Trip.com's performance this quarter can be described as stable within expectations, but also somewhat lackluster.

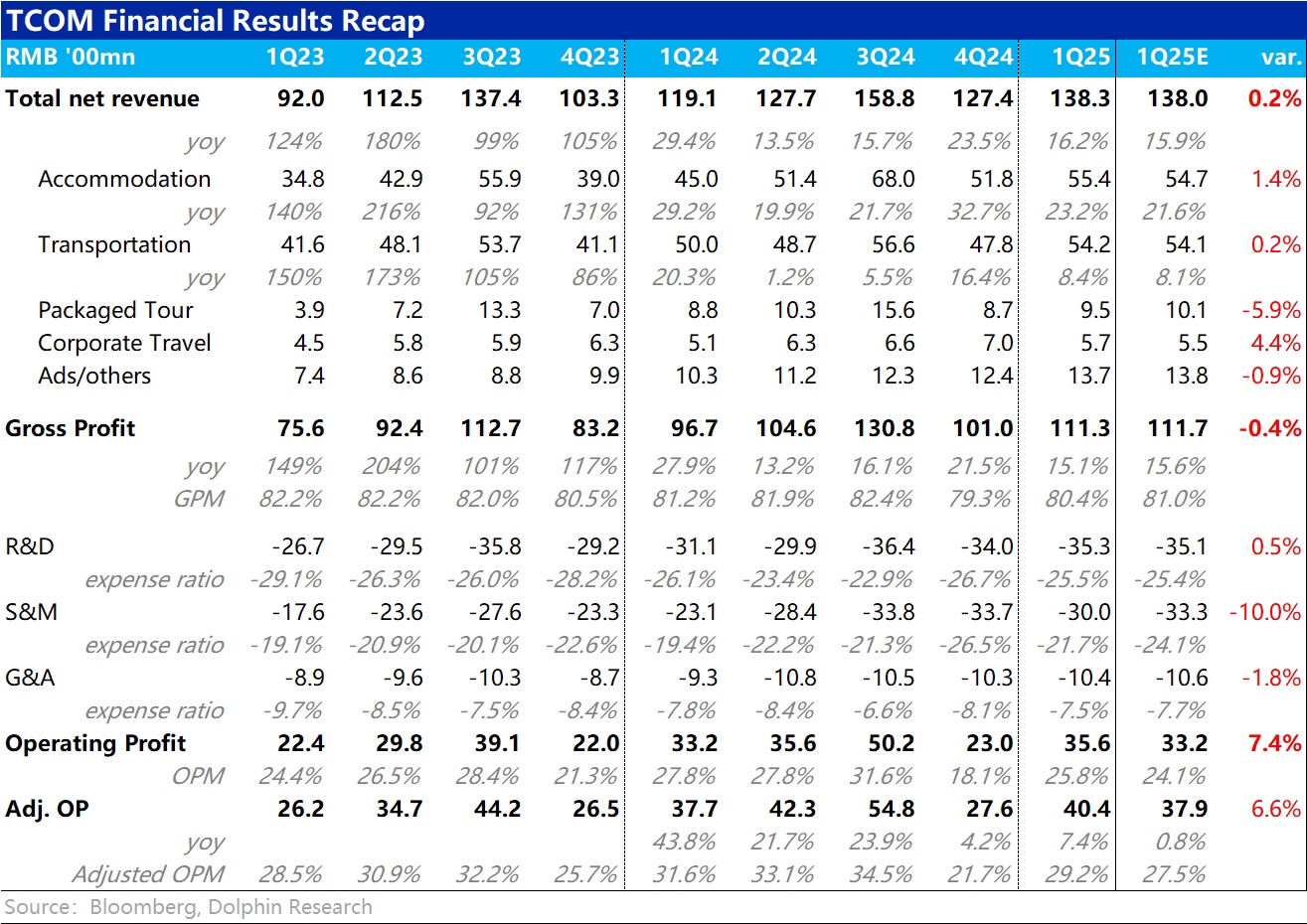

In terms of the big numbers, total revenue of 13.8 billion was exactly in line with market expectations, but the absolute revenue growth rate of 16% remains relatively high among leading Chinese internet companies.

In terms of profitability, gross margin was slightly below expectations, but the difference was small and had little impact; the main point is that although the company previously guided for significantly higher marketing expenses, the actual increase was not as high as expected—about 300 million lower. As a result, operating profit also slightly exceeded expectations by 300 million. And this was the "biggest highlight" of the quarter's earnings report. However, in absolute terms, adjusted operating profit only increased by about 7% year-over-year, truly reflecting the company's guidance of "revenue growth without profit growth," which is not particularly good.$Trip.com(TCOM.US)$TRIP.COM-S(09961.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.