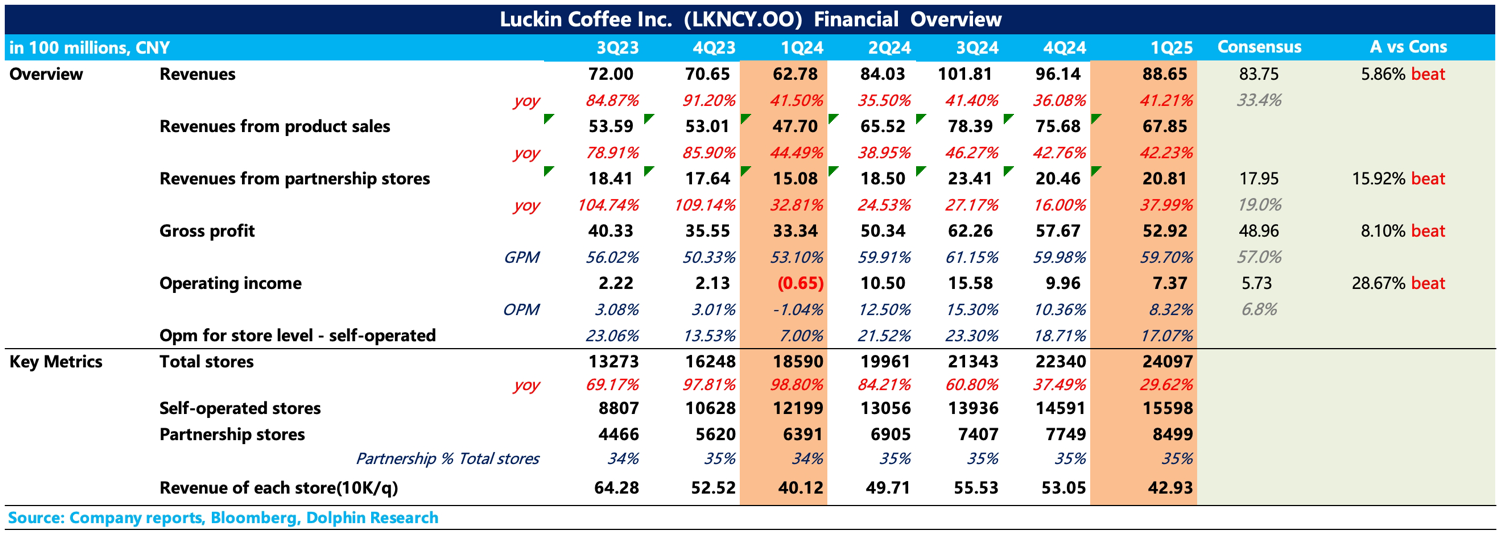

Luckin Coffee 1Q25 Quick Interpretation: Dolphin Research is relatively satisfied with this report card. It reflects Luckin's strong brand loyalty externally and excellent cost control internally.

The Q1 performance exceeded BBG's expectations, but due to conservative guidance from management last quarter (coffee bean price hikes and overseas expansion investments), market expectations had already been adjusted.

Since few institutions cover Luckin, and most funds follow higher-frequency metrics like daily cup sales and store opening speed for trading, BBG's collected expectations may not reflect the latest outlook. It's recommended to use them only as partial reference. Dolphin Research will base its analysis on specific operational conditions, marginal trends, and valuation.

Overall, Dolphin Research's relative satisfaction mainly stems from faster-than-expected store expansion while maintaining stable profitability for both the group and 1P stores.

1. Q1 revenue growth was 41%, partly due to a low base last year (an extreme situation under "weather + competition" pressure), and partly because the core revenue metric—same-store sales growth for directly operated stores—returned to positive territory.

2. At the same time, the company accelerated store openings, adding 1,757 new stores (including 14 overseas), showcasing Luckin's ambition to further dominate the market.

3. Q1 is typically a slow season, often putting pressure on profit margins. Combined with the prolonged surge in coffee bean prices, market expectations for profits were low. However, Luckin's product gross margin remained stable sequentially. The main cost increases came from accelerated store openings, leading to higher expenses as a percentage of revenue (e.g., rent, equipment depreciation, and store-related administrative costs). Year-over-year, these metrics still showed significant improvement.

Final Q1 net profit attributable to shareholders was 530 million yuan (with higher Q1 income taxes), and Non-GAAP net profit was 650 million yuan. Given this trend and assuming stable competition (rising coffee bean costs raise barriers for competitors, while Luckin locks in costs via long-term contracts), Dolphin Research expects this year's profit could exceed management's initial guidance.$Luckin Coffee(LKNCY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.