The performance of this little Tencent, Sea, can be said to be quite impressive—especially the 'explosive' results from the Garena gaming segment, but there are also indicators that fall short: for example, key metrics like e-commerce GMV growth were just mediocre.

Specifically, the highlights are mainly reflected in two aspects:

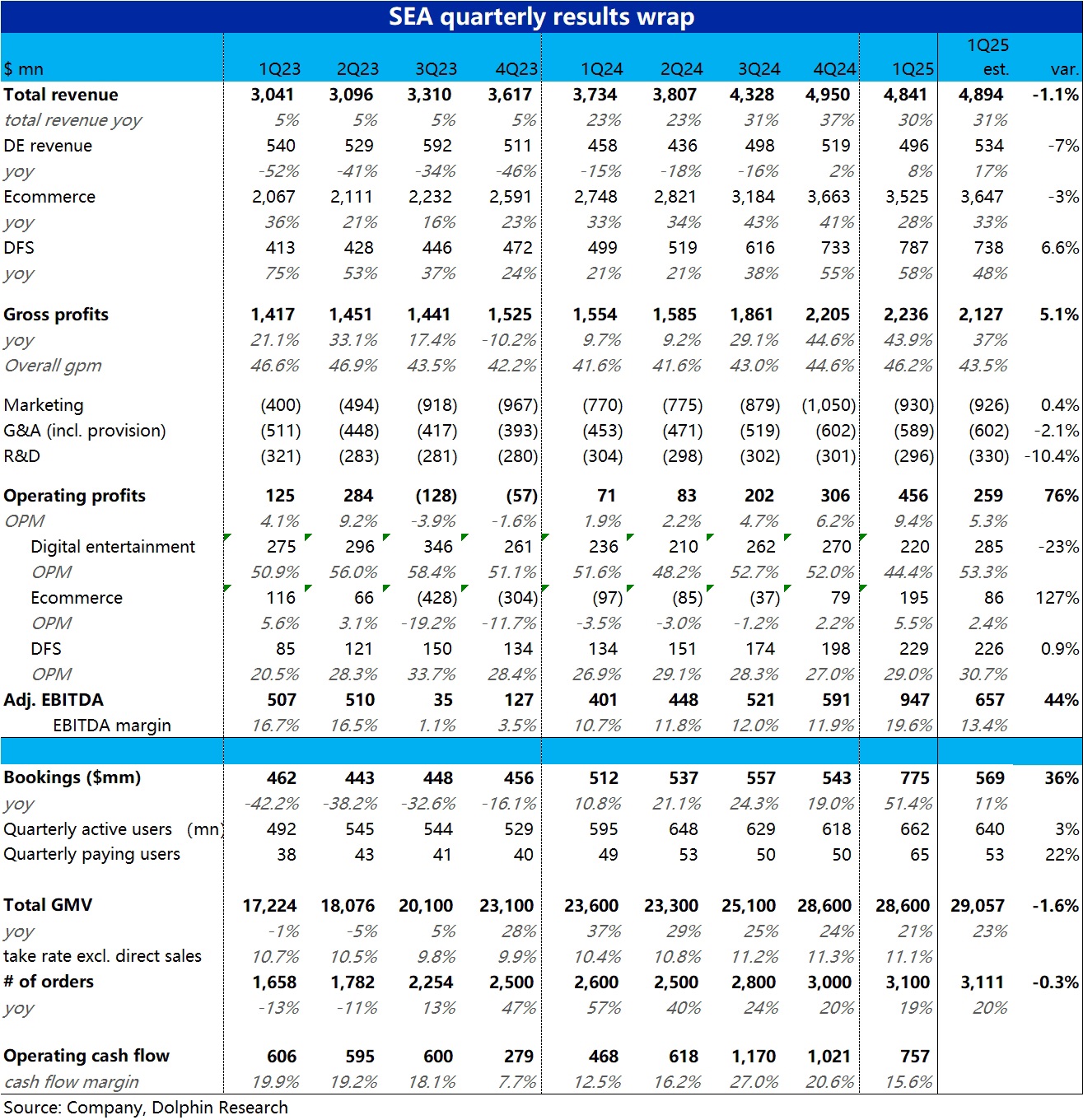

1) The most 'explosive' was Garena's quarterly revenue, which skyrocketed by 51% YoY, a staggering difference from the market's general expectation of around 10%~11% growth. Although the market had anticipated that Garena's revenue growth would stabilize and rebound before the earnings report, even the most optimistic investors probably couldn't have predicted such a high growth rate.

According to management's explanation, this quarter's explosive revenue was mainly attributed to the collaboration between Free Fire and the Naruto IP, which drove FF's daily active users back to near pre-pandemic historical peaks. (The disclosed 65 million paying users this quarter significantly exceeded the expected 53 million).

Due to the surge in revenue, the gaming segment's adj.EBITDA (accounting for deferred revenue, directly related to revenue) also surged by 57% YoY. Both growth and profitability performed quite 'explosively.'

However, the revenue growth rate jumped from around 20% previously to over 50%, which is an excessively large fluctuation. How long the effects of the collaboration can last remains to be seen, and it may just be temporary.

2) The second highlight is relatively less impressive. Although this quarter's e-commerce GMV and quantitative growth slightly underperformed expectations, the improvement in e-commerce business margins was significantly better than expected. This quarter's OPM reached 5.5%, far exceeding the market's expectation of 2.4%. At the same time, since e-commerce revenue also slightly underperformed expectations, the better-than-expected profit release was mainly achieved through cost and expense optimization rather than monetization rate improvement.$Sea(SE.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.