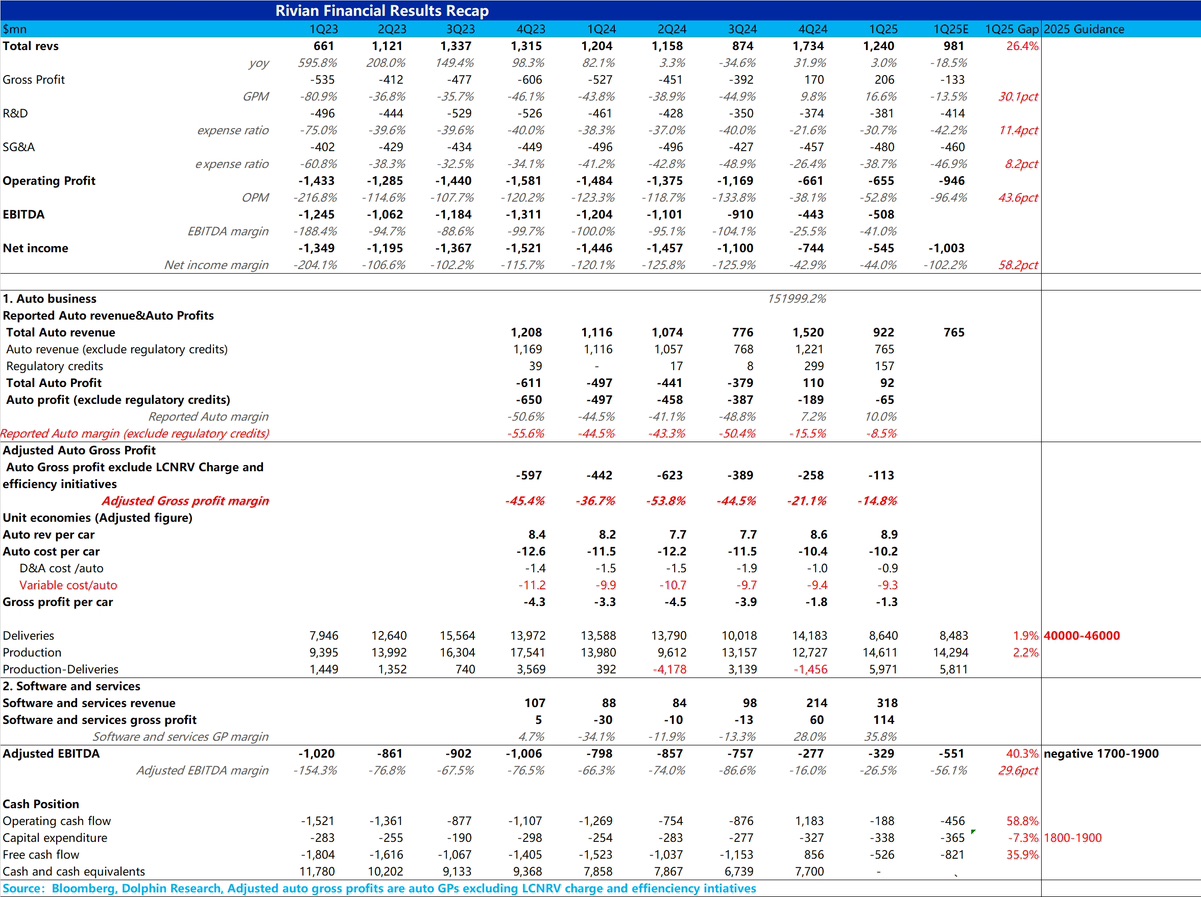

Rivian's performance this quarter was good, but the overall guidance for 2025 is terrible, and it continues to lower delivery expectations. Dolphin Research believes the market is most concerned about the 2025 outlook, especially under the impact of tariffs.

First, let's talk about this quarter's performance: Rivian exceeded market expectations in both revenue and gross margin. The market originally expected Rivian to have a negative double-digit gross margin in Q1, but surprisingly, Rivian achieved a positive double-digit margin. Dolphin Research believes this is mainly due to:

① The actual gross margin from car sales continues to improve, although it remains in negative double digits, there is clear marginal improvement.

② The contribution from the Volkswagen partnership to software and service businesses, with the software business gross margin reaching 36%! Essentially, Volkswagen's technology service fees are pure profit for Rivian.

However, the key lies in the guidance. With the R2 not yet launched, 2025 will be a tough year for Rivian with few upward catalysts for its stock price. Management's guidance for Rivian in 2025 is particularly crucial, especially under the current tariff impact.

For the overall delivery guidance, management has further lowered it by 5,000 units to 40,000-46,000 units (2024 deliveries are still at 52,000 units). The tariff impact remains significant for Rivian:

① Increased procurement costs: Although Rivian's supply chain appears to be in the U.S., its most critical component—batteries—are sourced from China's Gotion High-Tech (LFP batteries) and South Korea's Samsung. Higher tariffs will increase Rivian's procurement costs. The quantified impact on COGS will depend on management's comments during the earnings call.

② Increased Capex investment: Like Tesla, the tariff impact has led Rivian to raise capital expenditures by another $100 million, accelerating cash burn.

For more details, stay tuned for Dolphin Research's full analysis.$Rivian Automotive(RIVN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.