"Big and beautiful" = "big deficit", will US stocks be dragged down by US bonds again?

Hello everyone, I'm Dolphin Research!

In last week's strategy report, Dolphin Research mentioned that after the tariff issue was settled, the market's focus would shift back to Trump's second wave of tax cuts and industrial policies. "But the fatal BUG here is that tax cuts and industrial stimulus essentially require fiscal backing."

As for short-term trading, will it revolve around this "BUG," thereby affecting the valuation expectations of major asset classes? Let's take a detailed look:

1. Trump's 'Big, Beautiful Bill' = 'Big Deficit' Bill?

This new bill, the 'Big, Beautiful Bill', mainly extends the tax cuts passed in 2017, involving consumer and overtime tax credits, child tax credits, etc. It also slightly tightens Medicaid eligibility and food stamp standards.

Overall, however, it remains a tax-cut bill that will significantly increase the deficit, earning it the market nickname 'Big Deficit' Bill.

According to estimates by the U.S. Federal Budget Committee, it will raise the fiscal deficit for FY2027 (ending September 2027) from $1.7 trillion to $2.3 trillion, nearly doubling the non-interest deficit.

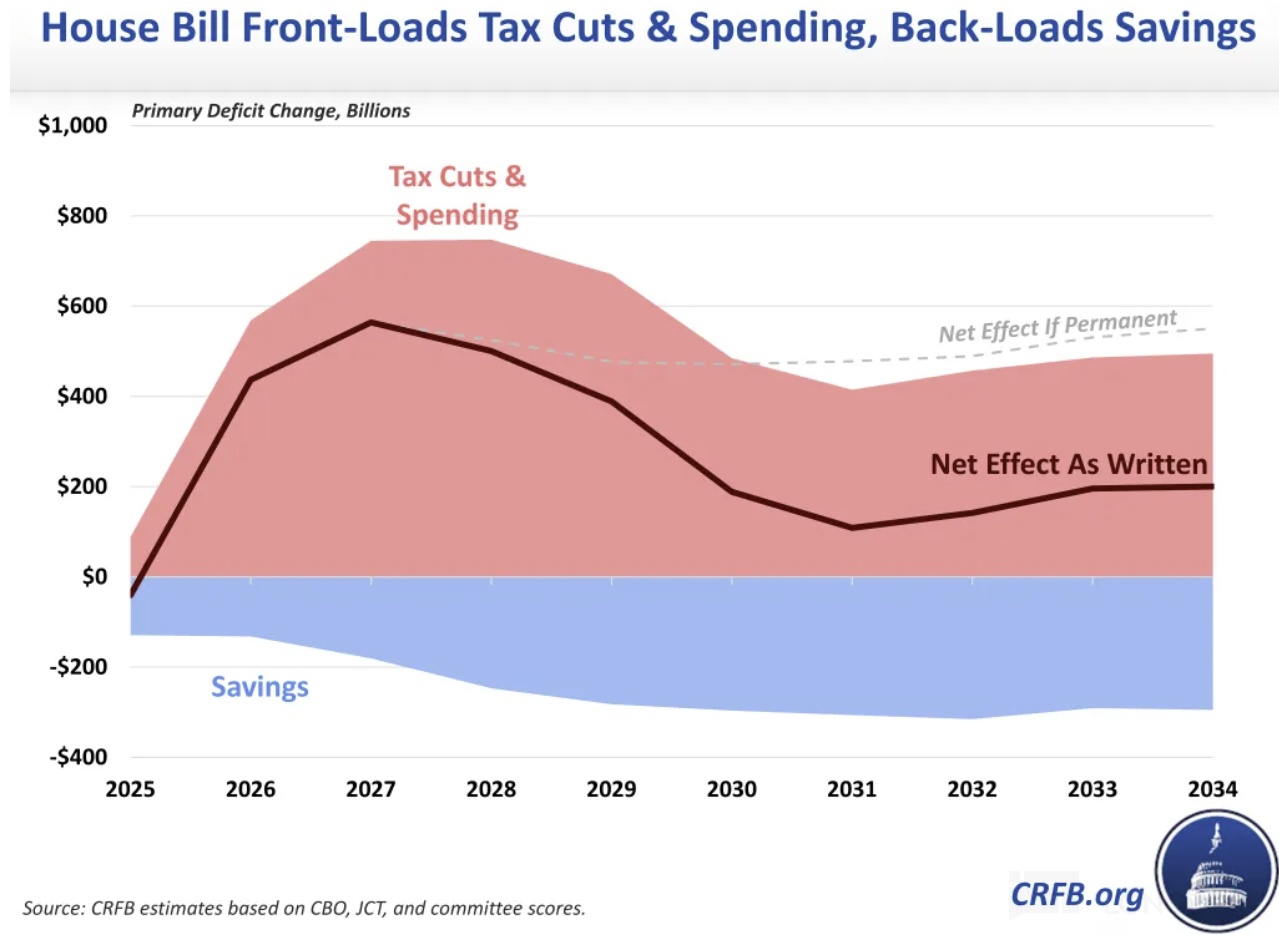

Moreover, the tax cuts under this bill are front-loaded, while the cost-saving measures are back-loaded. As a result, over a 10-year period, the bill will lead to higher deficits in the first half, particularly in FY2026 and FY2027, with contraction only occurring in the latter half.

The current reality is that, this year, the Trump administration has:

a. Effectively failed in DOGE government spending cuts;

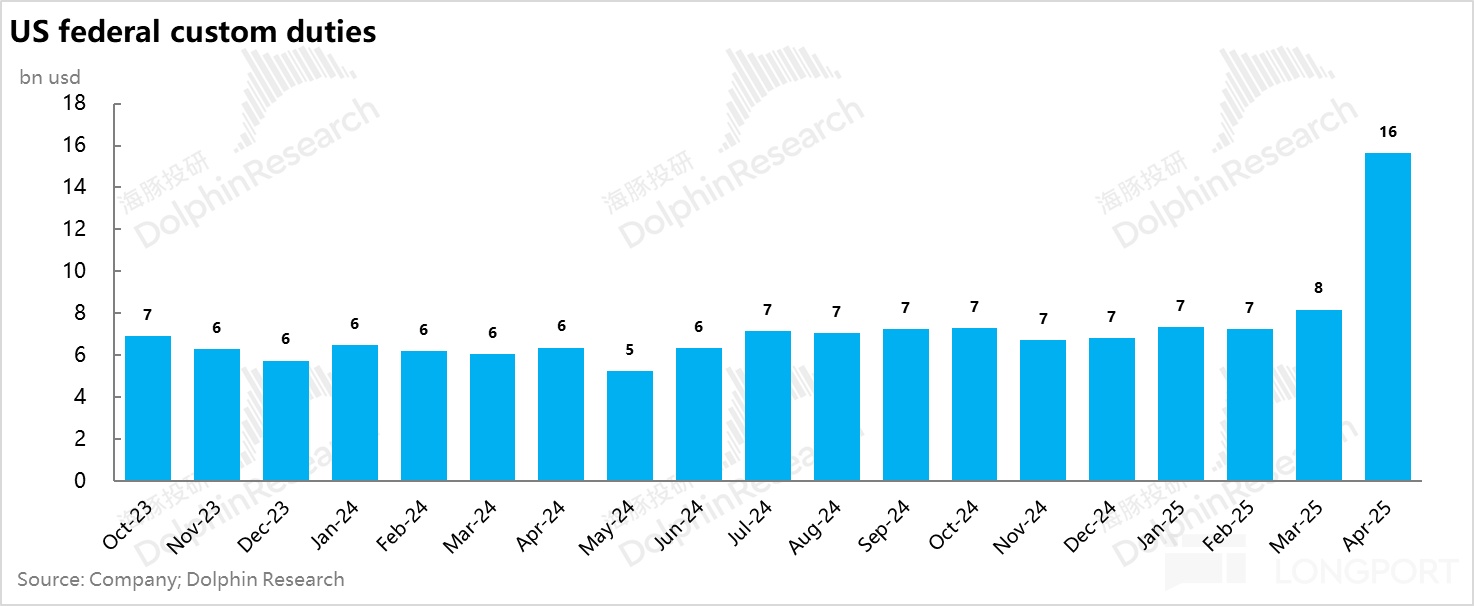

b. Limited gains from tariff hikes: Dolphin Research notes that the U.S. government's recent tariff increases are estimated to generate around $300 billion in additional revenue (quadrupling the current annual revenue of about $75 billion). In the first month of implementation, tariff revenue doubled, but it's still far from quadrupling monthly revenue.

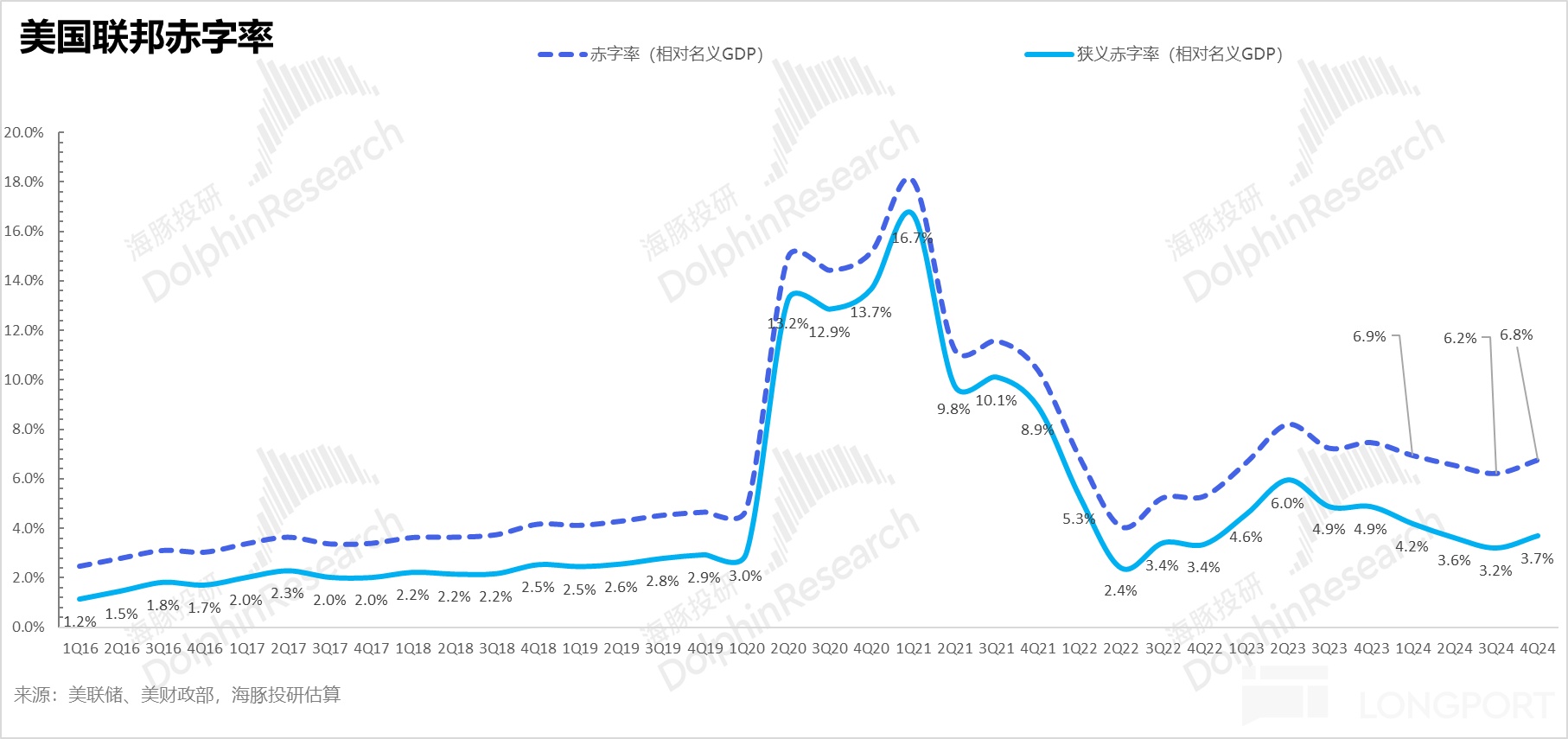

Originally, Bessent proposed a "333" plan—to increase daily crude oil production by 3 million barrels, boost GDP growth to 3%, and reduce the deficit to 3% by the new administration.

But under this tax-cut plan, the U.S. deficit ratio could approach 7% by 2034, with the 2025 budget deficit potentially rising to around 6.9%.

In summary, spending is front-loaded while cuts are back-loaded. Previous DOGE spending cuts and defense reduction plans have largely failed, tax cuts are accelerating, and the U.S. debt ceiling is being raised further. The U.S. Treasury's coffers need to be prepared early.

2. The Volatile Bond Market: A Silent Protest?

Preparing the Treasury's coffers hinges on financing government bonds. The question then returns to:

a. Will there be a compliant Federal Reserve to coordinate rate cuts?

b. Even if the Fed lowers short-term rates, how can long-term bond yields stay low enough to attract sufficient buyers? Will a compliant Fed need to directly buy Treasuries?

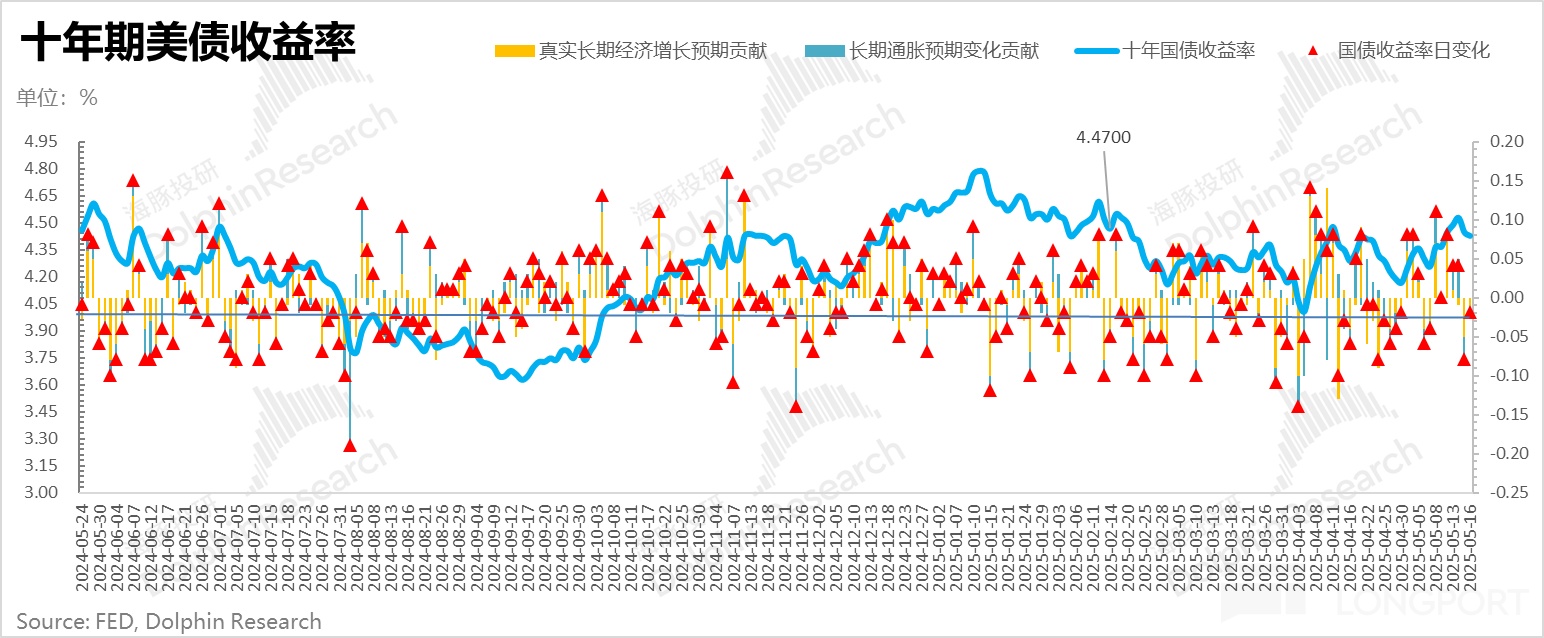

The current issue is that a compliant Fed hasn't arrived, but the market is already pricing in U.S. tax cuts widening the deficit and the government raising the debt ceiling. Long-term bond yields are showing signs of upheaval! The 30-year ultra-long Treasury yield has surpassed 5%, and the 10-year yield is nearing 4.5%.

Could the U.S. Treasury re-enter flood mode, weakening the dollar further?

For now, the Fed remains unwilling to cooperate, and with Treasury yields stubbornly high, the bond market's downtrend may persist. For U.S. stocks, another risk is that whenever the 10-year Treasury yield rises above 4.5% and climbs further, their sensitivity to this global asset pricing anchor increases, making them prone to corrections.

3. Portfolio Adjustments and Returns

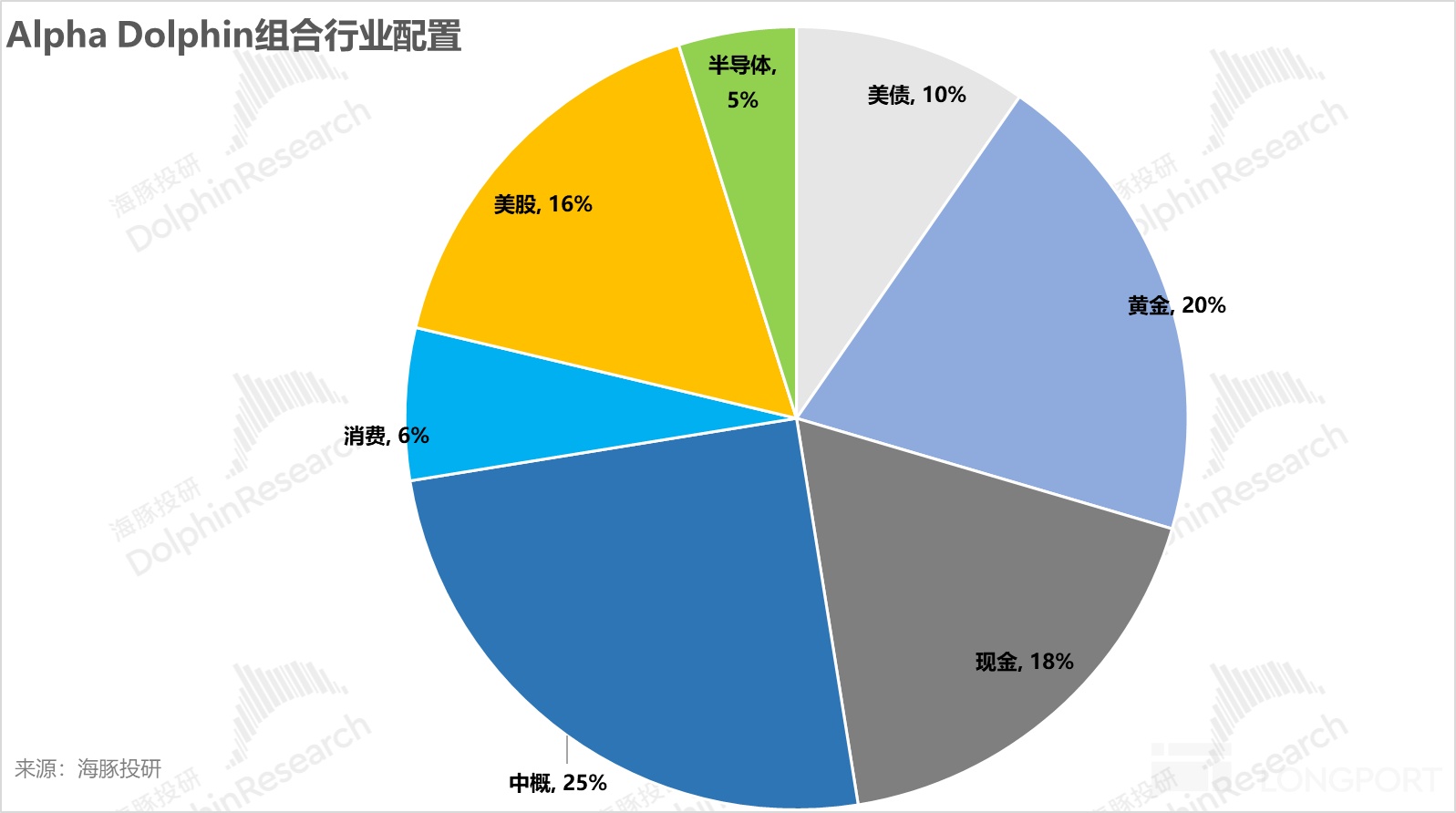

Last week, Dolphin Research noted that tariff risks had temporarily subsided, and the U.S. earnings season confirmed overall stable fundamentals. Dolphin Research gradually restored some equity asset weights, bringing equity allocation back to 53%. However, Dolphin Research believes U.S. bonds could still pose risks to stocks, maintaining a defensive 5:5 ratio for now.

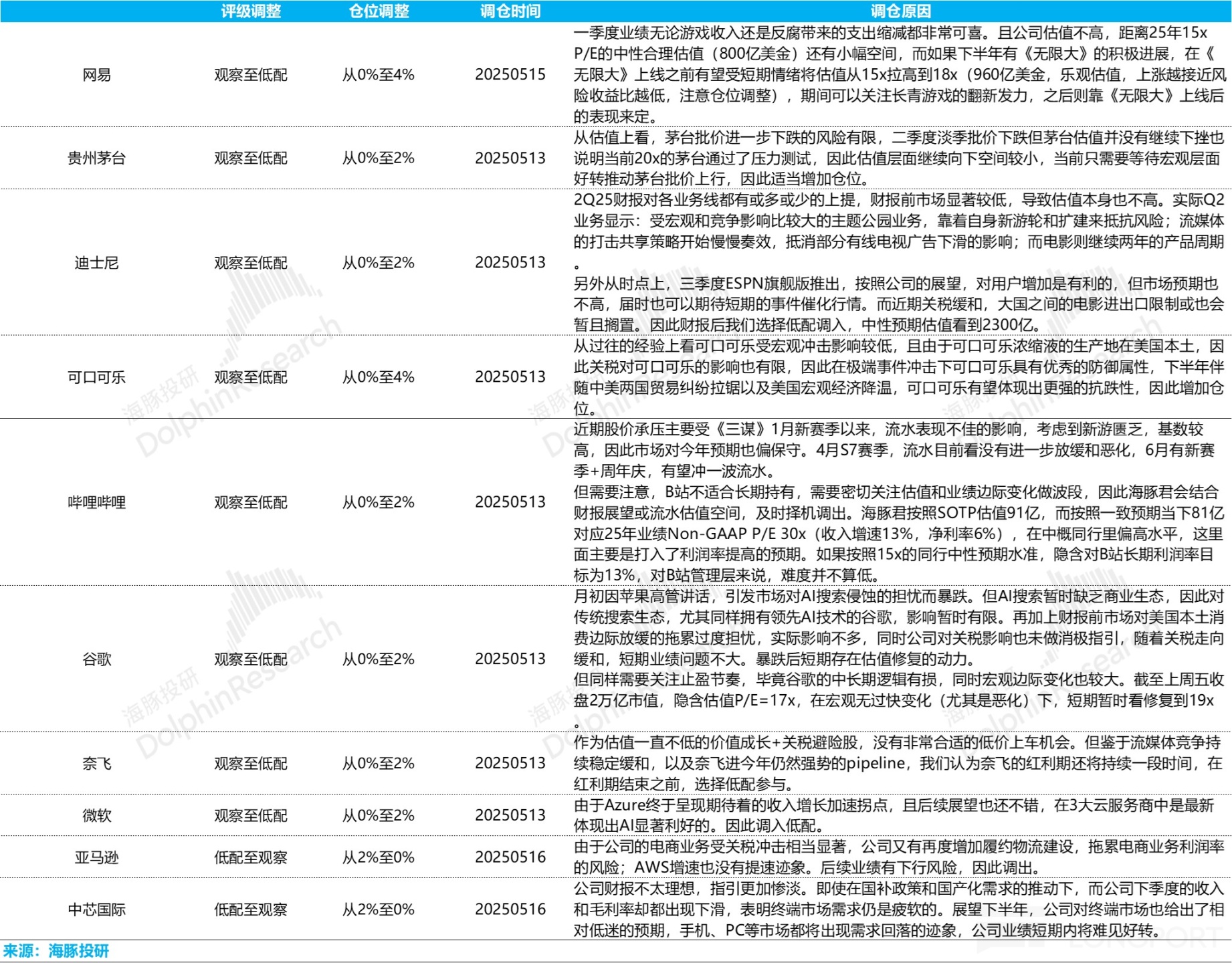

Details on individual stock additions and removals, along with explanations, are as follows:

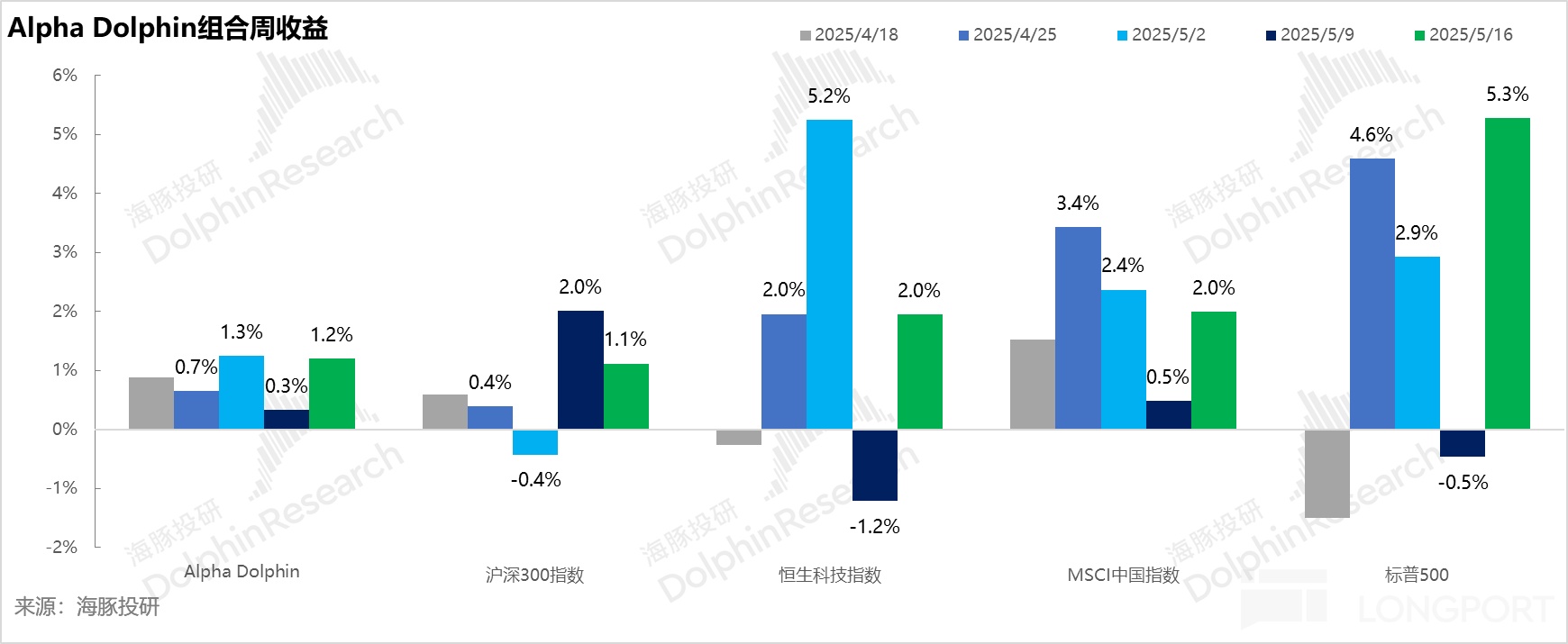

Last week, Alpha Dolphin's virtual portfolio returned 1.2%, outperforming the CSI 300 (+1.1%) but lagging MSCI China (+2%), Hang Seng Tech (+2%), and the S&P 500 (+5.3%).

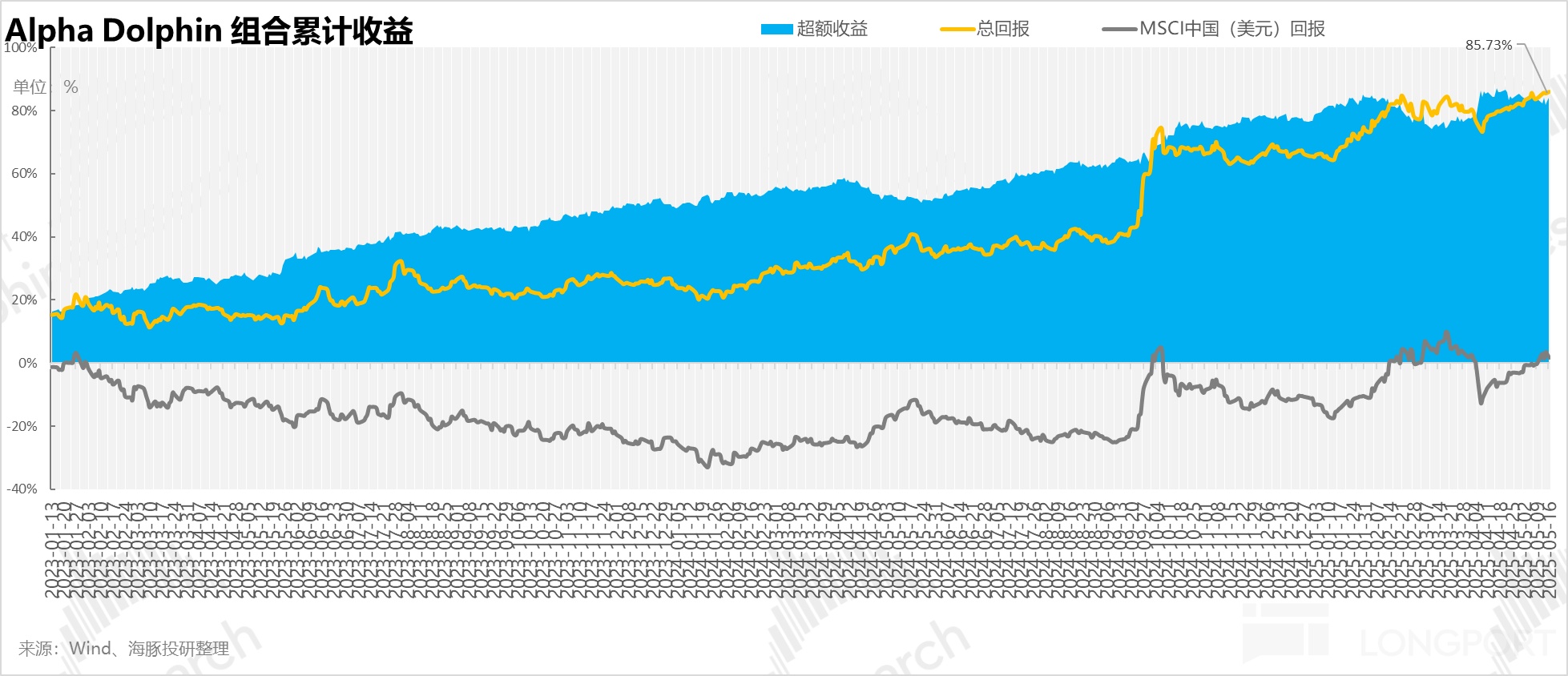

Since the portfolio's inception (March 25, 2022) through last weekend, its absolute return was 86%, with an 84% excess return over MSCI China. In terms of net asset value, Dolphin Research's initial virtual assets of $100 million have now exceeded $189 million.

4. Individual Stock Contributions

Last week's Alpha Dolphin performance was driven by equity rebounds following improved tariff conditions, particularly in Vipshop and TSMC. NetEase was added post-earnings rally and didn't contribute to last week's returns.

Key movers are explained below:

5. Asset Allocation

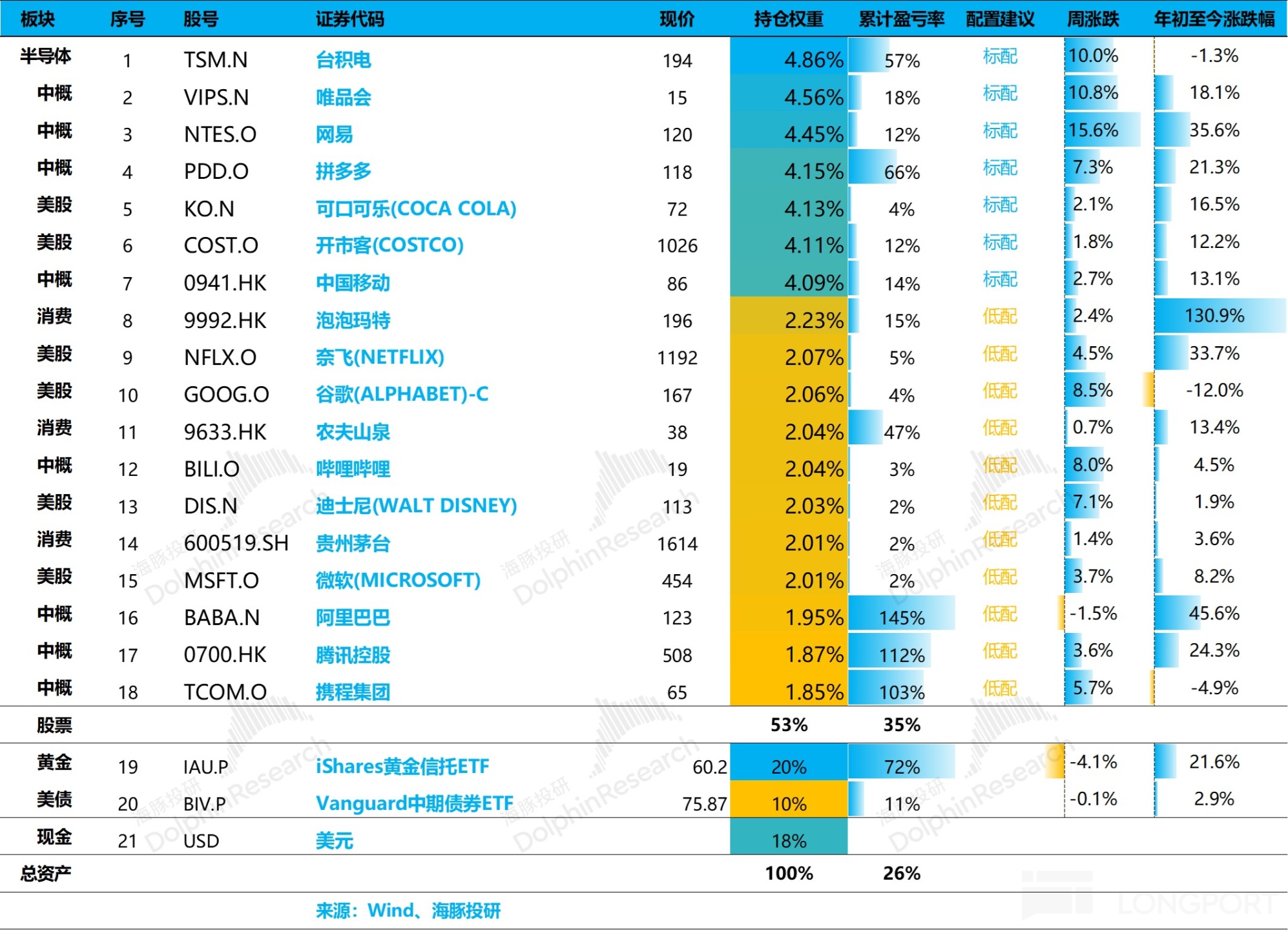

The Alpha Dolphin virtual portfolio holds 18 individual stocks and equity ETFs, with 7 at standard weight and the rest underweight. Non-equity assets are mainly in gold, U.S. Treasuries, and USD cash, currently split roughly 53:47 between equities and defensive assets.

As of last weekend, Alpha Dolphin's asset allocation and equity holdings were as follows:

6. This Week's Focus:

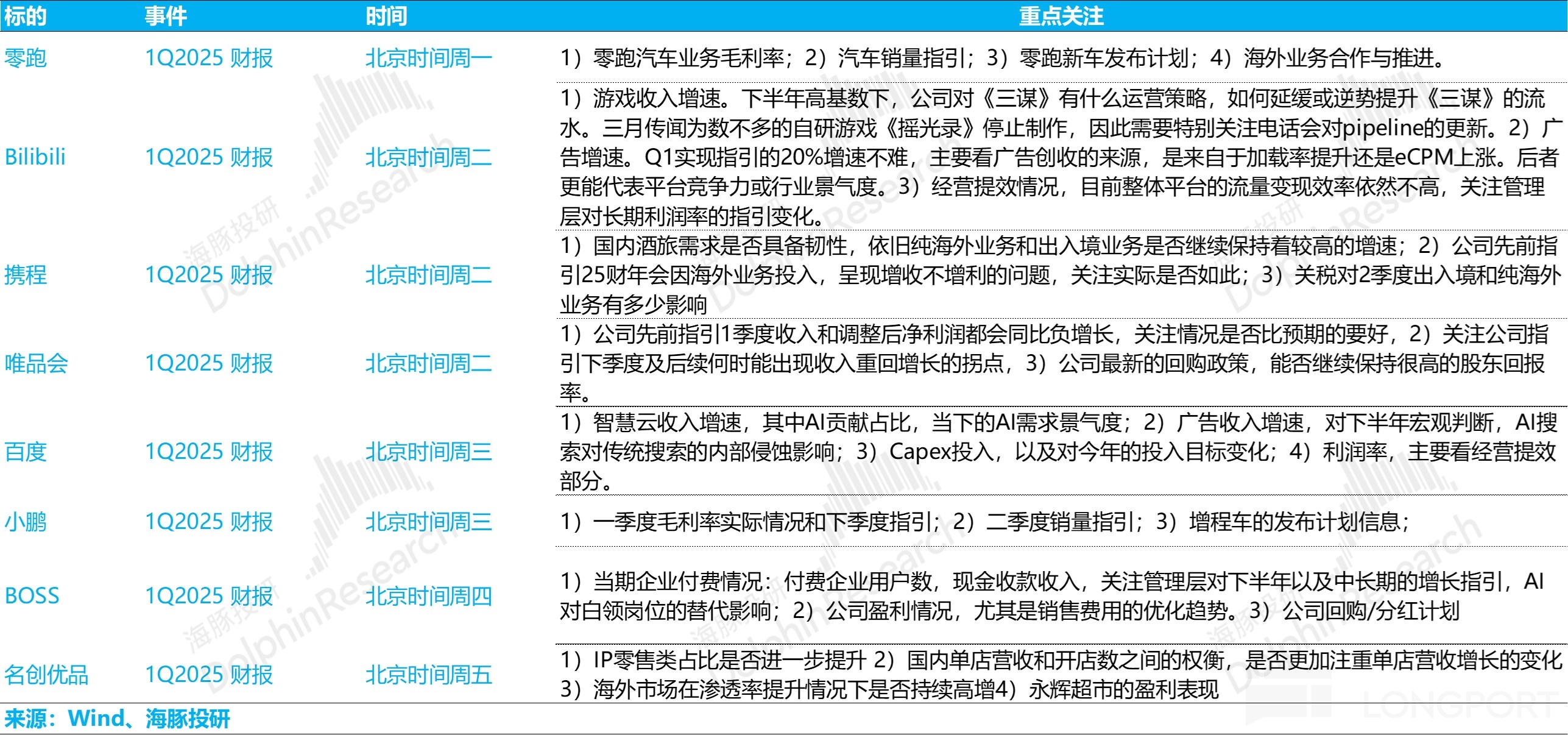

The mid-cap earnings season continues this week, shifting to niche players. Dolphin Research highlights key areas to watch:

<End of Text>

Risk Disclosures and Statements:Dolphin Research Disclaimer and General Disclosures

Recent Dolphin Research portfolio weekly reports:

《This Is the Most Down-to-Earth Approach: Dolphin Investment Portfolio Is Live》

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.