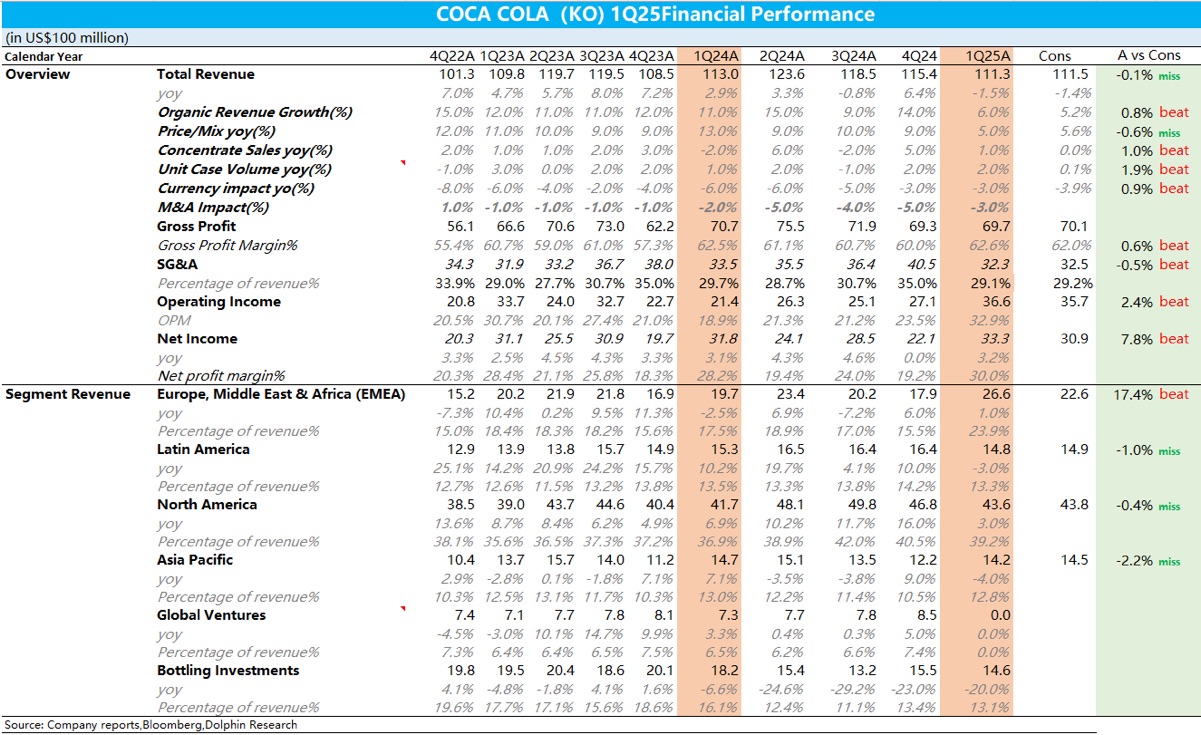

$Coca Cola(KO.US)1Q25 Quick Interpretation: The company's earnings report performed well overall, with Q1 organic revenue growing 6% YoY, slightly above the company's 5% guidance in the annual report.

Breakdown: Concentrate sales & price contributed 1% and 5% respectively. As Q1 is the off-season for the beverage industry, the slowdown in sales growth is within the normal range, and the headwind from foreign exchange has also weakened amid slowing inflation.

Thanks to the company's strong brand power, it successfully passed on cost pressures to bottlers & downstream consumers through direct price hikes and increasing the proportion of healthy & premium products, with gross margin rising further to 62.6%.

On the expense side, thanks to the company's continuous application of AI to daily operations (including pricing decisions in different markets & creating marketing ads, etc.), the expense ratio dropped to 29.1%, and core operating profit also exceeded market consensus.

For guidance, the company expects full-year 2025 & Q2 growth of 5%-6%, in line with previous expectations.

For more details, stay tuned for Dolphin Research's specific commentary and earnings call coverage.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.