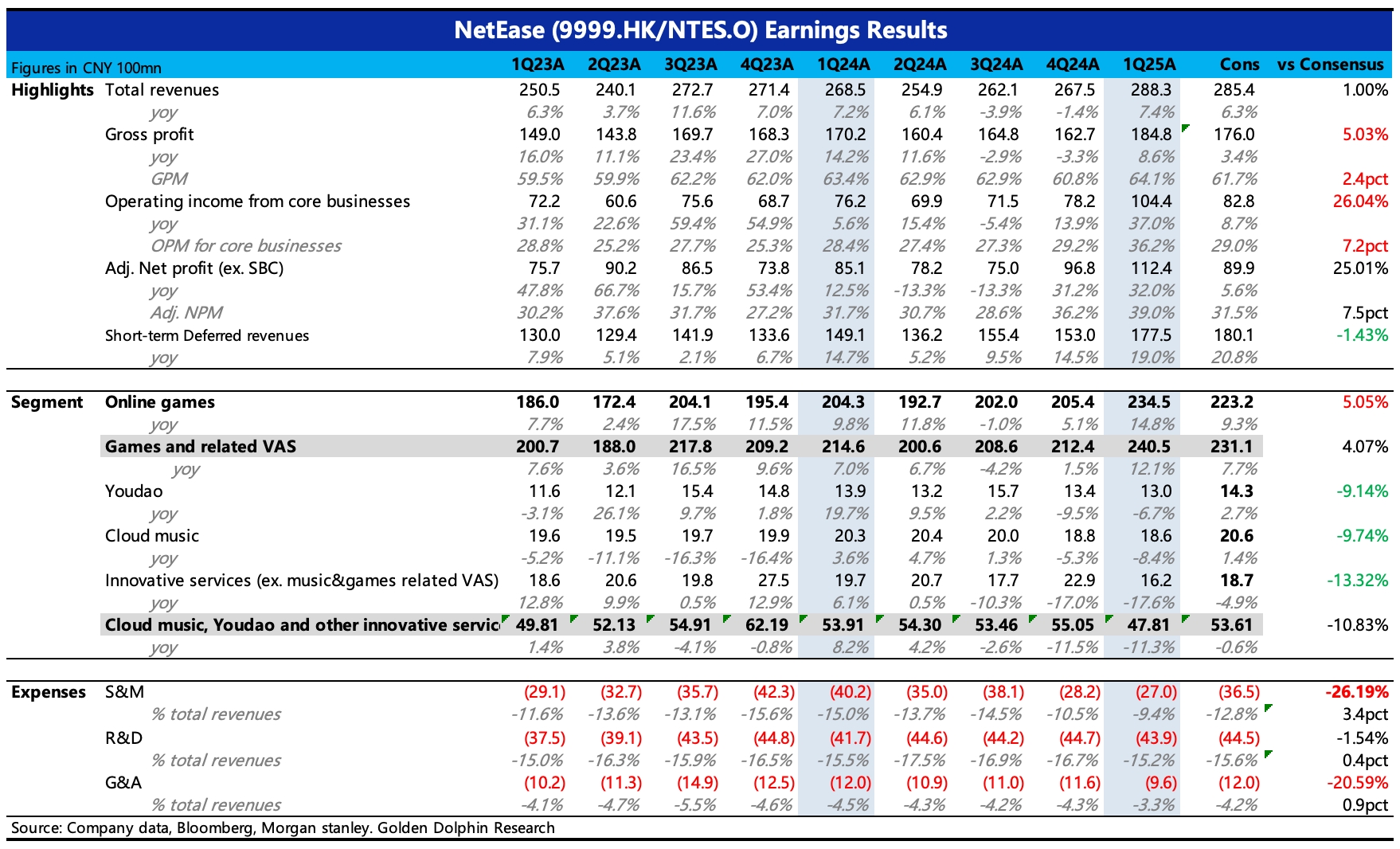

NetEase's first-quarter performance exceeded expectations overall. As a defensive stock, it once again beat conservative expectations:

1. The pillar once again exceeded expectations: Overall gaming revenue surpassed expectations by nearly 1 billion yuan. The financial report did not separately disclose the performance of mobile and PC games this time. Based on our simple estimates, there may be expectation gaps in both subcategories.

Gross margin did not decline sequentially as expected (affected by high-royalty Blizzard games) but instead increased by 2 percentage points. This potentially indicates that the mobile gaming business is continuously recovering.

2. Sub-businesses under pressure, focusing on profitability: Revenue growth for Youdao, Cloud Music, and other innovative businesses like Yanxuan continued to face pressure. However, gross margins did not deteriorate further, with Cloud Music's gross margin returning to 36%.

3. Continued release of operating leverage: Operating expenses in the first quarter were very low, especially sales and promotion expenses, which decreased by 33% year-on-year, a reduction of nearly 1.5 billion yuan. Even without the crazy marketing spending for Eggy Party, it shouldn’t have dropped to the lowest level in nearly four years, especially since Q1 should have included daily promotional expenses for new games like Where Winds Meet, Raging Tides, and Once Human. It can only be said that the anti-corruption efforts in the second half of last year have paid off.

On the other hand, combining Tencent's situation, one phenomenon is: The promotion expenses of the two gaming giants have significantly contracted, but revenue has not been affected. We believe there may be two reasons: (1) Increased focus on evergreen games, which are constantly "refreshed" to extract value, but evergreen games inherently have brand effects and often do not require much external promotion. (2) Changes in promotion models, shifting from simple and direct ad buys to content marketing collaborations with gaming influencers (short videos, live streams), resulting in higher conversion rates. NetEase already mentioned this last year.

Overall, the market may currently slightly underestimate NetEase's resilience as a veteran gaming company at the bottom of the cycle. This year, due to the lack of AI catalysts and the passing of the product cycle peak, NetEase has not been aggressive in its business. With decent shareholder returns at low valuations, it is viewed more as a defensive stock by the market.

As a result, market expectations for its performance have remained low. Although Blizzard and Where Winds Meet have brought significant incremental growth to PC games, considering the relatively 平淡 mobile gaming pipeline, market expectations have been conservative for three consecutive quarters.

Therefore, regardless of subsequent performance, leveling the expectation gap could slightly lift valuations. However, in terms of the pipeline, the next product boom cycle may still need to wait for Infinity at the end of this year or early next year. Short-term minor catalysts could come from the anniversary of Naraka: Bladepoint, the overseas release of Where Winds Meet, and the "refreshing" of evergreen games (a tactic that seems to work well for both Tencent and NetEase). Here, we can pay attention to the earnings call and the upcoming 520 Game Conference.$NTES-S(09999.HK) $NetEase(NTES.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.