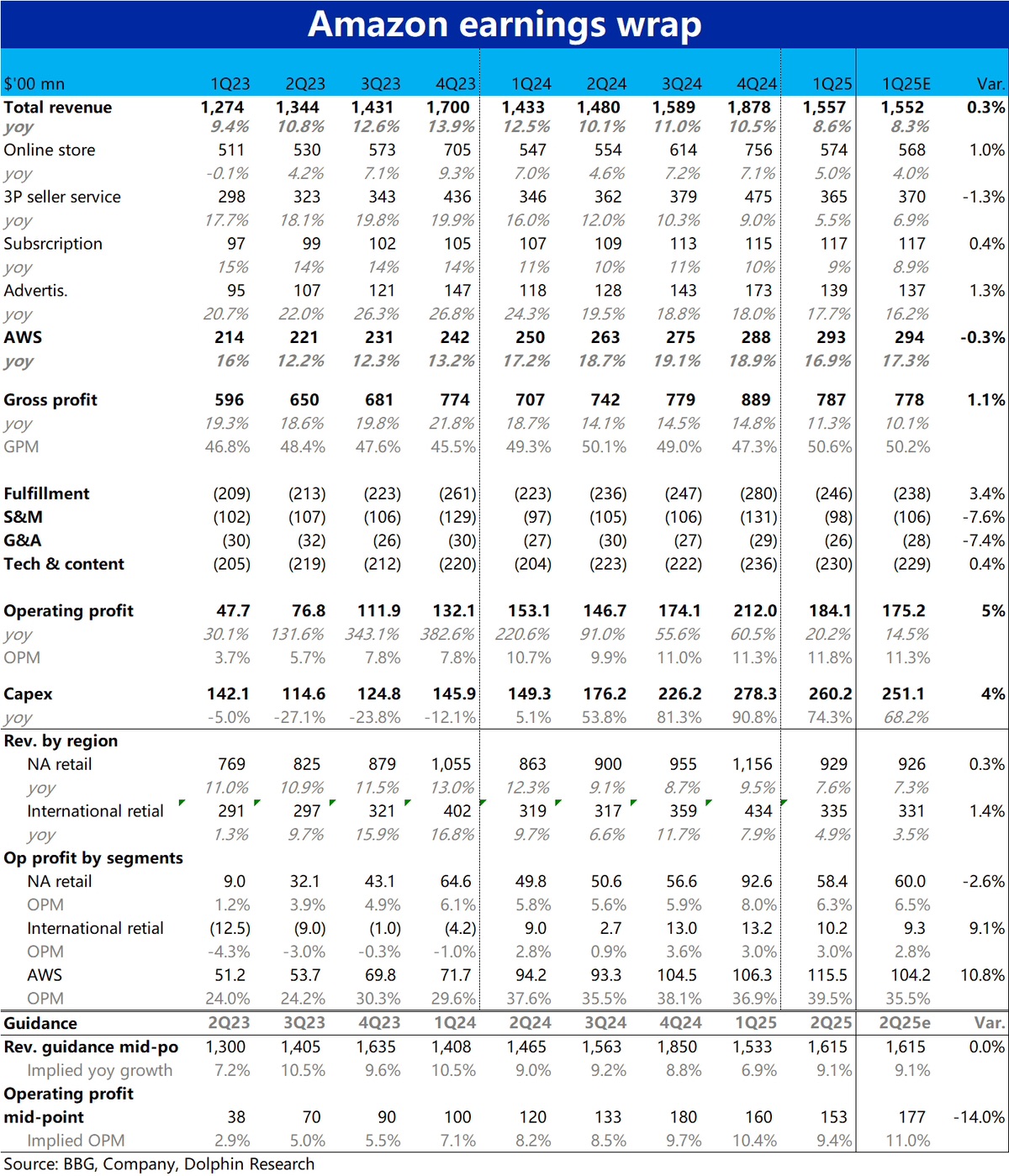

Amazon 1Q25 Quick Interpretation: Overall, this quarter's performance can be described as 'not as bad as feared.' Although the growth trends in total revenue and operating profit are indeed slowing, the actual results were slightly better than expectations.

For next quarter's guidance, revenue growth is still projected at 9%, which doesn't appear to have significantly worsened under tariff pressures. However, what the market is most concerned about is the lower-than-expected profit guidance for the next quarter. The upper limit of the guidance, $17.5B, is below the consensus estimate of $17.7B. Based on the median guidance, the implied overall OPM is 9.4%, a sequential contraction of 2.4pct (and only a 0.5pct decline YoY). This suggests that tariffs and the company's own Capex investments will lead to a contraction in corporate-wide profit margins.

In terms of segment performance, it's worth noting that the operating margin for North American retail has contracted from 8% last quarter to 6.5%, which is even lower than the expected 6.3%. This shows that in North America, weaker macro conditions & the company's investments in fulfillment efficiency have already led to margin erosion.

On the other hand, AWS's margin significantly exceeded expectations, reaching 39.5%, far above the expected 35.5%. Originally, due to the company shortening server depreciation periods by 1 year and a substantial increase in Capex, the market expected AWS margins to contract sequentially. Instead, they improved significantly. This is surprising, and it's important to focus on management's explanation for any non-recurring factors.$Amazon(AMZN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.