Good or bad performance? AMD's after-hours stock price fluctuates.

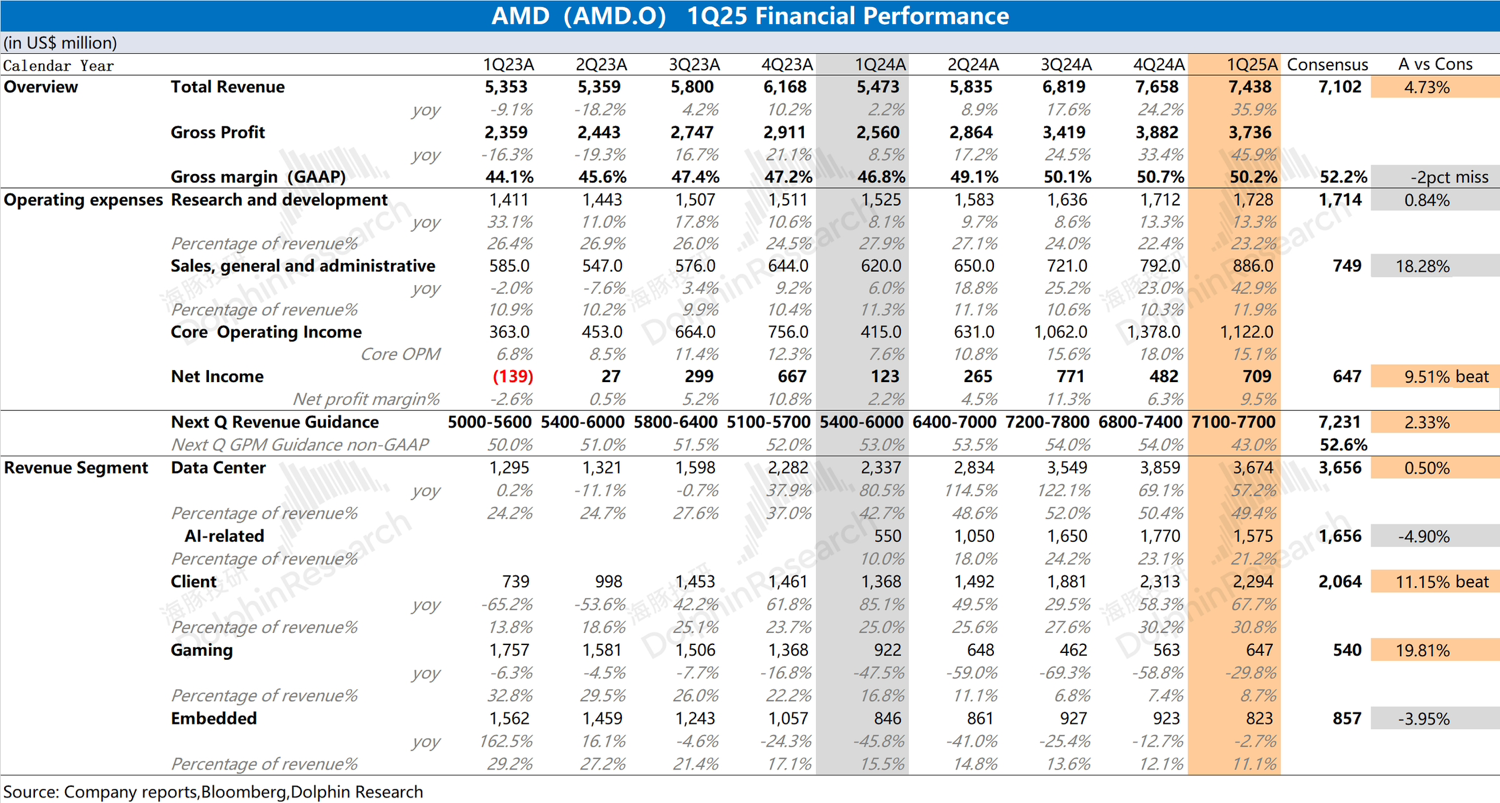

Overall, the company's revenue and profit performance this quarter were solid, with growth primarily driven by data center and client business segments. Among all business units, the client segment exceeded expectations the most, with the company's Ryzen processors continuing to gain market share in the PC market.

Additionally, the company's guidance for the next quarter is also decent. AMD expects next-quarter revenue to be between $7.1 and $7.7 billion, with a non-GAAP gross margin of 43%. Due to export restrictions affecting the MI308, the expected revenue impact for the next quarter is $700 million. Excluding this impact, the non-GAAP gross margin would rebound to 54%. Removing external factors, the company's overall operations remain stable with positive momentum.

For AMD, market focus remains on data center, client business, and trade friction. The continuous increase in CPU market share in the PC segment has driven sustained growth in the client business. For the data center segment, market attention is centered on the progress of MI325X and MI350, with major growth expected in the second half of the year. Regarding trade friction, the MI308 has resulted in approximately $800 million in inventory impact, translating to a revenue impact of around $1.5 billion. For detailed analysis, stay tuned for Dolphin Research's follow-up commentary.$AMD(AMD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.