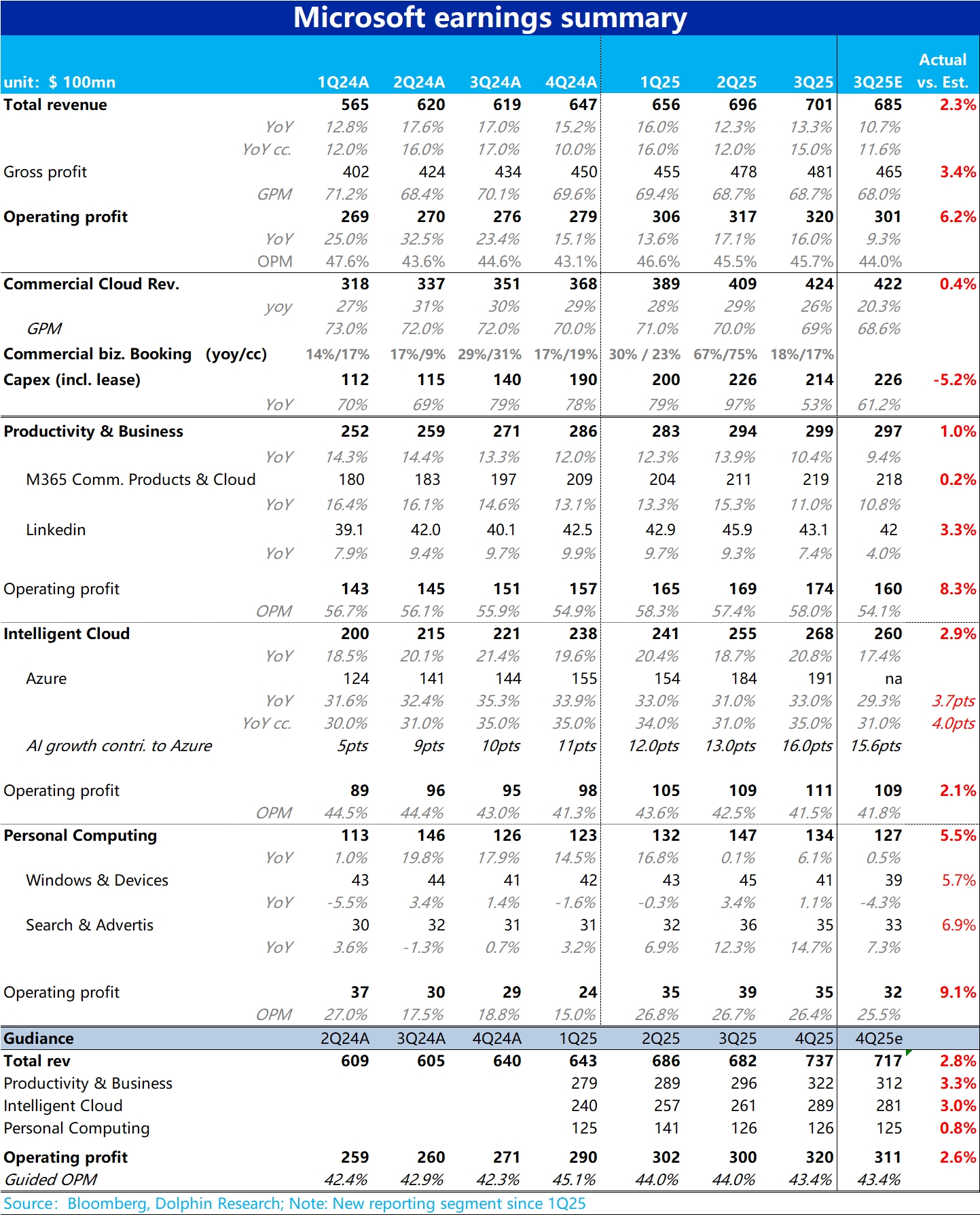

Microsoft FY3Q25 Quick Interpretation: Microsoft's earnings report performance was significantly better than the market's originally pessimistic expectations (much better than feared). In general, the market expected revenue growth to continue slowing quarter-over-quarter, dropping to just slightly above 10%. At the same time, the profit margin expansion cycle was expected to completely end and start declining, with operating profit growth projected at only 9%, lower than revenue growth, as the impact of high capex began to show. It was an expectation of overall deteriorating performance.

However, the actual results were completely the opposite. Revenue growth actually accelerated by 1 percentage point quarter-over-quarter, and after excluding the drag from exchange rates, it sped up by 3 percentage points, increasing instead of declining. Operating profit grew by 16%, significantly outperforming revenue, meaning the trend of profit margin expansion is still ongoing, and the drag from high investments on profits appears much smaller, at least for now.

In terms of segment performance, the most critical Azure revenue grew 33% year-over-year, and after excluding exchange rate effects, it reached 35%, accelerating by 2 and 4 percentage points quarter-over-quarter, respectively. Based on our understanding, due to weak enterprise IT spending intentions in Q1 surveys and renewed concerns about macroeconomic weakness, the market originally expected Azure's growth to remain flat year-over-year. However, strong AI demand (contributing 16% to revenue growth) drove Azure's growth to significantly exceed expectations. This is the most critical positive takeaway from this earnings report.

The market was also focused on capex, which was $21.4 billion this quarter, slightly lower than the previous quarter. This signals that the phase of quarter-over-quarter capex increases has ended, reflecting a slight cooling in Microsoft's investment attitude. However, the absolute amount of $21 billion in investment is still not low and aligns with the company's full-year capex budget of over $80 billion. Azure's stronger-than-expected growth also validates the necessity of capex investments. Attention should be paid to the capex guidance for the next quarter and fiscal year during the earnings call.$Microsoft(MSFT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.