Under the pressure of five short reports, Applovin fought back strongly against the shorts with a "expected yet unexpected" impressive performance.

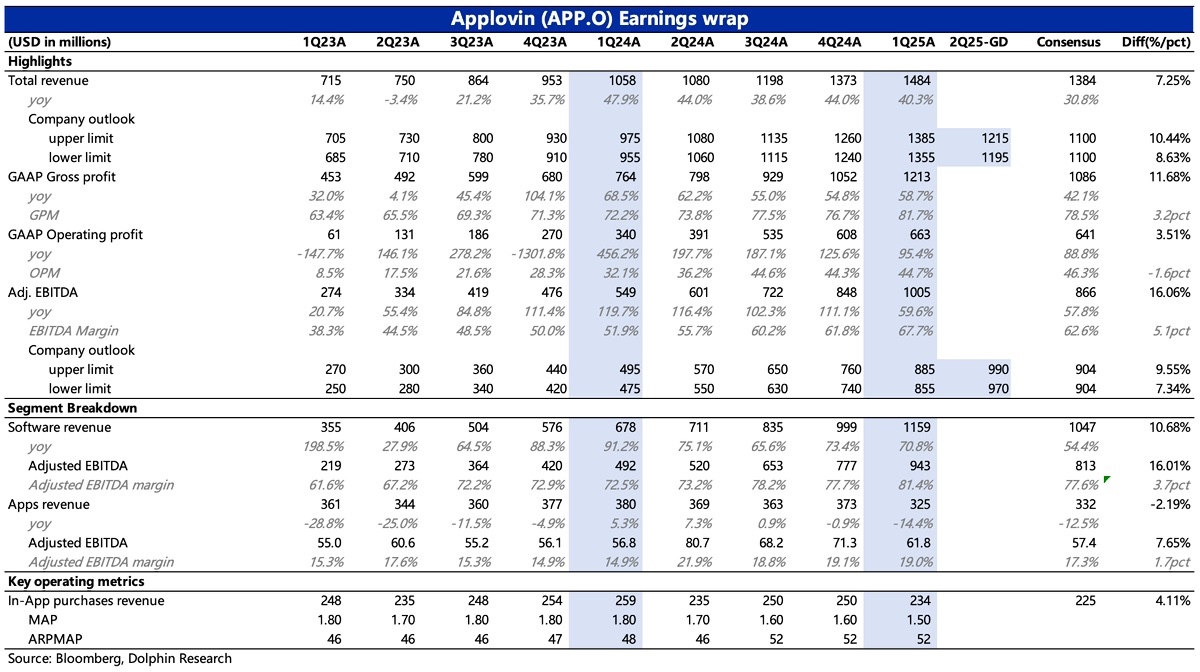

By "expected," we mean its stable position in game ads and the advance in e-commerce ads. Dolphin Research has discussed this multiple times. Due to the high ROAS, we had no doubt that Applovin would deliver a solid performance in Q1 during its early stage of entering the e-commerce market, and it would hardly be affected by the short reports. By "unexpected," we mean we didn’t anticipate such strong actual performance, not just in ad revenue but also in the significant improvement in profitability (mainly due to changes in business structure). Additionally, the Q2 revenue guidance also exceeded our expectations, with growth barely slowing down. This is quite rare in the current macro environment, especially given the e-commerce ad story Applovin is pushing this year.

In early May, its owned app business (1P games) was sold to Tripledot Studios (a casual mobile game company specializing in card, puzzle, and match-3 games) for $400 million in cash plus a 20% stake in Tripledot. Reports suggest Tripledot is valued at around $1.4 billion, implying a deal value close to $700 million, a discount compared to the $900 million valuation given last quarter. The transaction involved nearly $190 million in goodwill impairment.

During the short-seller attacks, the company wasn’t idle either. While strictly controlling expenses, it ramped up stock buybacks, spending $1.2 billion (including fees and withholding taxes) in Q1, equivalent to 40% of last year’s total, repurchasing and canceling 3.4 million shares. By the end of Q1, the total shares outstanding were 338 million, slightly lower than at the end of last year.$AppLovin(APP.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.