JD.com's Q1 performance looks good at first glance, but don't rush in blindly. Let's check the data first:

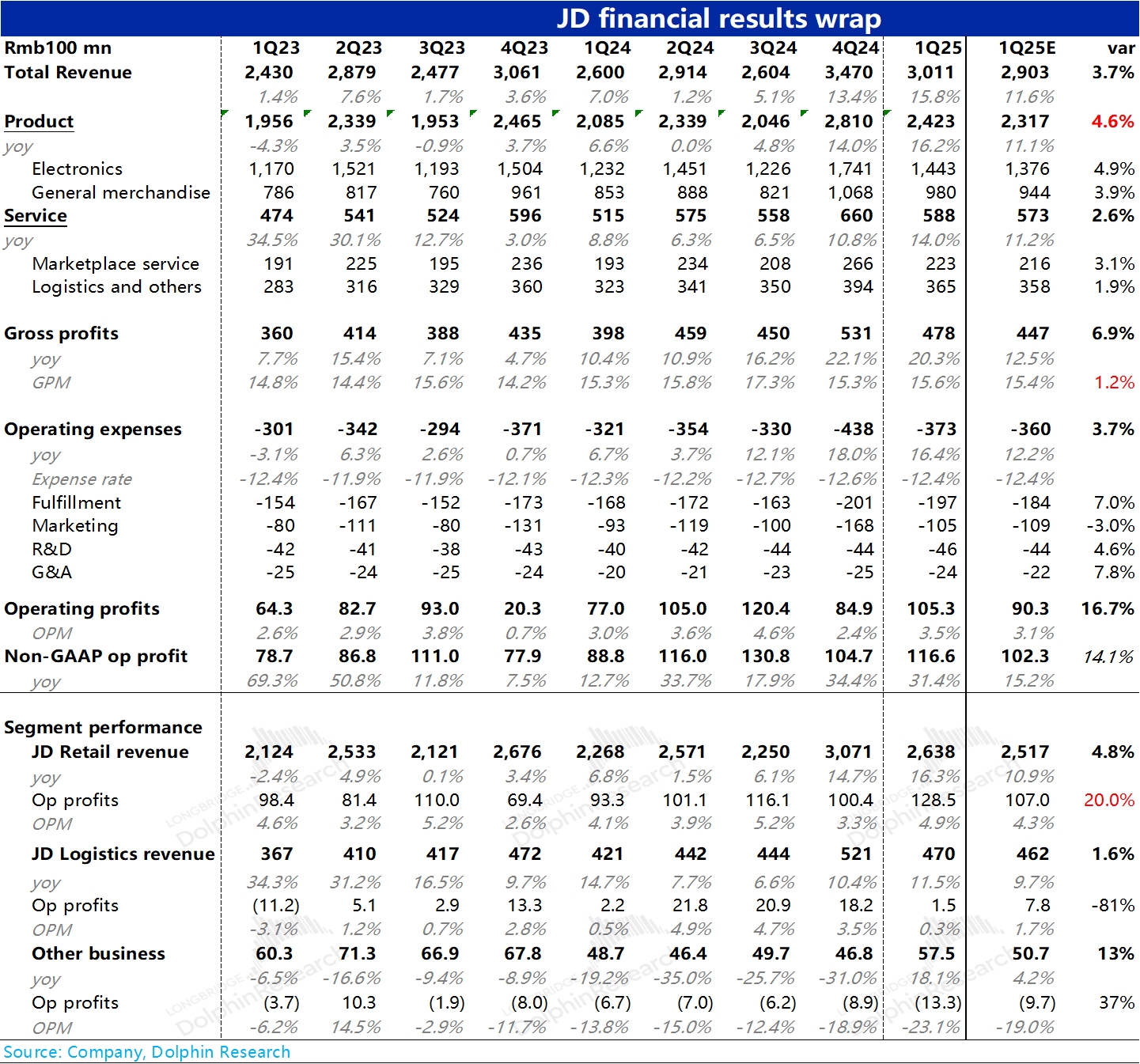

Since a small-scale outlook for Q1 performance was already provided in mid-April, with an upward revision of Q1 guidance, not all sell-side analysts on Bloomberg updated their forecasts in time. This made JD's core e-commerce business—from the rebound speed of revenue (accelerating to 16% YoY in Q1) to profit release (12.8 billion yuan in Q1 vs. market expectations of around 11 billion)—appear exceptionally strong.

Excluding this factor, the latest expected e-commerce revenue growth should actually be around 14%, so the expectation gap isn't particularly impressive. Of course, looking beyond the expectation gap, 16% total revenue growth and 30%+ adjusted operating profit growth do seem like solid undervaluation for a stock trading at just 8X PE (and this doesn’t even account for shareholder buybacks). However, the key issue is that Q1 growth was clearly driven by government subsidies for electronics, and with those subsidies now tapering off (refer to SMIC's bleak 2025 demand outlook for smartphones and electronics), replicating Q1’s results will be difficult.

Another interesting point: Both the fulfillment costs for JD’s e-commerce business and the widening loss margin for Dada’s new business seem to hint that the escalating food delivery war, which ramped up in April, could pressure JD’s profit margins going forward.

So, while JD had a good quarter, don’t rush in blindly. It might be wise to wait for the earnings call to hear how the company plans to position its food delivery business, how much it intends to invest, and whether the safety margin is clear. $JD.com(JD.US) $JD-SW(09618.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.