Alibaba (Minutes): AI is a ten-year opportunity, takeout subsidies can replace marketing investment.

The following is the earnings call summary for $Alibaba(BABA.US) FY25Q4. For earnings interpretation, please refer to《AI Lifeline Comes at a Cost: Is Alibaba Making a Desperate Move?》

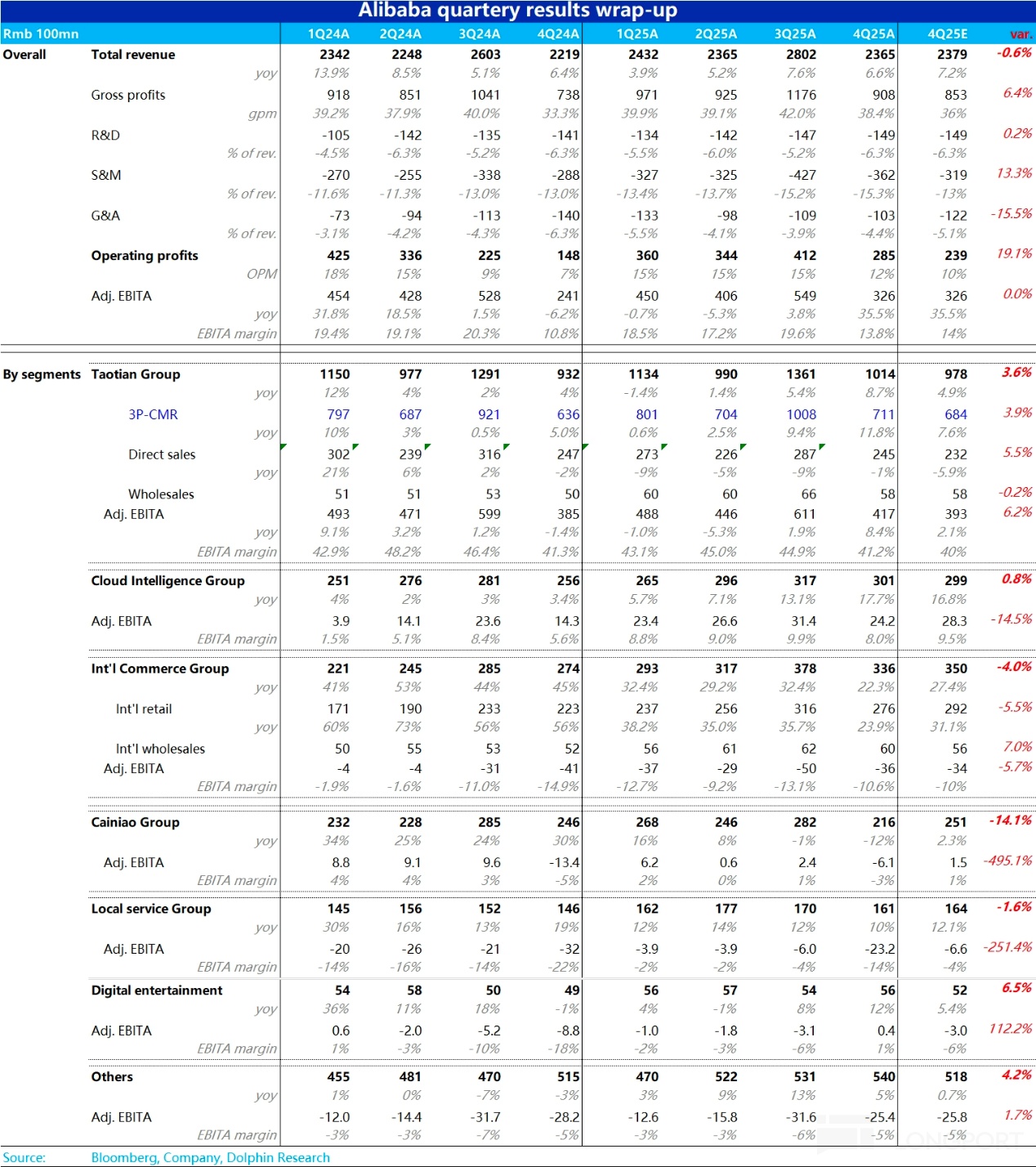

1. Key Earnings Highlights

1. Cash Flow: Operating cash flow reached RMB 275 billion (YoY +18%), while free cash flow was RMB 37 billion (YoY -76%, mainly due to increased cloud infrastructure investments). Net cash position stood at RMB 366.4 billion (USD 50.5 billion).

2. Dividends & Buybacks

a. Annual dividend: USD 1.05 per ADS (YoY +5%), special dividend: USD 0.95 per ADS (total USD 2.0 per ADS, amounting to USD 4.6 billion).

b. Share repurchases: Cumulative buybacks of USD 11.9 billion this fiscal year, with total shareholder returns reaching USD 16.5 billion.

3. Strategy:

a. Divestment of Sun Art Retail Group and Intime to generate up to USD 2.6 billion in cash proceeds, optimizing the business portfolio to focus on core operations.

b. Increased investments in AI products (e.g., Qwen3 model) and public cloud to capture surging AI demand and solidify market leadership.

4. Future Focus: Continued investment in cloud and AI, leveraging Qwen3’s open-source ecosystem to expand technological advantages. Enhancing Taobao and Tmall’s user experience and merchant support, elevating membership value (e.g., 88VIP). Advancing AIDC’s cross-border localization and business model diversification to navigate macro uncertainties.

2. Earnings Call Details

2.1 Executive Highlights

1. Core Strategy: The "User First, AI-Driven" strategy has accelerated growth in core businesses, forming a "AI + Cloud, E-commerce & Internet Platforms" growth matrix. Increased AI infrastructure and R&D investments reinforce global tech leadership.

2. Business Updates:

a. Alibaba Cloud:

- Outlook: Strong customer demand with clear long-term (10-20 years) opportunities unaffected by short-term supply chain fluctuations; ramping up cloud and AI infrastructure investments; advancing LLM R&D and open-source to maintain tech edge.

- Launched next-gen Qwen3 model (leading global benchmarks) in April. By end-April, Qwen open-source models exceeded 200 variants with 300M+ global downloads and 100K+ derivative models, becoming the world’s largest open-source model family.

- AI + Cloud Trends: Among mid/large enterprises, AI applications are expanding from internal systems to customer-facing use cases; simultaneously, AI adoption is rapidly spreading from large firms to SMEs.

b. E-commerce:

- Taobao Tmall Group: 88VIP members surpassed 50M, boosting user stickiness. Customer management revenue rose 12% YoY, adj. EBITA grew 8%; prioritized merchant support to enhance high-quality goods/services ecosystem.

- AIDC: Improved operational efficiency; expects quarterly profitability in int’l e-commerce next fiscal year, with heightened resilience to global trade uncertainties.

3. FY2026 Outlook: Focus remains on driving growth in core "AI + Cloud" and e-commerce, while shaping tech-driven secondary growth curves long-term.

2.2 Q&A

Q: Any material changes in AI-driven cloud monetization from recent customer dialogues? Which sectors/firms are accelerating cloud migration? Any FY26 cloud revenue guidance?

A: AI Cloud Monetization: No major recent shifts noted. AI-related cloud demand has seen triple-digit growth for 7 straight quarters, becoming the core growth driver. Legacy on-premise workloads are migrating to cloud to integrate with internal data/processes, boosting demand for products like Bailian, GPU leasing, and IaaS.

Cloud Migration Drivers: Early AI adopters were from internet, fintech, education, and autonomous driving. Now, traditional sectors (e.g., livestock, manufacturing, wholesale markets) are moving from on-premise IDCs/servers to cloud for AI deployment.

FY26 Cloud Guidance: No specific revenue guidance provided, but management expects sustained growth as enterprises transition from CPU to AI computing.

Q: How much market share gain is expected for e-commerce from AI deployment in 2-3 years? What’s the monetization potential of new AI tools?

A: Short-term: Focus on AI-optimized search/recommendations and ad systems (replacing legacy algorithms), showing early results in precision and efficiency.

Mid-term: Exploring AI for merchant-side tools (e.g., employee productivity, ops support) to enhance end-to-end efficiency.

Long-term: Piloting AI-driven user interactions (e.g., innovative engagement formats) as key to UX and commercial upgrades.

Q: What are Taobao/Tmall’s mid-to-long-term monetization goals? Current monetization rate vs peers? Impact of 2023 initiatives like QZT/0.6% service fee? Future plans?

A: Primary Goal: Stabilize market share with aligned monetization. Recent products like QZT improved ad monetization for unbranded merchants, while payment commissions boosted short-term rates. Long-term, UX-centric models and AI-driven innovations will unlock higher monetization.

Q: Post-Chinese New Year (Jan+), did inference workload demand sustain rapid growth? Quarterly sequential trends?

A: Jan-Mar included holiday distortions. Post-CNY (Feb-May), new clients and inference demand surged, reflecting normalized growth. No explicit QoQ data disclosed.

Q: How do small vs large AI models impact cloud inference demand?

A: Small models (<3B params) mostly run on-device (phones, IoT), with limited direct cloud demand but indirect needs for data/model support. Large models (32B+ params) rely on cloud for scalable, cost-efficient inference—the core demand driver. Edge-cloud synergy fuels holistic growth.

Q: Plans for instant retail investments? Timing rationale? Impact on local services profitability amid rising food delivery competition?

A: Plan: Integrate instant retail into Taobao’s ecosystem leveraging its user base, merchant network, and logistics. Timing: Market is large/fast-growing with new opportunities; early tests exceeded expectations. Profit Impact: Short-term focus on user acquisition; long-term balance via O2O synergies. Competition details withheld.

Q: 618 strategy changes? Merchant/consumer feedback? Instant retail synergies?

A: 618 Adjustments: Revised marketing/pace to adapt to competition, emphasizing price/service advantages (details post-event). Synergies: Near-term focus on converting Taobao users; long-term cross-platform integration.

Q: CMR growth drivers (GMV/0.6% fee/conversion)? FY26 CMR tools/outlook?

A: CMR Drivers: 0.6% fee (since Sep) and ad penetration drove growth (no split disclosed). FY26: Fee benefits will persist as rebates phase out; SME ad budgets to further lift monetization.

Q: Will instant retail investments pressure Local Services (TGG) EBITDA?

A: Mid-term focus is share stabilization via investments (UX/competitive pricing), pressuring EBITA. TGG EBITDA may fluctuate with competition, but user growth/engagement could offset marketing costs.

<End>

Disclosures:Dolphin Research Disclaimer