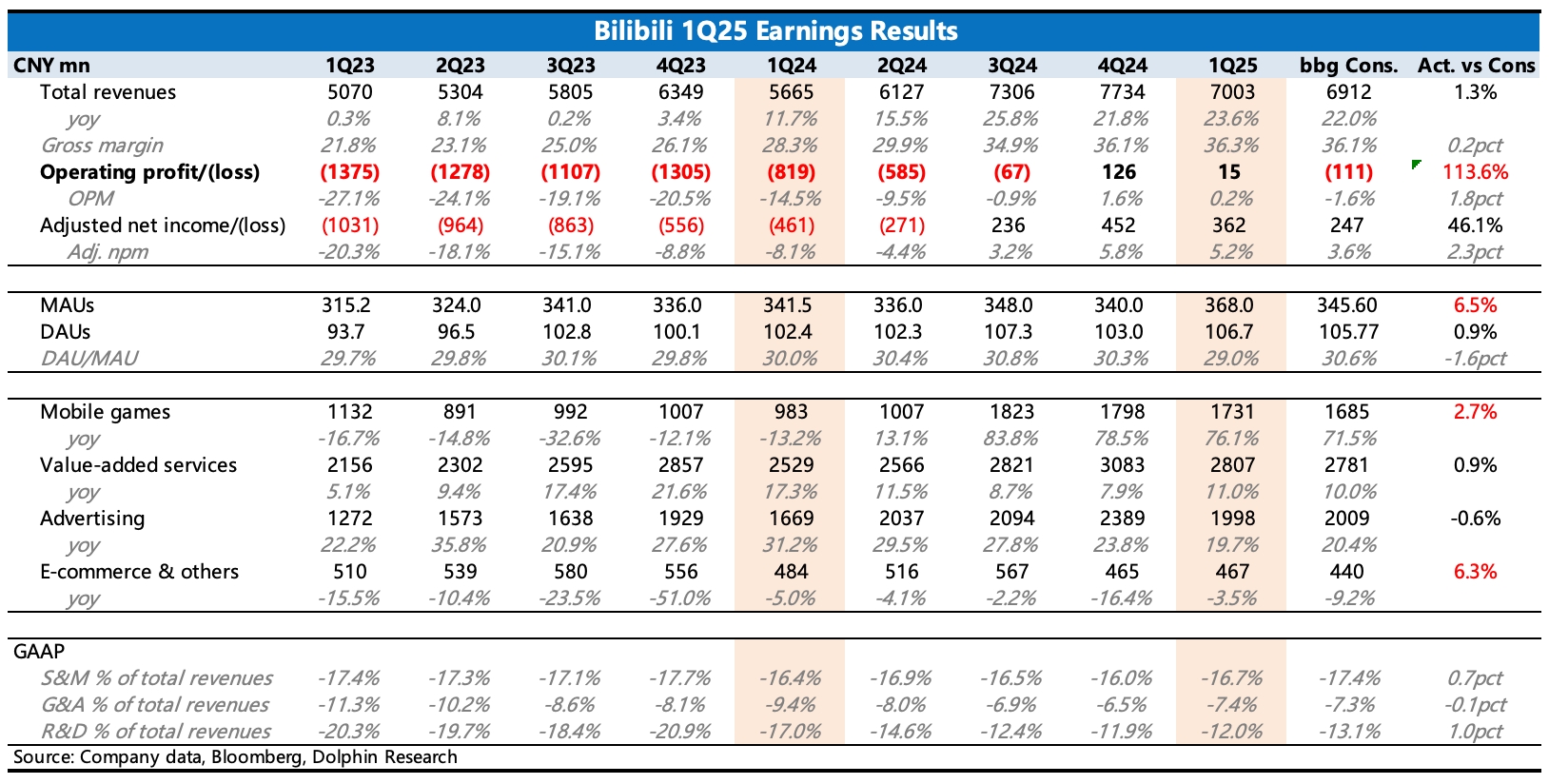

Bilibili 1Q25 Quick Interpretation: The first-quarter performance generally exceeded expectations, with small surprises mainly in profits and user numbers.

First, let's talk about profits. After the high-growth phase, apart from short-term revenue growth, this is the metric the market values most. Last quarter, the company set a long-term profit margin target—gross margin of 40%-45% and adjusted net profit margin of 10%-15%. Although some institutions directly adopted this long-term target in their valuations, many funds remain skeptical about achieving it.

Before the earnings report, the market had expected a seasonal fluctuation-induced loss (Q1 advertising is generally weaker than the shopping season in Q4). However, unexpectedly strong performance in gaming and slightly restrained operating expenses ultimately led to positive profits.

User numbers, a metric that Bilibili hasn't shown positive performance in for a long time, saw a net increase of 28 million monthly active users this quarter, significantly exceeding expectations. This should provide some emotional uplift. Although the driving factors weren't specified, we speculate that the user growth likely stems from the collaboration with the Spring Festival Gala broadcast, including the official account setup and the replay of past gala highlights. However, the market probably didn't set high expectations, considering competing platforms like Xiaohongshu also had similar collaborations. $Bilibili(BILI.US) $BILIBILI-W(09626.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.