$Focus Media(002027.SZ)Quick Interpretation: Despite the harsh macroeconomic environment, the leader in elevator media is still expanding against the trend.

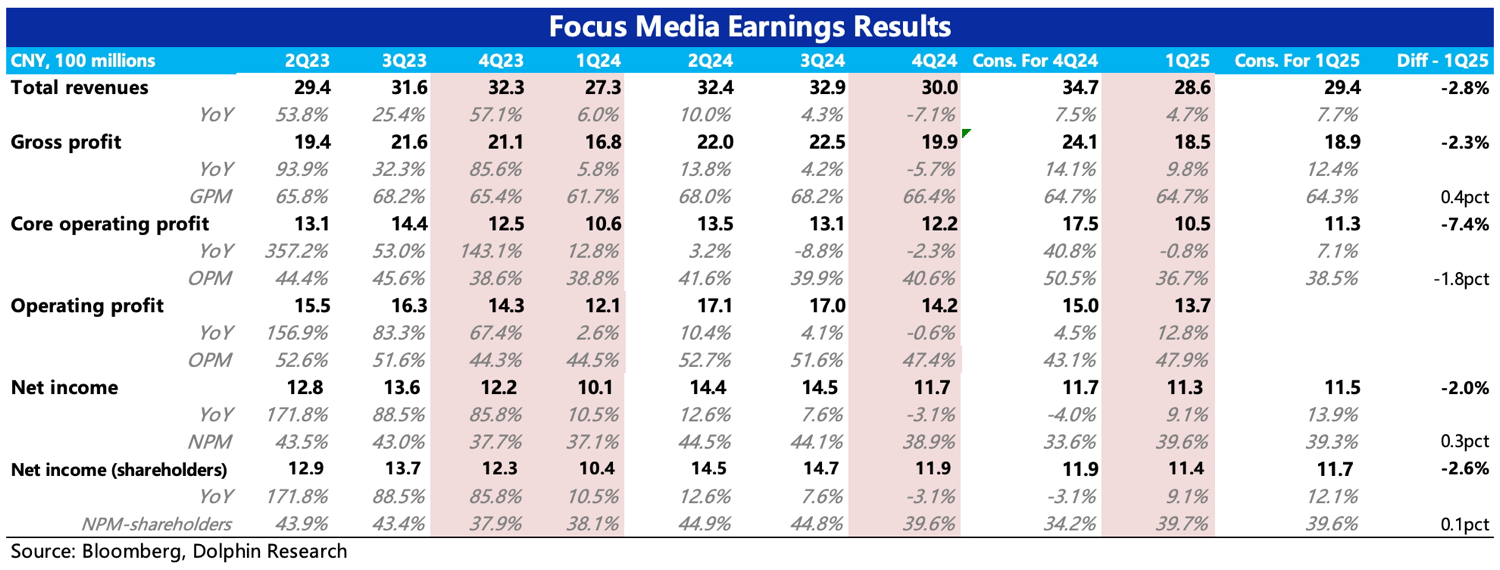

In terms of financial data, both 4Q24 and 1Q25 revenues fell short of expectations, but institutional expectations were more conservative than BBG's (institutions expected Q4 revenue to be flat, Q1 5-6% growth), so the actual miss wasn't as significant.

The good news is that thanks to strong gross margins, Q1 profits recovered and were in line with expectations.

Other operational indicators:

1. Client payment difficulties: Both credit impairments and accounts receivable increased quarter-on-quarter, with the turnover cycle extending further to 74 days.

2. Core OPM wasn't significantly affected, mainly due to continuous improvement in gross margins under the strategy of optimizing locations over the past year. Elevator media and cinema gross margins improved slightly year-on-year. Additionally, expenses were strictly controlled, with Q4 & Q1 operating expenses better managed compared to the trend in Q2 and Q3 last year, mainly reflected in sales and R&D expenses.

3. Continued location expansion: LCD screens and posters in first- and second-tier cities are still increasing, while third- and fourth-tier cities are generally shrinking and optimizing. Cinema coverage has also significantly increased, mainly due to partnerships with more theaters.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.