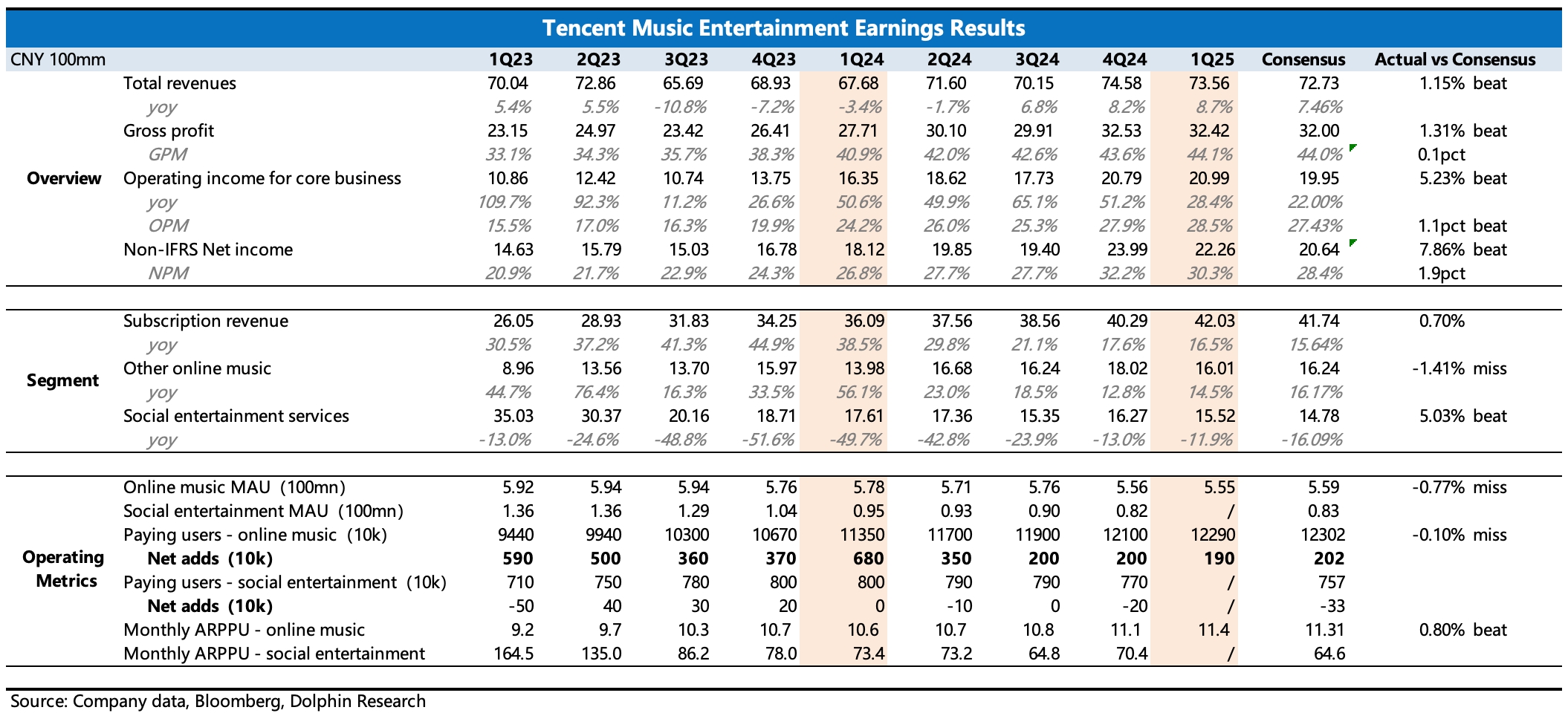

Tencent Music's first-quarter earnings met expectations, with profits slightly exceeding expectations. The earnings trend is relatively in line with the current valuation (17x P/E for 2025), which is not considered high. However, due to the resilience of the streaming media business, Tencent Music is worth special attention during the tariff confrontation. Key points in detail:

(1) Overall: Stable growth in subscription business, coupled with slowly optimizing cost structure and improved operational efficiency, led to continuous improvement in profitability. The core operating profit growth rate was 28%, naturally slowing down on a high base.

(2) Subscription: The main driver of growth. Both volume and price contributed, but from a marginal perspective, the contribution of price increases has become more prominent, which is the logic the company started emphasizing in the second half of last year. Q1 total subscription additions were 1.9 million, relatively average, but the company increased promotions for SVIP to improve penetration, accelerating per-user payment growth.

(3) Others: Ad revenue also saw some growth in Q1, mainly driven by the release of incentive ad inventory. Digital albums grew normally in Q1. Generally, the digital album business is tied to fan economy, with performance linked to the release dynamics of popular artists.

(5) Social entertainment: The adjustment impact of live streaming and karaoke continues to shrink. Detailed user metrics were not disclosed this quarter. Dolphin Research estimates that the decline in paying users has bottomed out, while per-user payment may have slightly declined. The actual situation can be followed in the earnings call.

(6) Shareholder returns beyond earnings: The current buyback pace is relatively slow compared to the $1 billion buyback plan approved at the beginning of the year for two years. Q1 acquisitions cost $65 million. Annualized buyback amount would not exceed $300 million at this rate. Current buybacks ($300-500 million) + dividends ($300 million+) imply a potential shareholder return yield of about 3-4%. Although the yield is not high, Tencent Music's ample cash flow keeps the market optimistic about increasing shareholder returns. $Tencent Music(TME.US) $TME-SW(01698.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.