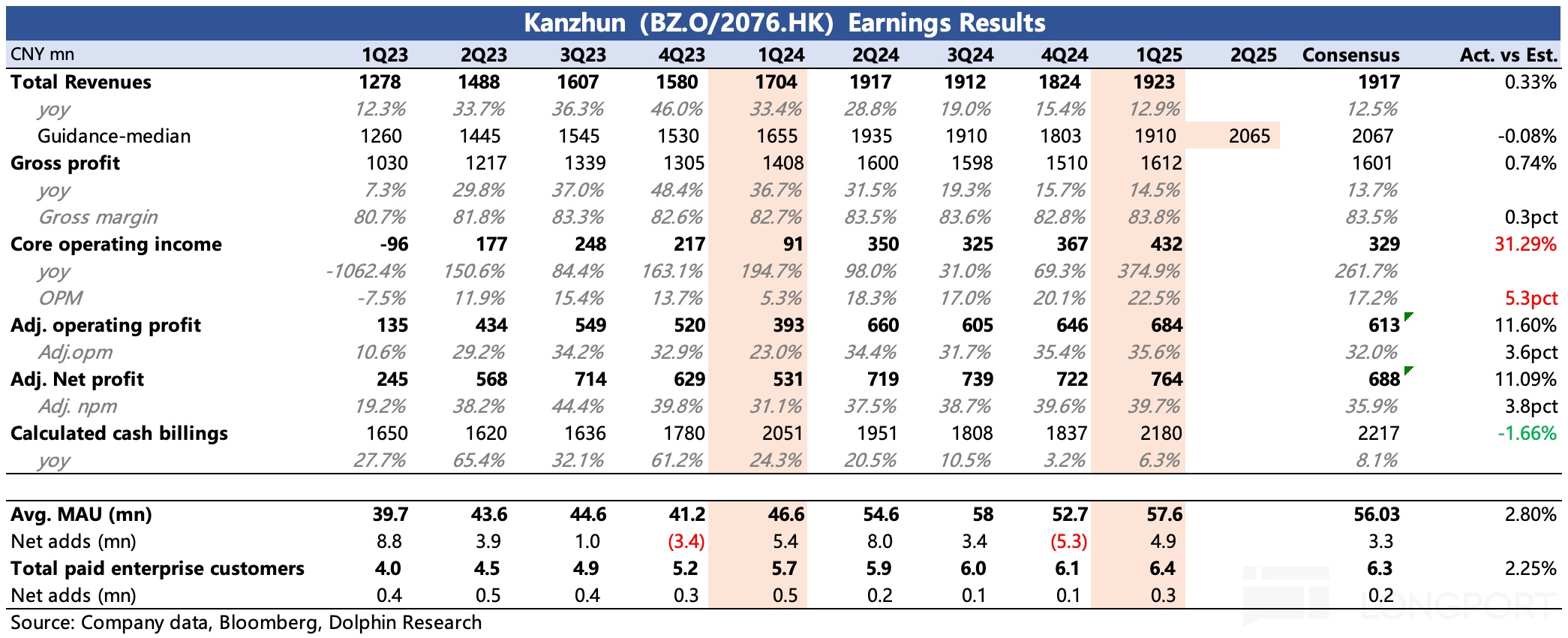

1. Key Financial Highlights

1. Stock-based compensation (SBC): Decreased by 10% QoQ, accounting for nearly 4 percentage points less of revenue YoY, and will continue to decline as revenue grows.

2. Operating cash flow: RMB 1 billion, up 11% YoY; cash reserves reached RMB 14.8 billion.

3. Q2 2025 guidance: Total revenue is expected to be RMB 2.05–2.08 billion, up 7.0%–8.5% YoY.Growth has bottomed out, and improved cash collection will drive recovery in subsequent quarters.

2. Detailed Earnings Call Content

2.1 Key Management Statements

1. User scale: Leveraging "bilateral network effects" and improved user satisfaction, marketing expenses decreased while user growth remained strong.

a. MAUs reached 57.56 million (up 24% YoY),with March single-month active users nearing 65 million. From January to April, cumulative new users exceeded 15 million,with blue-collar new users accounting for over 45%, driving blue-collar recruitment revenue share to over 39%.

b. New user growth in tier-3 and below cities accelerated, contributing 3 percentage points more to revenue, now exceeding 23%. Revenue from companies with <100 employees hit a record high, with paying enterprise clients reaching 6.38 million (up 22% YoY).

2. Impact of Tariff War:

a. Supply-demand fundamentals: No significant impact on recruitment demand observed. Post-Lunar New Year, corporate demand continued. Job postings grew 17%-19% YoY on average from January to April, with pay rates improving QoQ.

b. Industry performance:

- Blue-collar recruitment: Demand in urban service sectors like catering and retail rebounded steadily from April.

- Manufacturing: Job postings maintained YoY growth, showing resilience.

- White-collar recruitment: Demand in advertising, internet, and finance stabilized and recovered, with leading YoY rates.

3. AI Progress:

a. AI2C: Gray-test features: Added AI explanations to search results, now fully launched. AI interview bots help users practice interview skills, improving recommendation system understanding. Officially available for students and those with <3 years of experience.

b. AI2B: Resume submission service users grew 30%, generating cash flow. Smart recruitment assistant guides companies to articulate needs and match candidates, improving hiring success by 25%. However, large-scale deployment remains cautious.

c. AI2 Management:

- Weekly report reform: AI-generated summaries highlight project gaps and content issues, aiding decision-making.

- Talent evaluation: AI assesses performance data objectively, avoiding human biases.

4. Outlook: Focus remains on profit growth, with cautious scaling of AI in recruitment processes.

2.2 Q&A

Q: How did recruitment demand evolve during the tariff war? Any recent recovery signs?

A: Demand: Recovery trends persist, with limited overall impact. Industry/regional diversification mitigates export-sector exposure.

Recovery signs: April-May job postings grew steadily; export sectors saw a brief April dip but rebounded by mid-May.

Q: How does April-May 2025 demand compare to 2024? Differences by industry/company size? Will trends continue into June-July graduation season?

A: YoY: Supply-demand ratios improved, with post-holiday growth outperforming 2024.

Differences: Blue-collar (especially urban services) growth accelerated March-May.

Outlook: Graduation season trends appear optimistic but hard to predict precisely.

Q: Feedback on internal AI tests? Monetization plans?

A: Feedback: Positive; some features now fully launched.

Monetization: AI tools improved hiring efficiency by 25%; AI chat served 9M+ dialogues, boosting success rates by 15%. Monetization will be gradual.

Q: Thoughts on RMB 3B non-GAAP operating profit target? Long-term plans?

A: Target: Confident due to cost controls and seasonal tailwinds.

Capital: $2B+ cash reserves support buybacks and other returns.

Q: Will AI disrupt HR competition? Service expansion potential?

A: Competition: Stable for now; future AI waves may change dynamics.

Expansion: AI optimizes costs (e.g., placement services) with clearer ROI than early ChatGPT.

Q: Blue-collar KPIs and new business updates?

A: Blue-collar: 45% new users, 39% revenue; tier-3 cities are key. Simplifying services is the focus.

Placement: Heavy AI resources aim to boost efficiency and reliability.

<End>

Disclosures:Dolphin Research Disclaimer