ARM: Guidance warning "pouring cold water", is the valuation bubble about to burst?

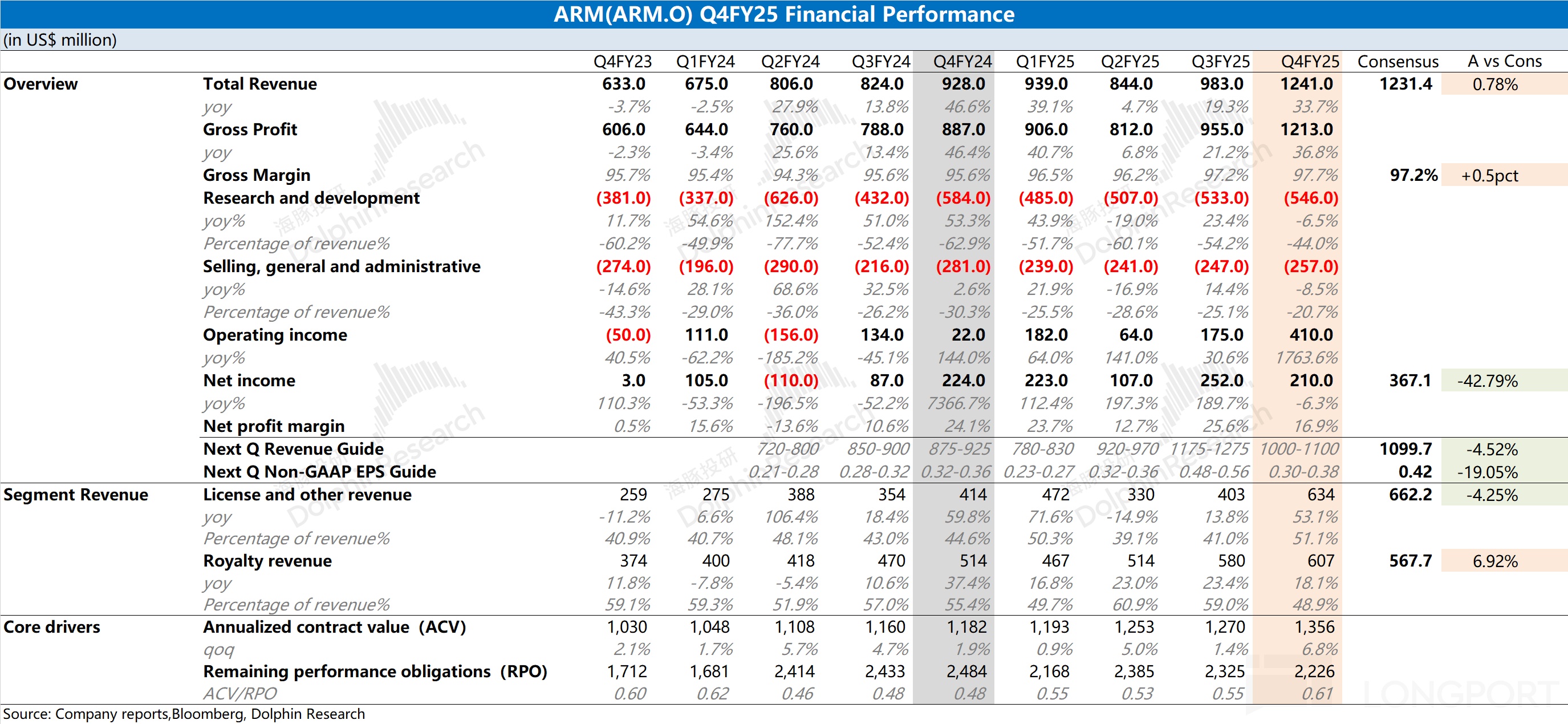

ARM (ARM.O) released its Q4 FY2025 earnings report (as of March 2025) after U.S. market close on May 8, 2025 Beijing time. Key highlights:

1. Overall Performance: Record Revenue & Gross Margin. ARM's Q4 FY2025 (i.e., 25Q1) revenue reached $1.24 billion, up 33.7% YoY, meeting market expectations ($1.23 billion). Revenue growth was primarily driven by licensing and royalty businesses. $Arm(ARM.US) Net profit was $210 million, down 6.3% YoY, mainly due to one-time losses from equity investments. Despite this, core operating profits continued to rise.

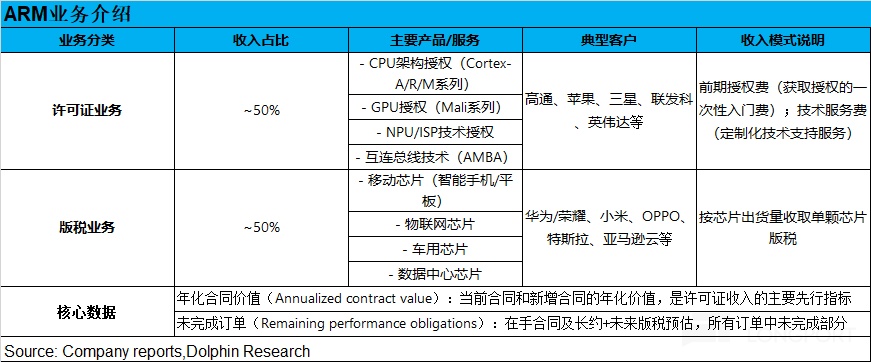

2. Segment Performance: Dual Growth in Core Businesses

1) Licensing Business: $634 million, up 53.1% YoY. Annual Contract Value (ACV) reached $1.36 billion, up 15% YoY.

2) Royalty Business: $600 million, up 18.1% YoY, driven by adoption of Armv9 architecture, increased Arm CSS-based chips, and growing use of Arm-based chips in data centers.

3. Guidance: Q1 FY2026 (25Q2) revenue is expected at $1.0-1.1 billion (vs. consensus $1.1 billion), with adjusted EPS of $0.30-$0.38 (vs. consensus $0.42).

Dolphin Research's View: Solid Earnings, Weak Guidance

ARM delivered strong results with revenue and gross margin hitting records, fueled by licensing and royalty growth. Operating expenses remained stable, while net profit decline was attributed to one-time equity investment losses. However, the Q2 guidance disappointed, with both revenue and profit below expectations.

With gross margin already at 97.7%, further upside is limited. Focus now shifts to revenue growth and cost efficiency. Key segment insights:

Licensing Business: ACV grew 15% YoY to $1.36 billion. Dolphin Research expects double-digit growth in new contracts.

Royalty Business: Up 20% in FY2025, benefiting from Armv9 adoption and AI/CSS chip demand. Seasonal factors may flatten H1 growth, but H2 should see double-digit sequential gains. Tariff risks remain, as 60% of royalty income comes from consumer electronics.

Key Takeaways:

1) Sequential Revenue Decline: Q2 guidance implies ~10% QoQ drop.

2) ACV/RPO Ratio: Rose to 0.61, indicating faster short-term revenue recognition.

3) Licensing Revenue per Project: Averaged $1.77 million, up 8.2% YoY.

Valuation Context: At $130.9B market cap, ARM trades at 93x FY2026 P/E. High multiples reflect its moat and growth, but sub-20% revenue growth may pressure valuations.

Long-term, Armv9 adoption, AI, and CSS chips are growth drivers, though tariff policies and commercialization timelines require monitoring.

I. Financial Performance: Records Across Metrics

1.1 Revenue

Q4 FY2025 revenue hit $1.24B (+33.7% YoY), in line with consensus. Licensing and royalties both grew double-digits.

1.2 Gross Margin

Gross profit reached $1.21B (+36.8% YoY), with margin at 97.7% (+2.1pp YoY), beating expectations.

1.3 Operating Expenses

OpEx fell 7.2% YoY to $800M as some costs were deferred. R&D dropped 5.6% despite headcount growth to 6,943 engineers.

1.4 Net Profit

Net income of $210M missed consensus ($370M) due to $290M equity investment losses. Core operating profit doubled sequentially to $410M.

II. Segment Deep Dive

Licensing and royalties each contributed ~50% of revenue, both growing double-digits.

2.1 Licensing Business

$634M (+53.1% YoY). ACV grew 15% to $1.36B. Total clients rose to 358 (44 full-access, 314 flexible).

2.2 Royalty Business

$610M (+18.1% YoY), driven by Armv9 (now >30% mix) and CSS chips. H1 growth may pause seasonally before rebounding in H2.

<End>

Dolphin Research's ARM Coverage:

Feb 6, 2025 Call: ARM (Minutes): Growth Hinges on "Royalty" Potential

Feb 6, 2025 Report: ARM: AI Lifts Results, But Rich Valuation Remains

Disclosures: Dolphin Research Disclaimer

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.