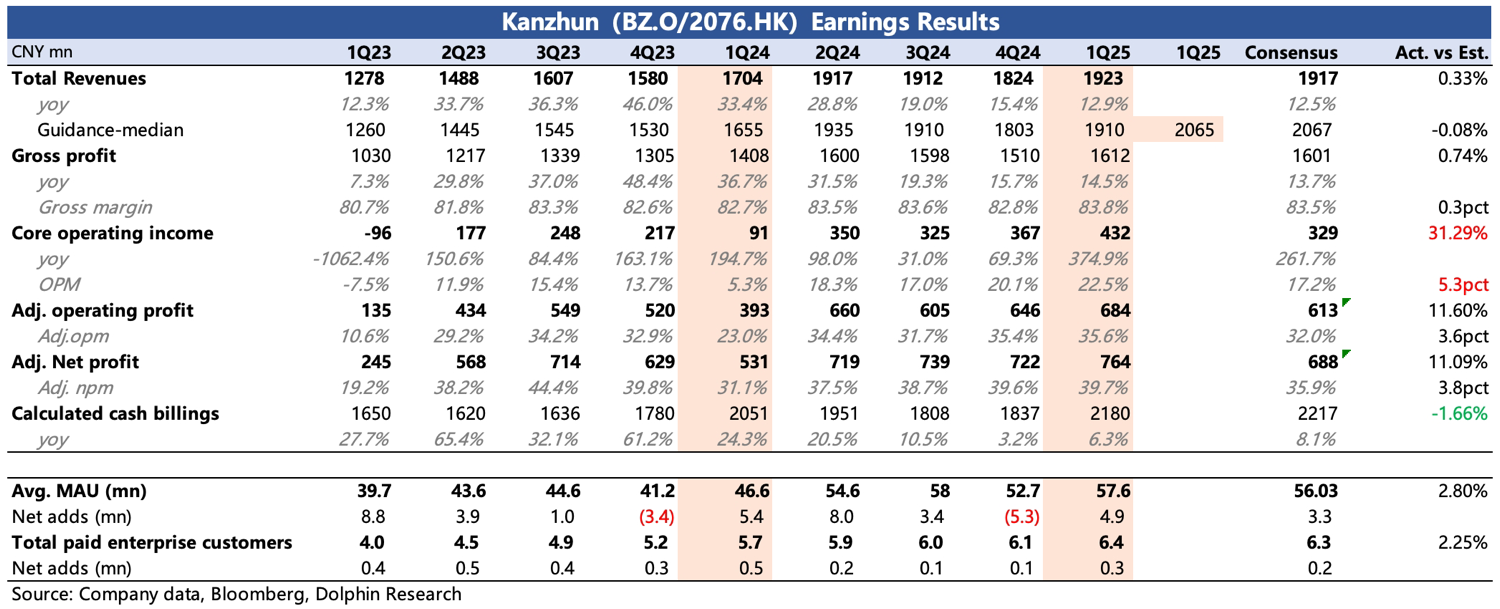

BOSS Zhipin 1Q25 Quick Interpretation: The first-quarter performance was mainly highlighted by profits, with current revenue and guidance both within expectations, while cash flow was slightly weaker. Overall, BOSS's first-quarter financial report still reflects its small but beautiful nature, but the increasing marginal macro pressures are hard to ignore. Investment opportunities still lie in valuation pullbacks.

1. Traffic growth slightly exceeded expectations, with the platform adding 4.9 million users quarter-over-quarter. However, sales expenses excluding SBC continued to decline by 18% year-over-year, meaning the platform's appeal remains strong despite reduced spending.

2. Revenue met expectations, but Q2 guidance growth continues to slow. Considering the platform's competitive position remains unchanged, this suggests the deteriorating hiring environment cannot be underestimated.

3. Gross margin remained stable, with declines in R&D and administrative expenses alongside sales expenses. However, the compression in administrative expenses was mainly due to reduced equity incentive fees. Excluding this, expenses increased due to overseas business expansion.

The core operating profit (excluding other income) was 432 million, significantly exceeding market expectations of 329 million, with a profit margin of 22.5%. The steady improvement trend remains intact, further confirming BOSS's external competitiveness and internal operational efficiency.$Kanzhun(BZ.US)$BOSS ZHIPIN-W(02076.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.