Ctrip (Minutes): Stable demand for hotel and travel, will continue to increase marketing investment

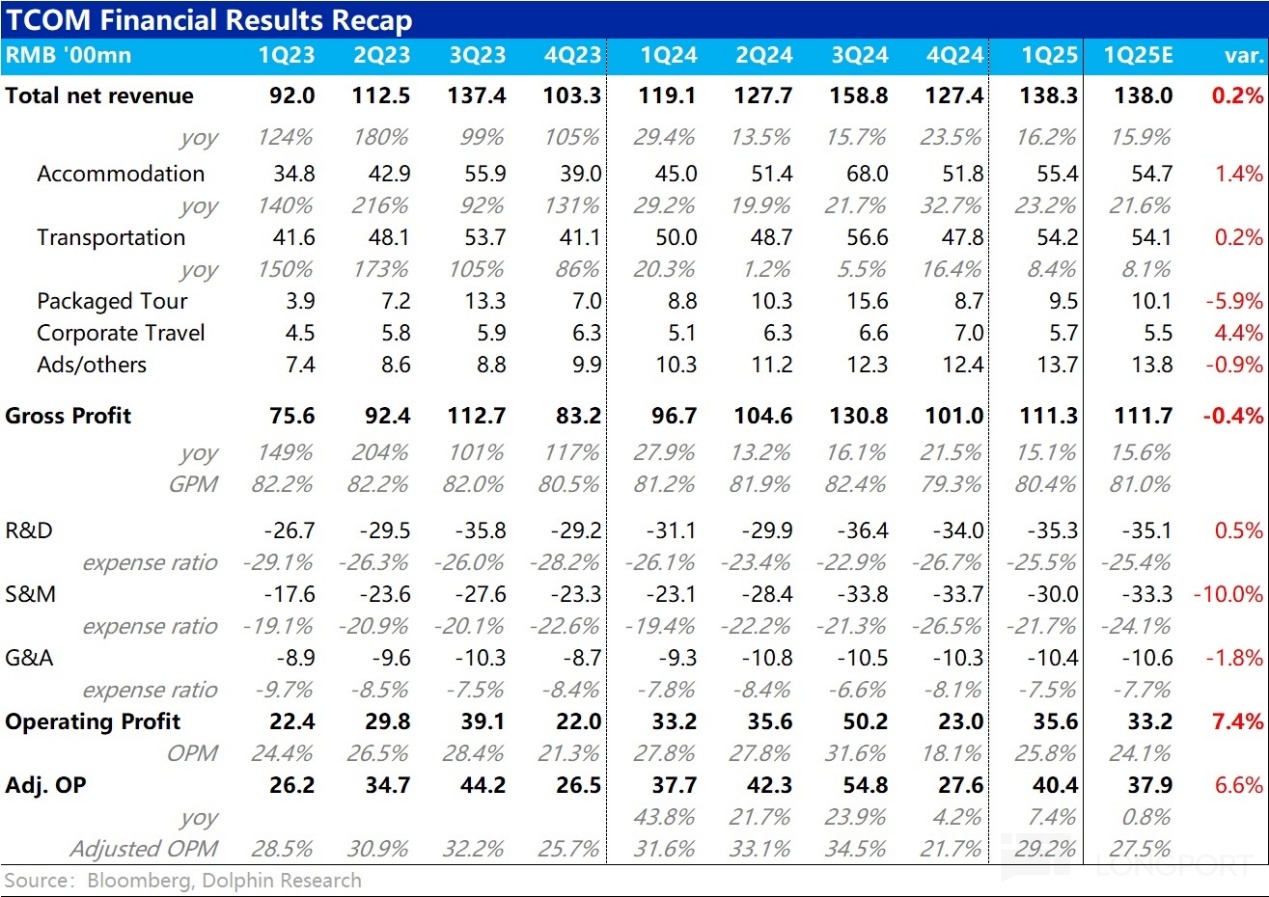

Below is$Trip.com(TCOM.US) the earnings call minutes for FY25 Q1. For earnings interpretation, please refer to《Trip.com: Another Revenue Growth Without Profit Growth, Even the Top Student Faces Challenges?》

1. Key Earnings Highlights

1. Shareholder Returns and Cash Reserves: As of March 31, 2025, total cash, cash equivalents, and short-term investments amounted to RMB 92.9 billion (approximately USD 12.8 billion). As of May 16, under the latest share repurchase program (initiated in 2024), USD 84 million has been repurchased, with further opportunities to be evaluated in 2025.

2. Detailed Earnings Call Content

2.1 Key Management Statements

1. Market Trends and Strategic Focus:

Inbound Tourism: Inbound bookings grew approximately 100% YoY, with hotel bookings from visa-exempt APAC countries like South Korea, Thailand, Malaysia, and Indonesia surging over 240%.

Outbound Tourism: Cross-border flight capacity recovered to 83% of pre-pandemic levels, with hotel and air ticket bookings exceeding 120% of 2019 levels, outperforming the market by 30%-40%.

2. Technology and Operational Initiatives:

AI Applications: AI assistant Trip Genie saw user session duration increase by ~50%, while AI customer service handled over 80% of post-sales inquiries, enabling 24/7 support.

International Expansion: Total bookings on international OTA platforms grew over 60% YoY, with APAC as the primary growth driver; 70% of international bookings were completed via mobile. Partnerships with local players like Japan’s JTB deepened product offerings.

2.2 Q&A

Q: How do vertical AI agents compare to general AI agents in the travel industry? After years of operating AI features, what are Trip.com’s plans for these technologies?

A: Vertical and general AI agents each have strengths. Vertical agents excel at providing real-time proprietary travel data and seamlessly integrating products/services to enhance travel experiences. General agents offer broader information beyond specific verticals but still rely on vertical OTAs during booking. Trip.com has launched AI tools like Trip Genie (advanced model for queries) and Trip.Best (data-driven recommendations) to build the most efficient, reliable one-stop travel platform.

Q: Could management comment on Labor Day holiday and Q2-to-date performance?

A: Labor Day saw robust results: domestic hotel bookings rose >20% YoY, cross-border bookings grew ~30%, with inbound bookings surging ~150%. Domestic airfares increased YoY, while hotel prices stabilized QoQ, reflecting resilient leisure demand.

Q: What are the trends in outbound travel, company performance, and full-year expectations? How might tariff/FX volatility impact this?

A: Q1 mainland cross-border flights recovered to 83%-84% of 2019 levels; CAAC expects >90% by 2025E. Trip.com outperformed, especially in long-haul (e.g., Europe). Inbound/outbound naturally hedge FX exposures.

Q: How was hotel ADR performance in Jan-Apr, recent pricing trends, and full-year outlook?

A: Q1 ADR declined high-single-digits YoY; Q2 saw narrowing declines. Labor Day ADR dipped low-single-digits. Supply grew high-single-digits, led by mid-to-upscale hotels. Normalizing supply and strong demand should stabilize prices.

Q: How is consumer travel sentiment amid macro/geopolitical tensions?

A: Demand remains resilient. Leisure stays strong (per-capita spend stable YoY); corporate travel is stable—90% of surveyed firms expect 2025 budgets flat or up.

Q: What’s the domestic competitive landscape? Any impact from rivals’ aggressive loyalty programs?

A: Competition is rationalizing. Our membership scheme drives 80% revenue from existing clients; we’ll maintain leadership.

Q: Any operational/financial details for Q1?

A: Total bookings grew >60% YoY. APAC remains priority; Middle East expansion diversifies markets. Marketing ROI meets targets despite higher spend.

Q: Where is Trip.com allocating overseas resources? What’s next for 2024?

A: Asia-focused mobile app (~70% orders) and marketing drove success. Brand campaigns boosted direct traffic/cross-sell potential.

Q: What are Trip.com’s core strengths in global expansion? Any trade war impact?

A: Strengths: 1) One-stop AI-powered platform; 2) Top-tier customer service; 3) Well-designed app for Asian users. No comment on trade tensions.

Q: Updates on inbound travel’s revenue contribution?

A: Policy tailwinds (visa waivers for 40+ countries, extended transit visas) and strong execution (triple-digit Q1 growth) support momentum.

Q: Sales/marketing expenses were below expectations—full-year outlook?

A: Q1 ratio dipped seasonally. Near-term marketing will fluctuate quarterly; long-term efficiency gains expected via direct traffic/loyalty.

Q: Capital return plan updates—more buybacks ahead?

A: USD 84M repurchased YTD (USD 200M total 2025 returns). Approved buyback quota: ~USD 600M remaining. Pending HKEX approval for additional capacity.

<End>

Disclosures: Dolphin Research Disclaimer