April 2025 Retail Review: The trend of recovery after hitting bottom remains unchanged, tariffs have no impact for now

The National Bureau of Statistics released the macroeconomic "data package" for April 2025 today (the growth rate disclosed by the official caliber this year is about 1pc higher than the growth rate calculated based on historical data, and we take the official data as the standard). Overall, the growth rate of various data this month has slightly declined compared to last month, but the extent is very small. Under last year's low base, overall retail consumption still shows a trend of bottoming out and warming up, with the social retail growth rate still above 5% this season. Similar to the situation in the United States, tariffs have not yet shown an impact on the domestic economy and consumption. When it will be released and how much impact it will have needs to be observed.

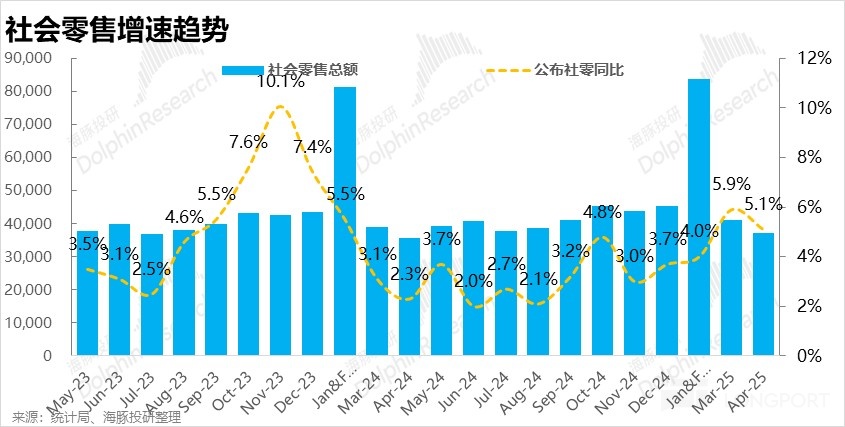

1. Social retail growth slightly declined but maintained at 5%

According to the data disclosed by the Bureau of Statistics, the overall social retail sales in March increased by 5.1% year-on-year (the growth rate calculated based on historical data is 4.1%). Although it slowed down slightly compared to last month, it still maintained above the 5% threshold. Under last year's low base, the central growth rate of social retail may rise from around 3% last year to around 5% this year.

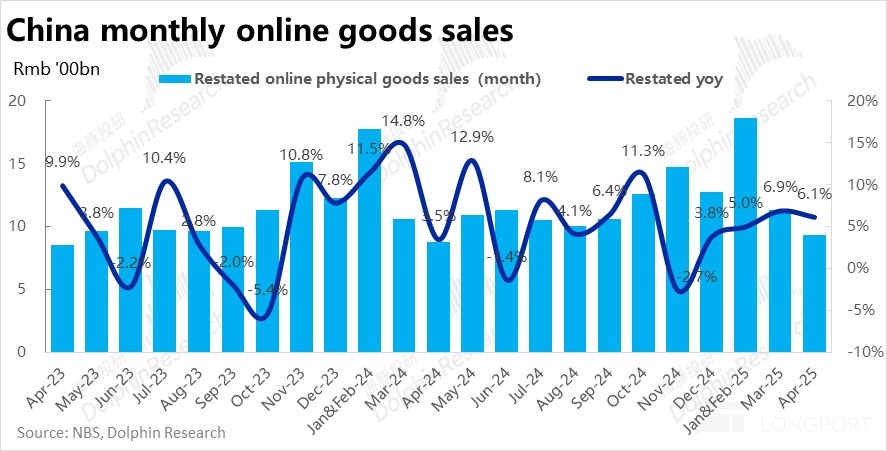

Following the overall warming trend of consumption, online physical retail (after adjustment) increased by 6.1% year-on-year in April, the growth rate also slightly slowed down month-on-month, and the extent was completely consistent with the social retail market (both 0.8pct).

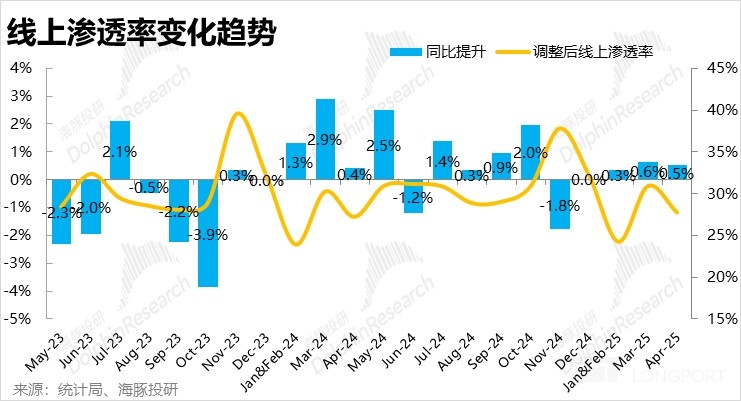

It is quite "coincidental" that since 2025, in every reporting cycle, the growth rate of online physical retail has always been +1pct on the basis of the overall social retail growth rate. (As shown in the figure below, there is no fluctuation)

In plain terms, the growth trend of online physical retail and the overall social retail market tend to be consistent, almost completely cyclical. (That is, when the market is good, online is also good, when the market is bad, online is also bad, there is not much anti-cyclicality). Reflected in the online retail penetration rate, the year-on-year increase since 2025 has been fluctuating in a narrow range of 0.3%~0.5%.

In terms of categories, from January to April, food and daily necessities increased by 14.6% and 5.5% respectively, while clothing increased by 0.5%. The growth rate of food continued to accelerate compared to last month at a high level, the growth rate of daily necessities remained stable, while the growth rate of clothing improved from the previous three consecutive months of negative growth to positive growth, but the absolute growth rate is still very weak.

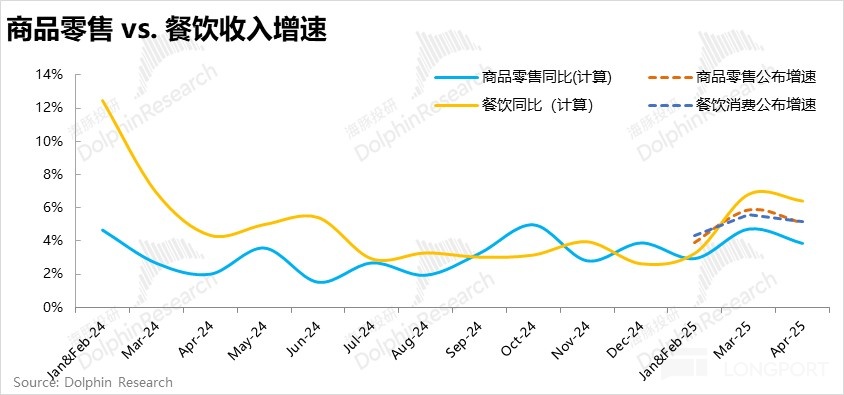

2. Commodity consumption continues to slightly outperform catering

Similar to the situation of the social retail market, since 2025, there is a certain difference between the growth rate of commodity retail and catering consumption directly disclosed by the Bureau of Statistics and the growth rate calculated based on historical data. Based on the data disclosed by the Bureau of Statistics, since this year, the growth of commodity consumption and catering consumption has also tended to be consistent, with the year-on-year growth rate of commodity retail at 5.1% and catering revenue growth at 4.8% this month. After experiencing the period from 2023 to the first half of 2024, where service consumption represented by catering significantly outperformed commodity consumption, the growth rates of the two have converged, and due to the low base, recent commodity growth has outperformed catering.

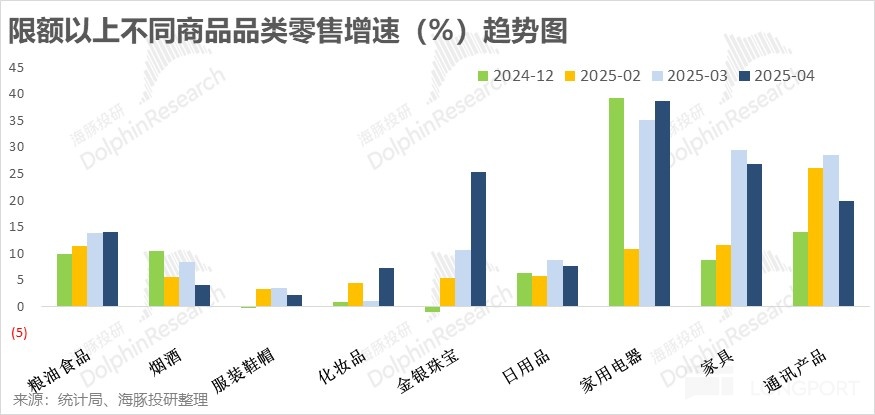

3. Mobile phone growth declines, furniture and home appliances remain good

In terms of product categories, according to data above the limit, the growth rate of cosmetics and gold and silver jewelry has shown a significant rebound, but the sales growth of clothing, shoes, and hats is still very weak.

In the sectors that have benefited from national subsidies in recent quarters, in April, the sales growth rate of communication products mainly based on mobile phones declined significantly compared to last month (from nearly 29% to 20%), which is consistent with the situation where SMIC guides the decline in demand for mobile phone chips. However, the two categories of home appliances and furniture continue to maintain high growth (over 25%), with no signs of marginal weakening. This should be related to the significant warming of real estate transactions between the fourth quarter of last year and the first quarter of this year under policy stimulus. However, recent real estate transactions are also cooling down, which needs attention.

<End of full text>

Risk disclosure and statement of this article: Dolphin Investment Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.