Alibaba's earnings report is out, and the stock fell rapidly in pre-market trading. Is this reasonable?

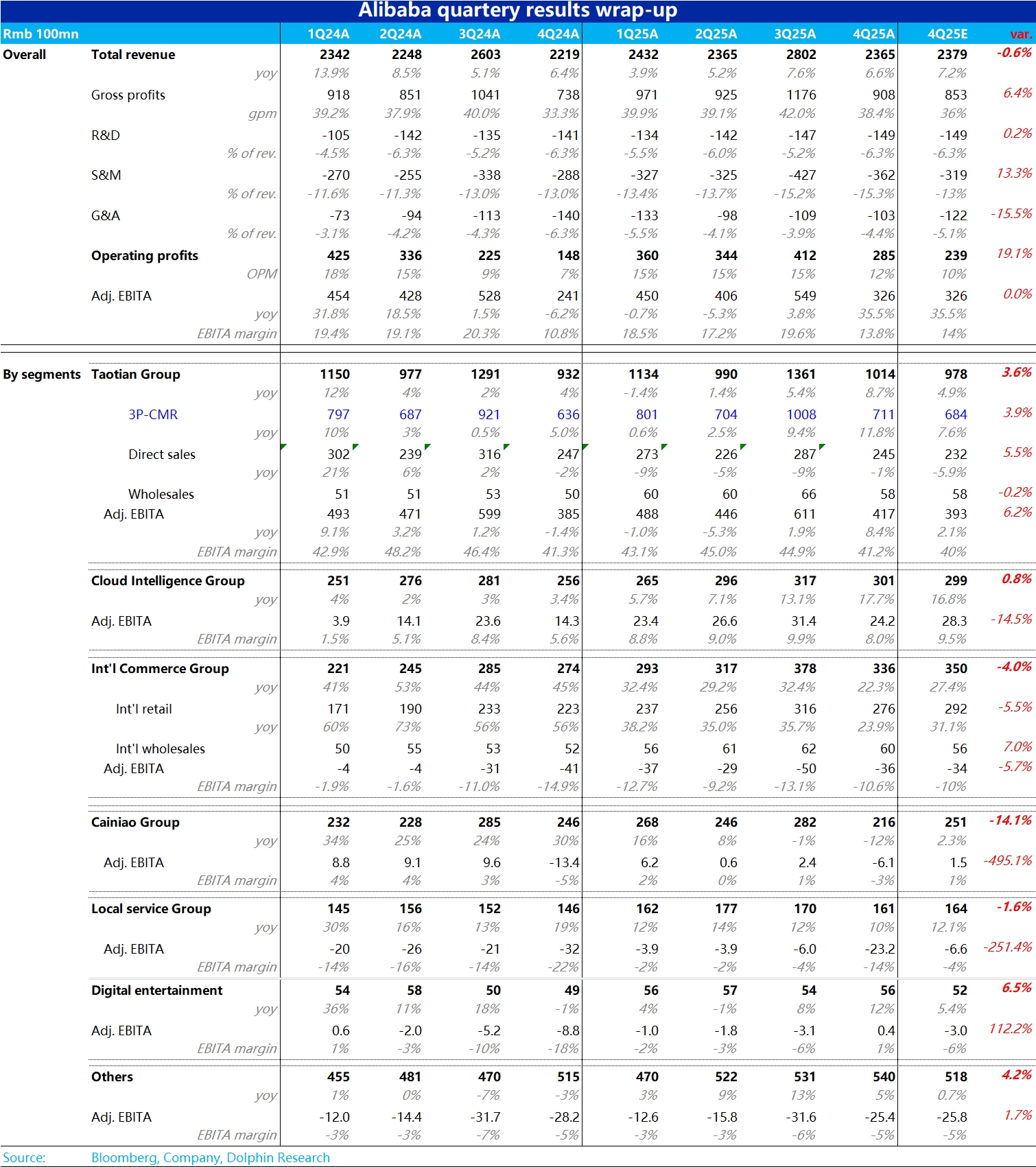

From the pre-market reaction, it's clear that the market is not happy with Alibaba's financial performance this quarter. In terms of big numbers, total revenue grew 6.6% year-on-year, 0.6 percentage points lower than market expectations (mainly due to lower revenue from Cainiao and international e-commerce, as well as the divestment of Sun Art and Intime). In terms of profits, the key metric—group adj. EBITA—only met expectations. In other words, there were no standout performances in either growth or profits.

Breaking it down by business segment:

1. The core Taotian Group performed well this time. CMR grew by 11.8%, and adj. EBITA increased by 8.4% year-on-year. Although Bloomberg's consensus expectations were too low to be meaningful, even compared to the more credible JP Morgan expectations of 10% CMR growth and ~7% EBITA growth, Taotian's performance this quarter still exceeded expectations. This is similar to JD.com's strong performance earlier. The main driver is likely the continued positive impact of monetization tools like Quanzhan Tui on take rates.

2. However, outside of Taotian, other segments each have their own issues. First, Alibaba Cloud, the second most important business, saw growth accelerate to 17.7%, but compared to the market's median expectation of 16.8% and the more optimistic investor expectation of 20%, this isn't particularly impressive. At the same time, high capex has clearly dragged on profits, with adj. EBITA margins 1.5 percentage points lower than expected and a noticeable quarter-on-quarter decline. This is a case of decent growth but a miss.

3. As for the less critical segments, each has its own problems. International e-commerce grew below expectations while also failing to deliver better-than-expected reductions in losses. Cainiao saw both revenue and profits decline due to the divestment of some businesses to sister companies. Local services also unexpectedly posted a quarterly loss of 2.3 billion yuan in Q1, theoretically before the food delivery wars even began.

Given that the stock had already rebounded to $130 before the earnings report, recovering most of the tariff-related decline, it wasn't at a low point. Against this earnings backdrop, a short-term drop is reasonable.$Alibaba(BABA.US) $BABA-W(09988.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.