Unity's Q1 performance can only be said to barely meet the market's latest adjusted expectations. But the key point is still how effective the new model testing is. There is limited information available in the market, and Unity itself hasn't disclosed much progress, so the earnings call remains crucial.

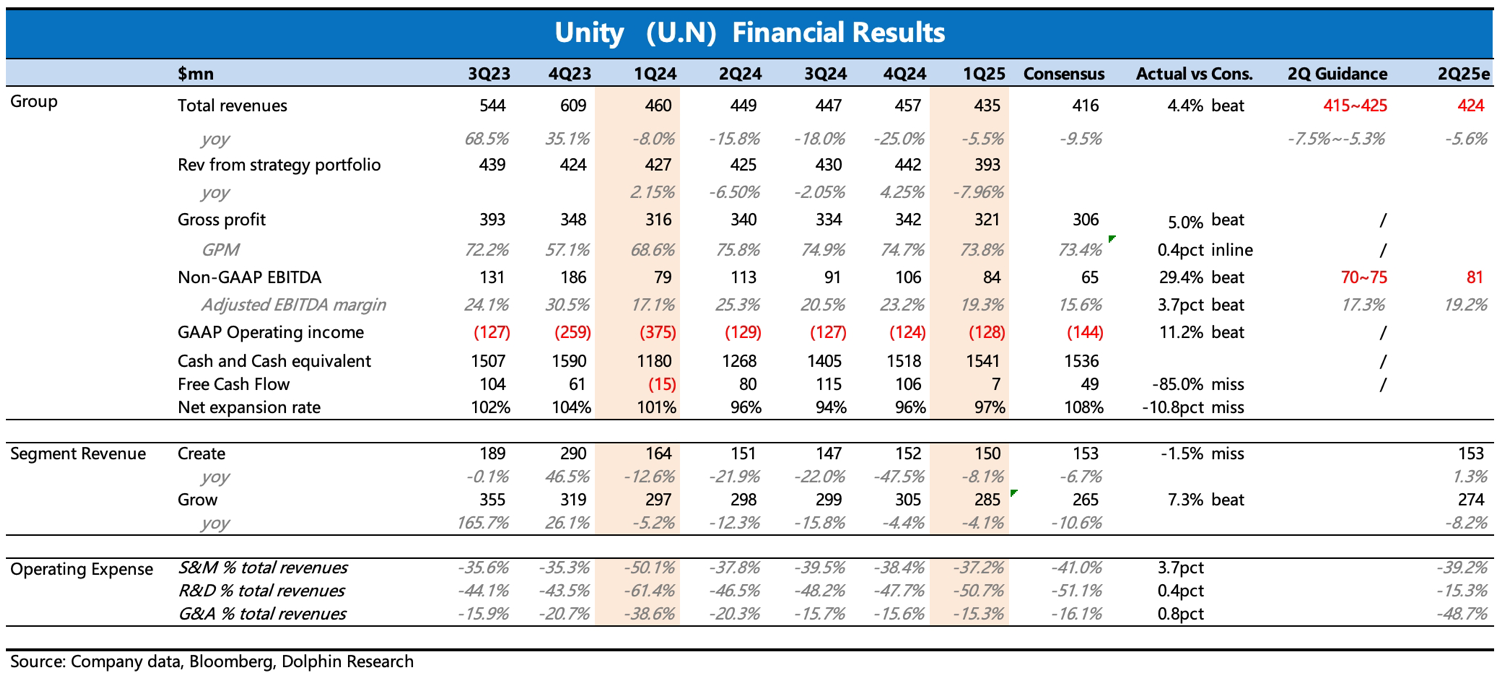

1. Revenue exceeded expectations, mainly due to the Grow business, which is a positive. Although Create revenue was slightly below expectations, the Create business itself has stabilized, and the adoption rate of Unity 6 continues to improve. Therefore, missing expectations in Q1 is not a major issue.

2. While key operating metrics on the revenue side showed improvement, they were below expectations and can't be considered solid positives. Q1 saw a net increase of 6 customers, with the net expansion rate rising by 1 point to 97%, but a rate above 100% is needed for healthy growth in existing user expansion.

3. Profits significantly exceeded expectations, mainly due to ongoing internal efficiency improvements (layoffs).

4. Outlook: Q2 revenue and Non-GAAP EBITDA guidance were both below expectations, and the improvement trend isn't particularly fast, indicating that the new model hasn't yet had a noticeable impact on the business.

According to recent surveys of individual game developers organized by institutions, the integration of the new model into the ad system has slightly improved ROAS overall, but there's still a significant gap compared to competitors. Under macroeconomic pressure, advertisers are less willing to test new channels and tend to focus limited budgets on platforms with the highest ROAS, such as Google, Meta, and Applovin.

Therefore, the latest full-scale test results will be the core issue to watch during the earnings call.$Unity Software(U.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.