From the perspectives of both current quarter performance and next quarter guidance, Shopify's earnings report shows relatively resilient growth, but the market's focus on gross profit growth and free cash flow fell short of expectations. It appears that tariffs and macroeconomic headwinds have not significantly impacted Shopify's business growth, but they have put considerable pressure on the company's profit margin improvement narrative. Although the miss is not substantial, the company's current valuation at over 9x price-to-sales ratio for 2025 revenue is quite high, requiring rapidly growing profits to support such a premium valuation. Therefore, the pre-market reaction has been quite intense.

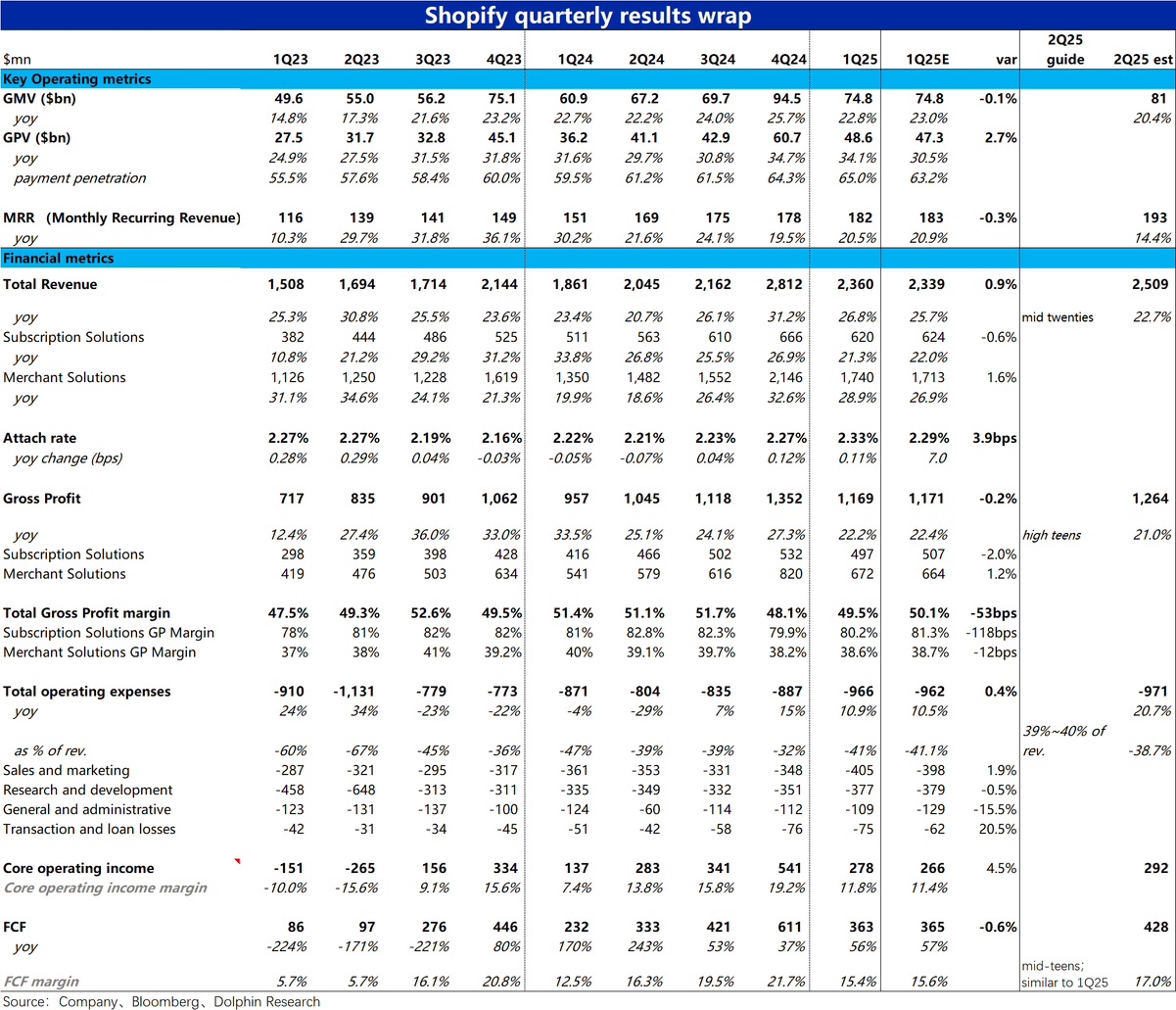

Specifically, the core metric—GMV growth within the ecosystem—was 22.8% year-over-year, slowing by about 2.9 percentage points quarter-over-quarter, which was within expectations. Consequently, revenue growth largely met expectations. However, the improvement in gross margin this quarter was lower than anticipated, causing gross profit growth (22.4% YoY) to lag behind revenue growth. Additionally, higher-than-expected marketing expenses and loan loss provisions led to free cash flow (FCF) missing expectations.

For next quarter's guidance, revenue growth is projected in the mid-twenties range, which is actually better than expected. Similarly, however, gross profit growth is only in the high-teens, implying continued gross margin decline. As a result, the FCF margin guidance remains flat at 15.4% for the next quarter, while the market had expected 17%. Clearly, the biggest issue highlighted in Shopify's earnings is the underperformance of both current and next quarter's gross margin and FCF margin guidance.$Shopify (SHOP.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.