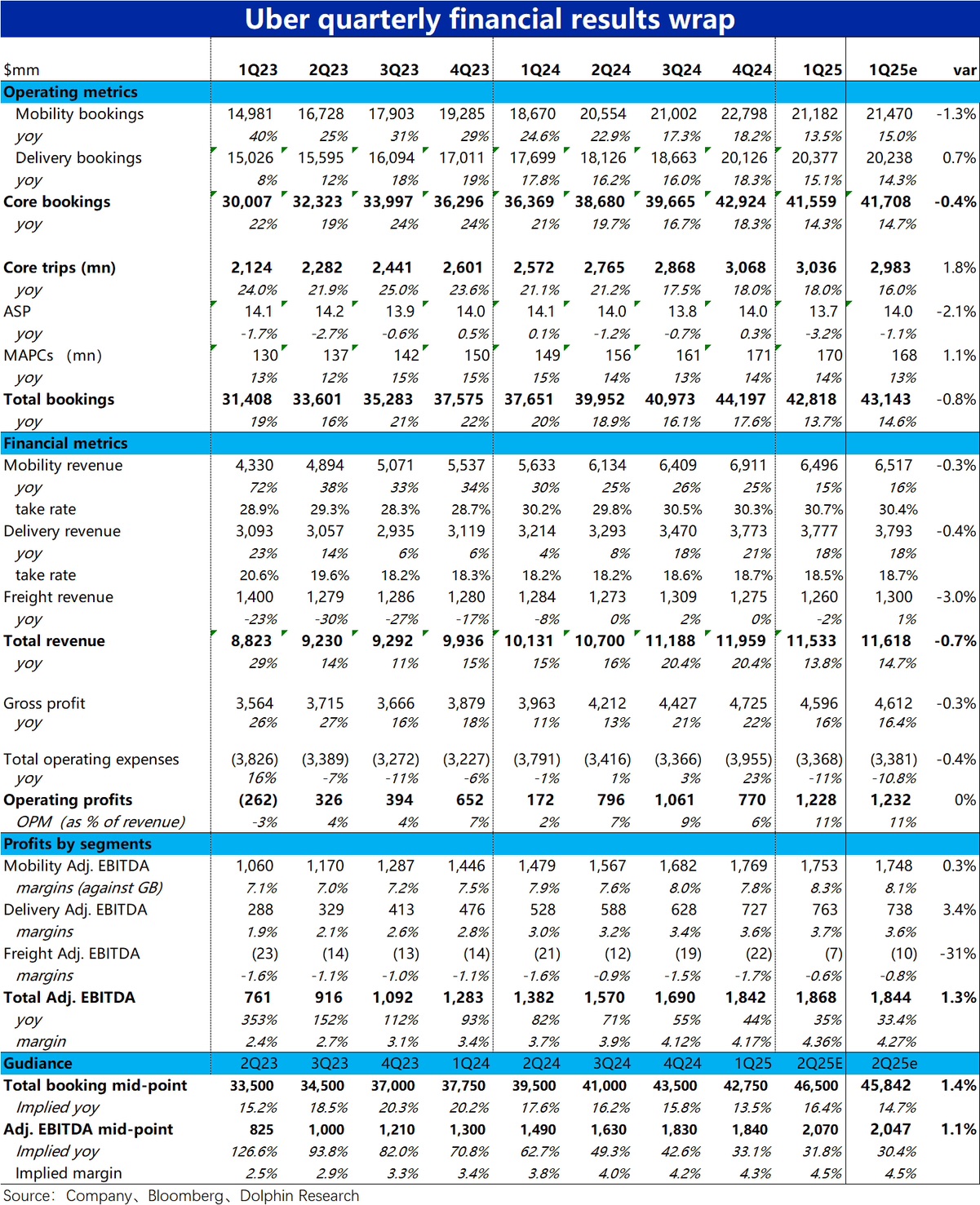

Although Uber's earnings report this quarter was slightly disappointing, its guidance for the next quarter was unexpectedly better than expected. Specifically:

1) On the growth front, the main issue this quarter was the significant slowdown in the growth of ride-hailing business Mobility's order value, which declined by nearly 5 percentage points quarter-over-quarter. Even after excluding currency effects, the slowdown was still 4 percentage points. This was notably lower than the already modest market expectation of 15%. Given that the growth rate of order volume for the core business (food delivery + ride-hailing) this quarter remained flat quarter-over-quarter without slowing down, the drag was primarily due to a 3.2% year-over-year decline in average order value. We preliminarily speculate that this might be due to a shift in product mix toward lower-priced items or an increase in the proportion of emerging markets. The exact reason will need to be clarified by management during the earnings call.

In addition to the sharp slowdown in order value growth, another issue for the ride-hailing business this quarter was the (temporary) halt in the upward trend of the take rate, which increased by only 0.5 percentage points year-over-year, compared to the usual 1-2 percentage point increases in previous quarters. As a result, the revenue growth rate for the ride-hailing business this quarter was only 15%, a dramatic slowdown from the sustained growth of over 25% in prior quarters.

The food delivery business, however, showed relative resilience (somewhat surprising to Dolphin Research, given that Dash's food delivery business missed expectations in yesterday's earnings report). Order value and revenue grew by 15% and 18%, respectively. Although this also represented a slowdown from the previous quarter, it was largely in line with market expectations.

2) Although growth was slightly disappointing due to the drag from the ride-hailing business, profitability metrics were slightly better than expected. First, the ride-hailing business's margin was 0.2 percentage points higher than expected, so despite the growth miss, adj. EBITDA still met expectations. The more resilient food delivery business also saw its adj. EBITDA margin come in 0.1 percentage point higher than expected, ultimately leading to profits that were about 3.4% above expectations.

3) Offsetting the impact of the underperforming ride-hailing business was the company's better-than-expected guidance for the next quarter. Logically, with tariff effects becoming more pronounced in Q2, the market expected further declines in business growth (total order value growth of 14.7%). However, the company's actual guidance for next quarter's total order value growth was a quarter-over-quarter acceleration to 16.4%, significantly better than expected and surprising. Investors are looking forward to management's explanation for this counter-trend acceleration in growth next quarter. That said, the adj. EBITDA margin guidance was largely in line with expectations at 4.5% (based on order value). Given the better-than-expected total order value growth, the overall adj. EBITDA was only slightly higher than expected.$Uber Tech(UBER.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.