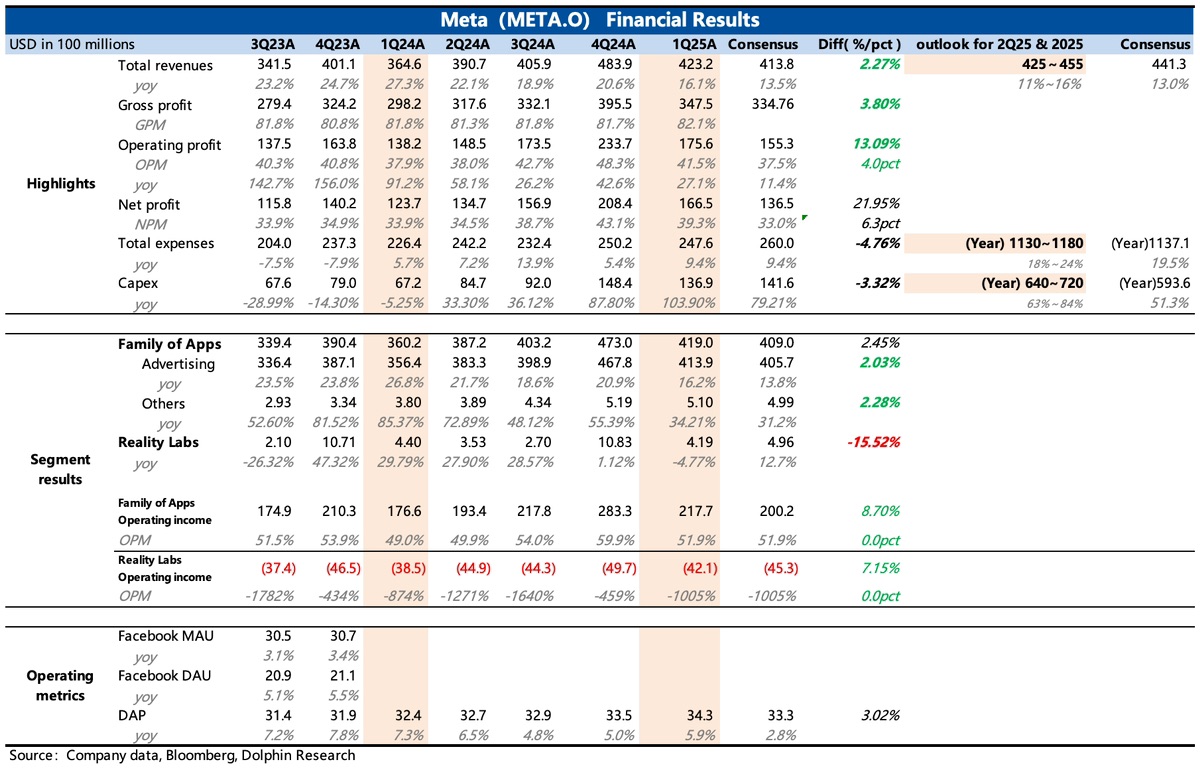

Meta 1Q25 Quick Interpretation: The highly anticipated quarterly report performed well, with all metrics either exceeding or meeting expectations except for the VR revenue miss. Particularly, the management's Q2 revenue guidance did not turn into a "horror show." With two consecutive advertising giants confirming the current macroeconomic resilience, market concerns and sensitivity over tariffs are likely to ease.

However, Dolphin Research believes that Google and Meta's outperformance is not due to macroeconomic stability but rather their leading competitive advantages. In this market environment, small and medium-sized platforms with a significant share of brand advertising may suffer more.

1. Q2 revenue guidance growth is in the range of 11%-16%, which indicates a natural slowdown in growth. But Meta's guidance primarily alleviates the current market pessimism, especially as weaker-than-expected economic data disclosed pre-market suppressed earlier market expectations.

2. Capital expenditures increased again: The company raised its capital expenditure guidance for the year to $64 billion to $72 billion. Compared to previous fears of Meta overspending on capital expenditures, combined with Google's earnings report, this increase is seen by the market as a confirmation and assurance of AI demand, signaling new growth momentum.

3. Lower operating expenses, Efficiency Year 2.0 to offset AI investments?: Due to extended server depreciation, Q1 gross margins improved both year-over-year and quarter-over-quarter. Despite increased R&D spending, total operating expenses grew only 9.4% year-over-year (lower than revenue growth) after excluding a one-time legal fee, boosting short-term profitability.

The management also lowered full-year operating expenses by $1 billion. Although Q1 headcount continued to grow net (the 5% layoffs were insufficient to offset new R&D hires), Zuckerberg repeatedly mentioned the trend of AI replacing internal R&D engineers.

To navigate the complex environment and ease profit growth pressure this year, the company may relaunch its Efficiency Year strategy, optimizing non-core R&D areas.$Meta Platforms(META.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.