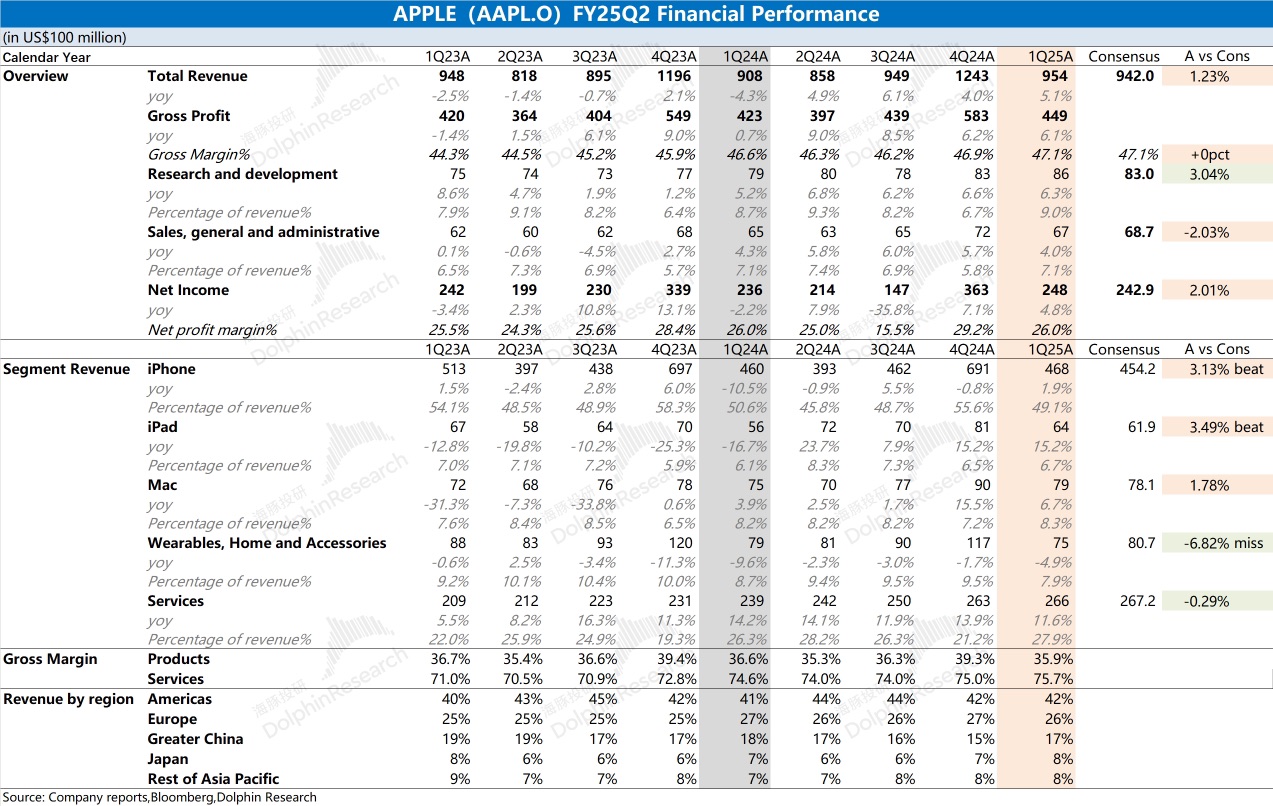

Apple FY25Q2 Quick Interpretation: The company's financial results this quarter were generally good, with steady growth in both revenue and profit. The growth in revenue was mainly driven by the service business, iPad, and iPhone businesses; the improvement in the gross margin of software services structurally pushed up the overall gross margin.

Specifically, the iPhone business remains the company's largest source of revenue. The launch of the iPhone16e this quarter halted the decline in the smartphone business but only brought a 1.9% year-on-year increase. The iPad and Mac businesses saw a recovery this quarter, driven by replacement demand, while other hardware like wearables continued to underperform. Software service revenue maintained double-digit growth, becoming the primary driver of revenue growth this quarter.

Although the company's financial results this quarter were stable, some risks cannot be ignored: 1) Even with the support of the iPhone16e, the iPhone business only saw slight growth; 2) Demand for wearables and other hardware products remains weak, with revenue growth still negative; 3) Although software service revenue continues to grow, the growth rate is showing a downward trend; 4) While mutual tariff treatments are currently applied to products like smartphones and PCs, wearables and other hardware will still be affected by tariffs, increasing the company's related costs.$Apple(AAPL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.