Disney's Q2 performance was good, with profits significantly exceeding expectations. In addition, management has also significantly raised its outlook for the year.

Details:

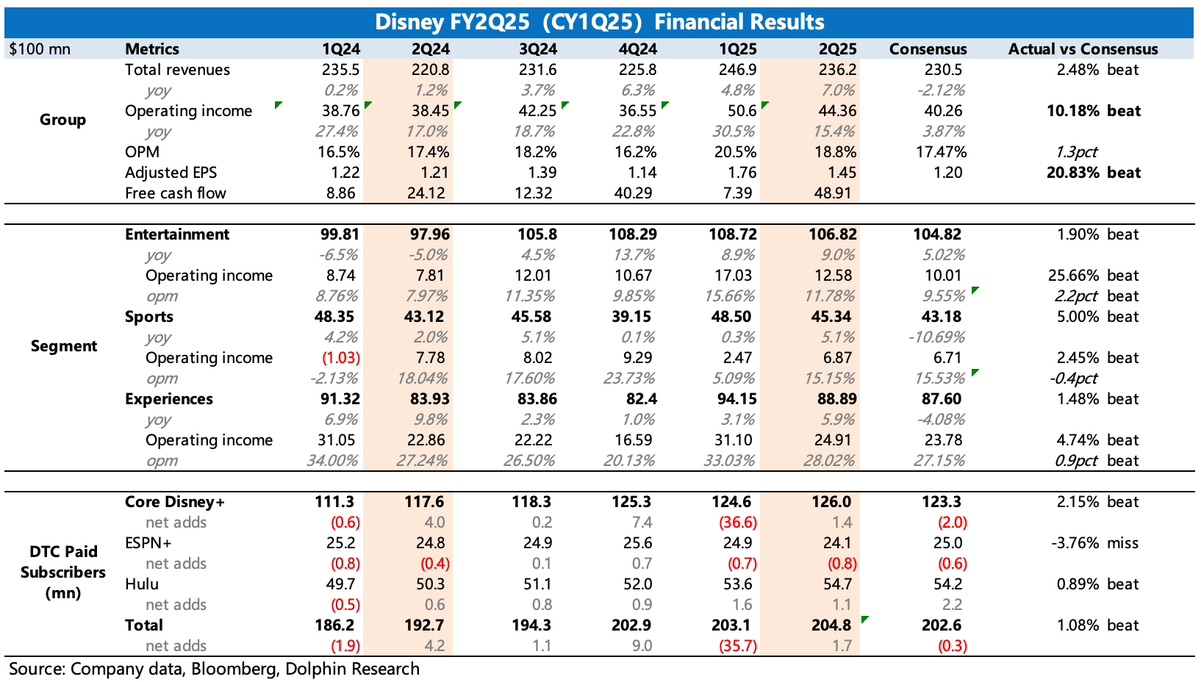

1. Q2 Results: Financially, profits beat expectations by a wide margin, but Dolphin Research found the growth in Disney+ subscribers even more encouraging.

Before the earnings report, market concerns were mainly based on third-party data tracking, which showed poor Disney+ user metrics. Combined with the company's conservative guidance last quarter (expecting a slight sequential decline in subscribers), the market was not particularly satisfied with the strategy of trading price hikes for "temporary" revenue and profit growth.

However, the actual results showed a net addition of 1.4 million subscribers in Q2, with guidance for a slight increase in Q3 as well. This is likely due to the crackdown on account sharing starting to take effect, which undoubtedly alleviated the market's main concerns.

2. Raised FY2025 Guidance:

(1) Adjusted EPS was raised to $5.75. Based on yesterday's closing price, the implied forward non-GAAP P/E is only 14x, which is on the lower end of the range, whether looking at growth trends or historical valuations.

(2) The group's profit guidance was raised, driven not only by DTC expansion and further integration of cable TV resources to improve monetization efficiency but also by higher expectations for Sports. The company raised its Sports profit growth forecast from 13% to 18%. Sports primarily consists of ESPN (including streaming) content. In August this year, ESPN will launch its flagship version (integrating cable TV and streaming content under a unified streaming subscription model). While market expectations were not high initially, the company's upward revision of growth could boost market sentiment.

(3) While there were no significant changes (or upward revisions) to guidance for other businesses, in the current uncertain macro environment—especially for a multinational like Disney—this actually provides more confidence in growth to a market that had been relatively conservative in its expectations.

Dolphin Research will provide a detailed earnings review later, incorporating insights from the earnings call.$Disney(DIS.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.