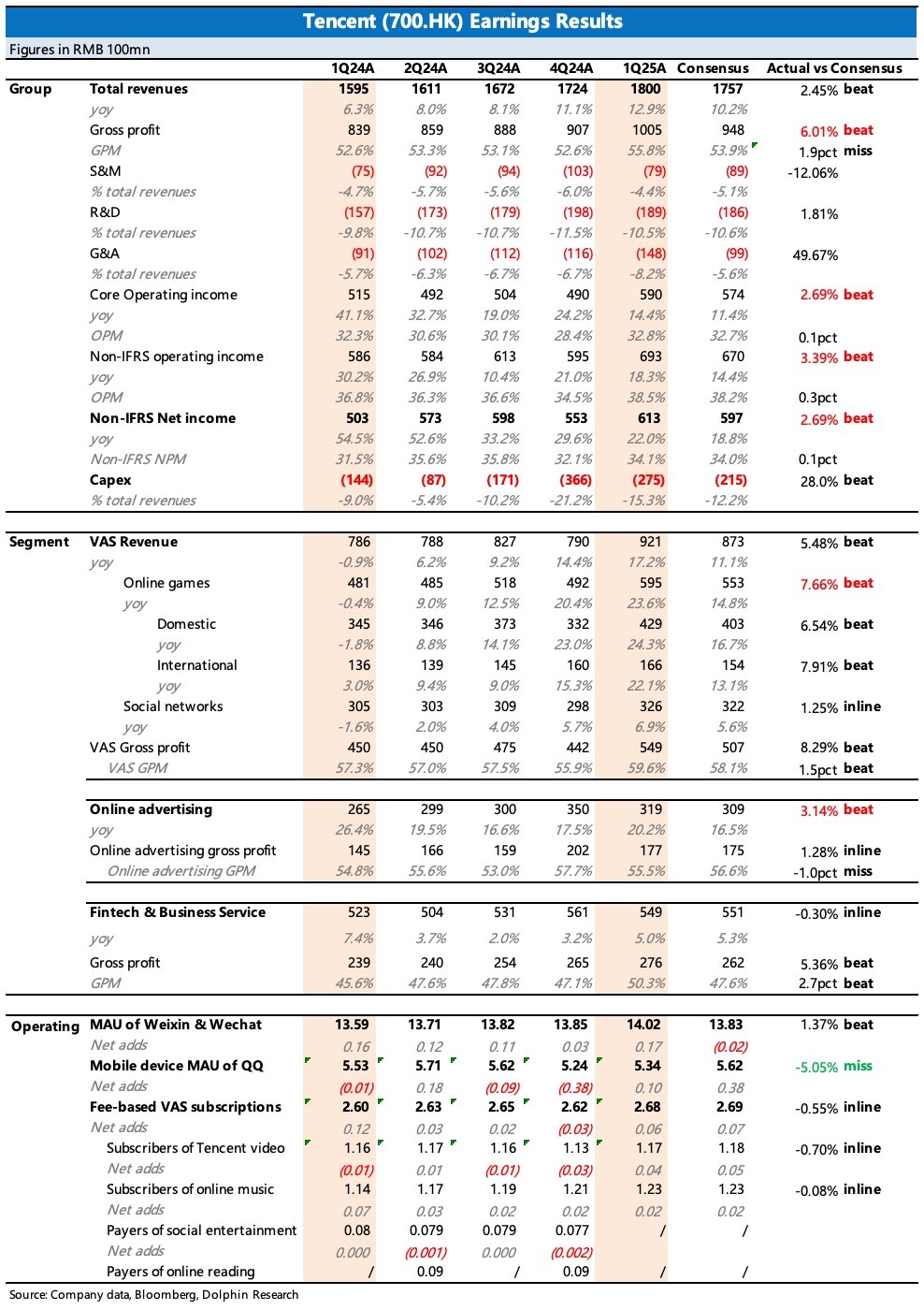

Tencent, the stock king, delivered impressive first-quarter results, primarily driven by the strong performance of its two cash cows—gaming and advertising. With solid revenue growth, profit margins also improved. Excluding the one-time equity compensation of 4 billion yuan due to Ubisoft's business restructuring, the actual profit beat was even more significant. For instance, according to Dolphin Research's consistent tracking of core operating profit metrics, there was a 22% year-on-year increase, maintaining high growth despite a high base.

1. Gaming significantly exceeded expectations, growing by 24% against a market expectation of 15%. While expectations were not low, they still proved conservative. Domestic revenue in Q1 saw notable growth in gross merchandise volume (GMV) due to evergreen game content updates and operational activities, along with incremental benefits from DNFm. Overseas revenue continued to be driven by high growth from PUBG Mobile and Supercell's classic games.

2. Advertising slightly outperformed expectations, growing by 20%. Some institutions had recently raised their advertising expectations, but the results still exceeded projections. The growth in advertising was primarily fueled by Video Accounts, Mini Programs, and Search. Increasing the load rate of Video Accounts is a key initiative this year to counter overall economic weakness and sustain solid growth.

3. Fintech recovery was in line with expectations, supported by some implemented policies. However, given the high uncertainty in the consumer environment, growth for the full year may remain slow.

4. Enterprise services were mainly driven by AI cloud demand and e-commerce commissions. Last quarter, the company mentioned insufficient supply of AI cloud services. With accelerated chip deployment, revenue growth is expected to pick up. However, according to the company's broader strategy, computing power will be prioritized for internal use, so cloud service growth this year should not be overly optimistic.

5. E-commerce, however, is worth watching closely. Today, news broke that Tencent's WeChat Group is establishing an e-commerce product division, and WeChat Stores have become a focal point in recent earnings discussions among executives. This reveals Tencent's strategic intent for e-commerce—technical service fees are secondary, while advertising is the real goal. Increased investment in e-commerce is also a fundamental condition for smoothly raising the load rate of Video Accounts.

6. Capital expenditures also exceeded expectations. Although the company mentioned in the last earnings call that the sudden spike in Q4 capital expenditures was due to temporary orders, Q1 capital expenditures reached 27.5 billion yuan, annualizing to 112 billion yuan. While there's a possibility of further advance purchases amid escalating chip restrictions, as Dolphin Research previously discussed regarding capital allocation, Tencent's attitude and ambition toward super AI are anything but ordinary, especially as AI investments begin to generate positive feedback for internal operations.$TENCENT(00700.HK) $Tencent(TCEHY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.