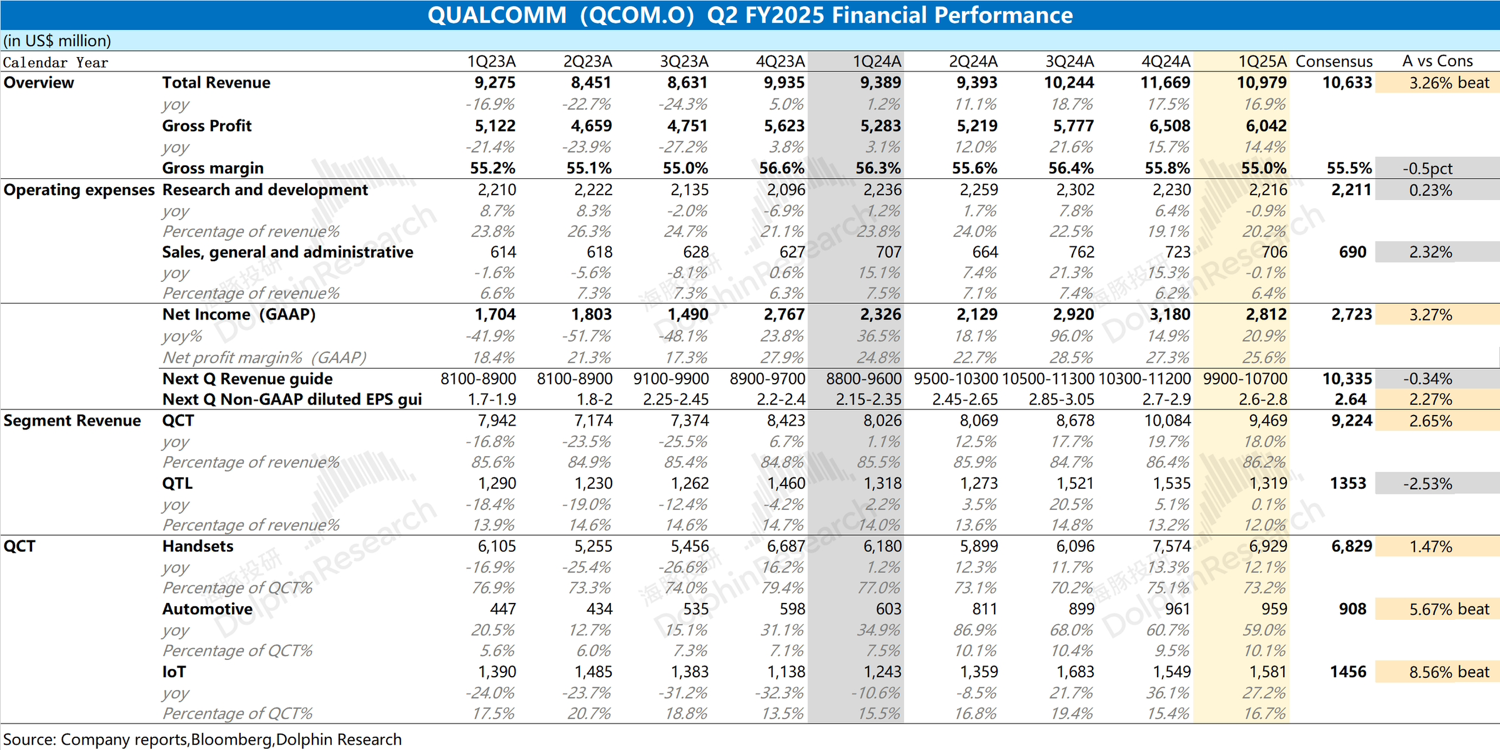

Qualcomm 2QFY25 Quick Interpretation: The company's performance growth this quarter was mainly driven by the growth of QCT business. Among them, the company's mobile phone business, automotive business and IoT business all showed varying degrees of growth, while QTL business (technology licensing) was basically flat year-on-year due to the impact of mobile phone sales in emerging regions.

Although the data for this quarter is acceptable, the guidance given by the company for the next quarter is relatively mediocre. The company expects revenue for the next quarter to be $9.9-10.7 billion, with adjusted earnings per share of $2.6-2.8. The revenue performance is basically in line with market expectations, while the profit side is mainly driven by the company's control of related expenses.

Such guidance does not alleviate market concerns: 1) Apple has already used its self-developed 5G baseband chip in iPhone16e, and future revenue from Apple may decline; 2) Despite the support of China's subsidy policies, it has not brought the company any better-than-expected positive performance, and next quarter's revenue faces another sequential decline; 3) The company still faces potential impacts from tariffs and Chinese customers in the future.$Qualcomm(QCOM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.