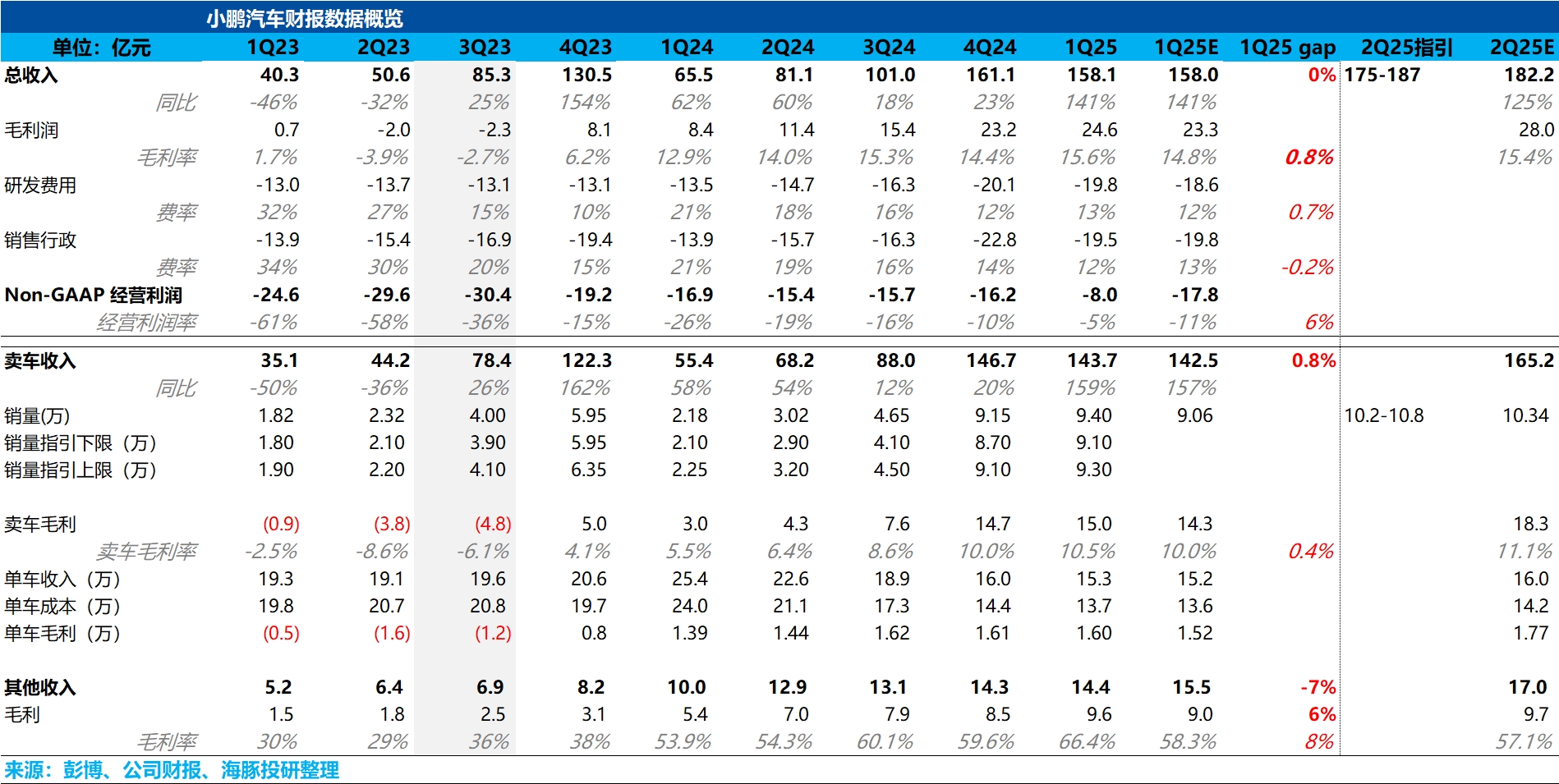

XPeng 1Q25 Quick Interpretation: Overall, XPeng's performance this time is quite good, with revenue basically in line with market expectations and gross margin slightly exceeding expectations, mainly driven by good gross margins in both vehicle sales and other business revenues.

Looking at the most important automotive business, management had previously provided guidance indicating that the gross margin for the automotive business in the first quarter would show a quarter-on-quarter improvement trend and could reach double digits. Although the average selling price has declined due to the downward shift in model structure, benefiting from economies of scale, the actual gross margin from vehicle sales this quarter did indeed slightly exceed expectations as guided.

In terms of guidance for the next quarter, the sales guidance is 102,000 to 108,000 units, implying an average monthly sales of 33,500 to 36,500 units for May/June, which is basically unchanged from April's sales of 35,000 units and is within market expectations. This is mainly due to the relatively average order volume for the refreshed G6/G9/X9 models (currently around 7,000 weekly orders, but the mediocre weekly orders have already impacted the stock price), and among the new cars set to be launched and delivered in the second quarter, there is only the Mona M03 intelligent driving version. Therefore, to be precise, XPeng's new vehicle cycle will not begin until the third quarter, and the sales guidance for the second quarter is also within expectations.

However, in terms of the implied average selling price guidance for revenue, there is indeed a marginal upward trend, with the implied average selling price expectation in the revenue guidance at 158,000 yuan, an increase of 5,000 yuan quarter-on-quarter, which is basically in line with expectations. Overall, XPeng is moving through a relatively quiet period in the second quarter (but still showing marginal improvement), and as it approaches the major product cycle in the third quarter and beyond, it still has significant potential for further upward movement. $XPeng(XPEV.US) $XPENG-W(09868.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.