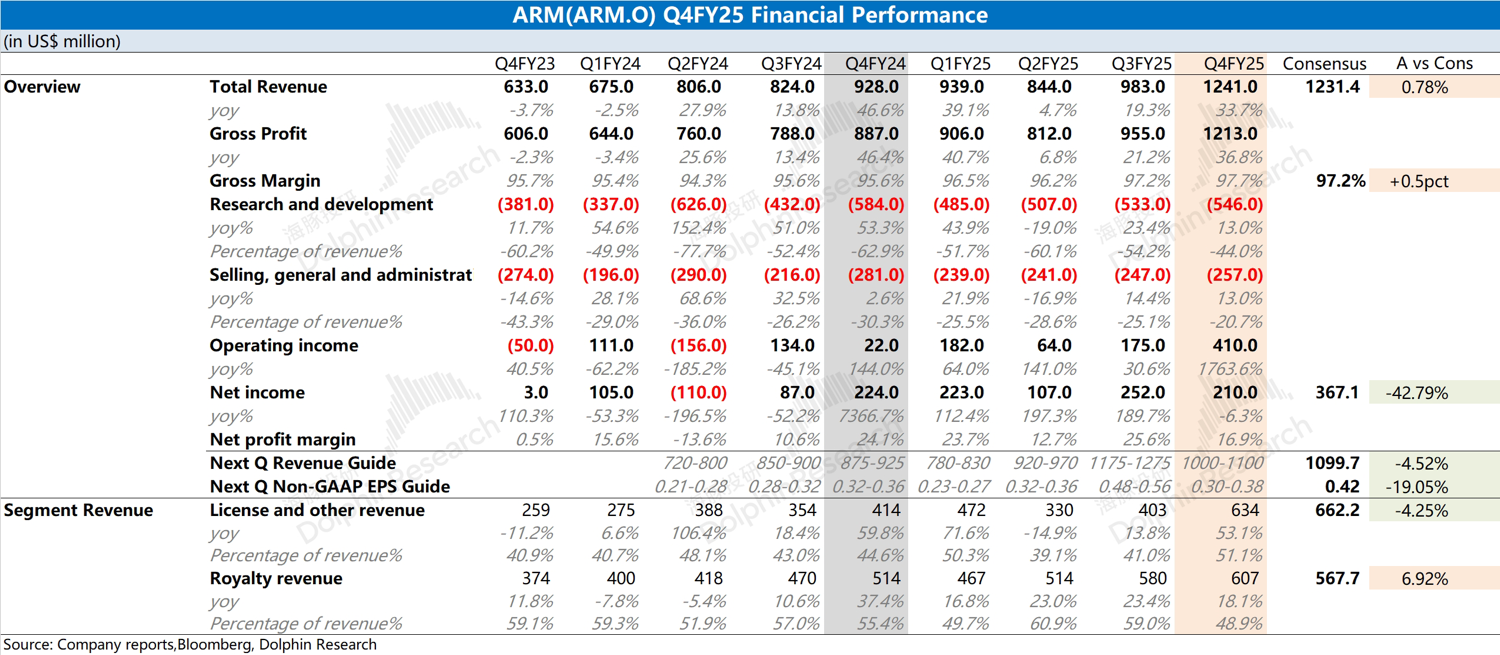

ARM's financial results for this quarter were decent, with both revenue and gross margin increasing, mainly driven by growth in the licensing and royalty businesses. The company's operating expenses remained stable, while the decline in net profit this quarter was primarily due to a one-time impact from equity investment losses, with operating profit still steadily improving.

Although the company's data for this quarter was good, its guidance for the next quarter is not ideal. The company expects revenue guidance for the next quarter to be $1.0-1.1 billion (market expectation: $1.1 billion), with adjusted earnings per share of $0.30-$0.38 (market expectation: $0.42). Both figures fell short of expectations, mainly due to a sequential decline in the licensing business.

Since about 60% of the company's royalty revenue comes from consumer electronics such as smartphones and computers, adjustments in tariff policies will directly impact the company's performance. ARM's further development will primarily focus on opportunities in AI business and the penetration rate of v9.$Arm(ARM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.