Vipshop (Minutes): Expect to return to positive growth in the second half of the year, returning 75% of profits to shareholders

Below is$Vipshops(VIPS.US) the earnings call minutes for FY25 Q1. For earnings analysis, please refer to《Vipshop: Falling to the Bottom Again, Is There Still a Buyback to Support It?》

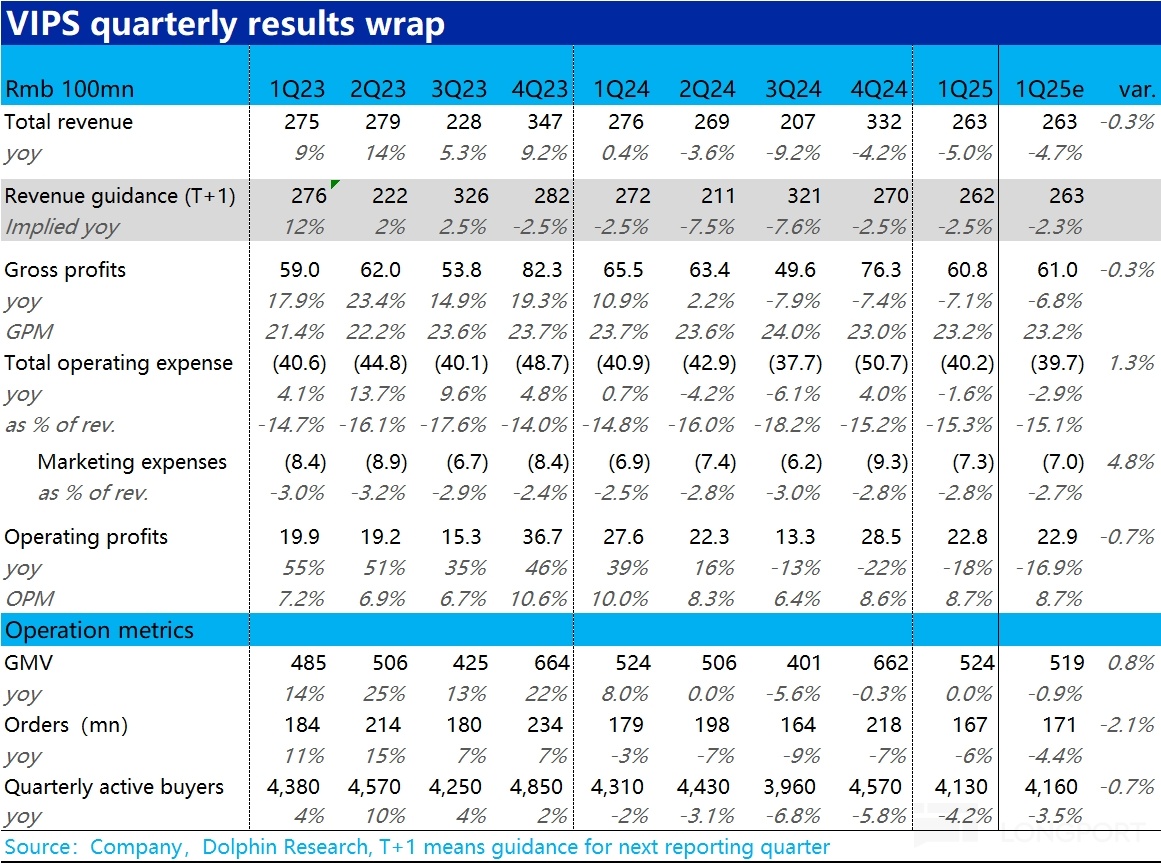

1. Key Earnings Highlights

1. Shareholder Return Plan:

2025 Commitment: Return no less than 75% of 2024 non-GAAP net profit (RMB 9 billion).

2025 YTD Returns: Over $400 million returned to shareholders, including ~$250 million in annual dividends and over $150 million in share repurchases.

As of March 31, 2025, the company held RMB 28.9 billion in cash, cash equivalents, and restricted cash.

2. User Operations: Super VIP (SVIP) program saw active members grow 18% YoY, contributing 51% of online GMV; upgraded member benefits (e.g., "Gold Card" perks for hotel/travel services) cater to family users.

3. Q2 Outlook: Revenue guidance of RMB 25.5–26.9 billion, representing a YoY decline of -5%–0%.

II. Earnings Call Details

2.2 Q&A

Q: Given macro headwinds like tariffs, could management comment on monthly GMV trends in Q2 2025 so far and the full-year revenue/profit outlook?

A: Consumer sentiment has shown signs of improvement since January-February, with marginal recovery in March. Q2 (April onward) momentum is stronger. For full-year 2025, after a -5%–0% H1 trend, we expect H2 growth to resume. Net margins should remain broadly stable vs. 2024.

Q: Have export-oriented apparel products been redirected to domestic markets recently, potentially diverting demand to competitors?

A: Our tariff exposure is minimal, with negligible direct U.S. procurement—mostly healthcare products or non-U.S. goods. For exporters shifting focus domestically, we began collaborating in April to explore distributing their products to Vipshop users. This takes time due to differing standards (branding, certifications, etc.).

Q: Any updates on a potential Hong Kong secondary listing?

A: Updates will be disclosed when available.

Q: SVIP growth has been steady—what’s the strategy to sustain it? Any H2/2026 targets?

A: SVIP growth remains strong (double-digit for consecutive quarters). We’re confident in maintaining double-digit SVIP growth for 2025, driven by exclusive discounts during flash sales to boost retention. SVIPs’ GMV share will further increase.

Q: How has e-commerce competition evolved amid macro uncertainty?

A: Competition is intense. Our edge lies in branded discount retail—we aim to become the online outlet for deep discounts. Long-term, consumers prioritize value, quality, and service.

Q: Latest SVIP purchase frequency and ARPU trends?

A: Metrics are steady. New SVIPs dilute ARPU temporarily, but 2-year cohorts show smaller declines. We’re enhancing cross-category recommendations for family shoppers.

Q: Return rate trends?

A: Stable policies; return rates rose ~2pp. A 1pp annual increase is expected as service expectations rise.

Q: Is the 2025 capital return guidance unchanged?

A: Since April 2021, we’ve returned >$3B via buybacks/dividends ($400M YTD). We’ll return ≥75% of 2024 non-GAAP net profit as pledged.

Q: GMV impact from national subsidies?

A: Subsidies cover appliances (not our strength), contributing ~1% of GMV with minimal financial impact.

Q: Post-Shanshan financing, any Shenzhen strategy shifts?

A: Synergies exist between our online discount retail and Shanshan’s 20 offline outlets (China’s top outlet operator). We’ve filed REITs applications to fund expansion.

Q: How to balance H2 marketing spend with margins?

A: Marketing spend was 2.7% in 2024 (2.8% in Q1); we’ll cap it at 3%. Growth is achieved efficiently via targeted partnerships.

<End>

Disclosures: Dolphin Research Disclaimer