Trump backed down, can the US stock replay "KTV" mode?

Hello everyone, I am Dolphin Research!

After taking a tough stance, Trump first called for a 90 - day pause, and then, as if he had "switched souls," he began to frequently show goodwill towards countries including China. The market originally expected the average tariff rate to be around 20%, but now it seems that after Trump's moderation, the final tariff rate might only be between 5 - 10%.

In this situation, the market has shifted from a Risk - off mode back to a Risk - on mode. However, after this wave of Trump's miraculous operations, will the U.S. stock market shrug off past issues and continue to perform as it did before April 2nd?

I. What has changed before vs. after April 2?

In Trump's rare unexpected operations, the biggest change from a narrative perspective is probably that the belief in "American exceptionalism" has been shaken. During the process when global funds overweight U.S. assets, besides the fact that the U.S. is a mature market with stable shareholder returns and rational capital allocation, a significant reason is the belief in the continuous rise of dollar assets.

However, Trump's extreme operations have made the market realize that the prosperity of the U.S. since the pandemic mainly comes from the federal government's leverage. Now, with U.S. Treasury yields high, it has become very difficult to continue adding leverage.

From the changes in the U.S. macro leverage ratio, we can see:

a. The overall leverage ratio of the U.S. economy is currently still at 258%, which is 7 percentage points higher than the 251% before the pandemic (Q4 2019);

b. However, from a sectoral perspective, leverage has been concentrated in the federal government, while the leverage ratios of enterprises and households have all decreased, with enterprises reducing by 4.5 percentage points and households reducing by more than 5 percentage points.

Currently, government leverage can no longer be increased. In this case, the ideal situation would be for the corporate and household sectors to take over the baton of adding leverage for the economy to continue to prosper. However, with the 10-year Treasury yield hovering above 4%, households are certainly unwilling to add leverage to purchase real estate and other long-term assets at such high levels, and enterprises have already stocked up on leverage during the zero-interest period in 2020, lacking motivation to add more leverage.

From the perspective of government as a spending entity, regardless of whether it is the Democratic Party or the Republican Party in power, the choice faced in the next four years is actually to reshape the fiscal record of the U.S. government.

Currently, the U.S. economy is in good shape, and the Democratic remedy is to raise taxes. However, during good economic times, the Republican Party still emphasizes streamlining administration and reducing taxes. To reshape fiscal discipline, it can only find supplements from various sources, whether through tariffs or the so-called imposition of a substantial capital circulation tax on foreign holders of U.S. debt, which to some extent externalizes internal economic issues.

II. The Collapse of the "American Exception" Belief? Even if it doesn't collapse, the foundation has already been shaken

Since the pandemic, the long bull market in U.S. stocks, driven by superior fundamentals and a strong dollar, has seen continuous foreign capital inflow, earning returns from both the stock and foreign exchange markets. However, this issue is variable, as the U.S. economy continues to show strong fundamentals during the government's leverage increase.

In Dolphin Research's view, the most explicit signal released by Trump's recent tariff actions is that the government's leverage cannot increase any further. The bond market, with persistently high yields, is also pressuring the federal government to reshape fiscal discipline.

a. The government is deleveraging. Who will be the next to leverage?

However, the reshaping of fiscal discipline is essentially the government's process of "deleveraging." In the absence of other sectors taking over the leverage, if there is no industrial revolution brought about by AI to offset the negative impact on productivity, then deleveraging is likely to put pressure on the current state of the U.S. economy.

b. What is different about this round of tariffs? Tariffs on capital goods shake corporate capital expenditure expectations.

Another fundamental change is that, compared to the last round of tariffs on end-demand products, this round imposes high tariffs of 145% on China, affecting more capital input factors in China's export structure. The tariffs will impact corporate capital expenditure expectations and progress, thereby negatively affecting the U.S. economy.

This point was already evident to Dolphin Research during Tesla's earnings call: “Tariffs have affected our capital expenditure progress. This sounds somewhat counterintuitive (because manufacturing is returning, which should increase domestic capital expenditure), but in reality, to build or expand production lines domestically, we must import equipment from abroad, as U.S. capacity is insufficient. In the current trade environment, the import of this equipment is restricted. The cost of importing equipment from China is affected by tariffs, and we expect capital expenditure (CapEx) to exceed $10 billion this year, while still assessing further measures.”

The meaning expressed in this statement is quite clear: even with manufacturing returning, the first step in building production lines still requires equipment from China to set up the lines. However, the current level of tariffs has made it impossible to take this step. The prolonged U.S.-China tariff negotiations mean that the investment commitments made by companies to the U.S. are merely verbal promises that cannot translate into substantial investments.

Here, Dolphin Research noted an interesting interview with an American expert discussing the construction industry:

“Imagine you are a real estate developer in the U.S. The reality is: almost everything you use to build houses, such as appliances, pipes, tiles, etc., relies on products from China. If you go to Home Depot, 70%-80% of the shelves are filled with Chinese-made products.

Now, which rational person would start a new project under these circumstances? You have no idea what the prices of the materials you need are, or even if they can be delivered on time. If the pipes are delayed by a week, the entire project will collapse—plumbers can't come, and the drywall work will also be delayed. This entire process is a precisely coordinated system.We have seen this supply chain dislocation during the pandemic, and the entire economy took a year to recover. This time, the impact will not be lighter.

Dolphin Research will continue to pay attention to the upcoming earnings report week for major companies, observing how U.S. internet giants will adjust capital expenditures and plan the pace of capital spending in such a highly uncertain environment.

In Dolphin Research's view, (a—b) will continue to have a lasting impact on the investment logic of U.S. stocks after the negotiations on Trump's tariff policy stabilize, thereby creating upward pressure on the recovery strength of U.S. stocks.

At the same time, another important factor needs to be addressed. Apart from the disruption caused by tariffs, the high valuation of U.S. stocks is also due to their absolute leading position in AI technology. This dominance contributes to the high valuations. If China can gradually catch up and erode the high-profit characteristics of this industry, it will also reduce part of the valuation premium of U.S. tech stocks. On this issue, we can continuously monitor whether domestic and international AI players, including Deepseek and ChatGPT, make new progress in AI iteration.

III. How should we view this round of U.S. stock rebound?

With these considerations in mind, we can analyze the decline of the U.S. dollar index. During this round of decline, the current economic fundamentals of the U.S. have not changed significantly. Instead, what has changed are expectations for the future economy and concerns about policy uncertainty.

Due to fear, non-U.S. funds are gradually fleeing the U.S. stock market. However, as Trump's tone gradually becomes milder, the uncertainty regarding policies is gradually dissipating, and the dollar is likely to stabilize in the short term. Non-U.S. funds remaining in U.S. stocks will at least not continue to suffer from exchange rate losses.

But can U.S. stocks continue to party afterward? Dolphin Research's answer is negative. The reason is also the two points mentioned above; the exceptionalism of the U.S. in recent years has led to a continuous increase in the valuation of dollar assets.

However, with the cracks in exceptionalism and the obvious valuation premium of country-specific assets, further increasing valuations is actually quite difficult. This means that for U.S. stocks to generate cross-market Alpha in the future, it will rely on consistently outstanding EPS.

However, fundamentally, if the U.S. enters a deleveraging process in the future + the uncertainty brought by tariffs affects the pace of capital expenditure investment, the hope for U.S. asset EPS to continue to beat is not great. Therefore, Dolphin Research believes that 2025 is likely to be a year when the investment returns of U.S. stock assets turn mediocre.

However, the evolution of EPS does not happen overnight; it needs to be continuously tracked and confirmed through the evolution of the U.S. economy. Therefore, the mediocrity of U.S. stock returns is also a process that the market needs to continuously verify and confirm.

IV. Portfolio adjustment and returns

The Alpha Dolphin portfolio made slight adjustments, mainly based on the fact that the most uncertain moment regarding tariffs has passed, and risks are gradually decreasing. Dolphin Research has begun to gradually increase the proportion of equity positions. The priorities for adjustment are: a. Strong tariff resistance capability - TSMC; b. Strong shareholder return attractiveness - Vipshop; c. Low valuation - Pinduoduo; d. Pop Mart: good growth potential with room for upward movement.

The specific explanations are as follows:

Last week, the virtual portfolio Alpha Dolphin from Dolphin Research achieved a return of 0.7%, outperforming the CSI 300 (+0.4%), but underperforming MSCI China (+3.4%) and Hang Seng Tech (+3.4%), as well as the S&P 500 (+4.6%).

Since the portfolio began testing (March 25, 2022) until last weekend, the absolute return of the portfolio is 81%, with an excess return of 84% compared to MSCI China. From the perspective of net asset value, Dolphin Research's initial virtual asset of 100 million USD has exceeded 184 million USD as of last weekend.

V. Individual Stock Profit and Loss Contribution

Last week, the Alpha Dolphin portfolio underperformed the major indices primarily due to a lighter position, as it did not increase holdings in a timely manner during the market recovery process. Additionally, the heavily weighted gold ETF fell last week, affecting the overall performance of the portfolio.

The specific stocks with significant price fluctuations are explained by Dolphin Research as follows:

VI. Asset Allocation Distribution

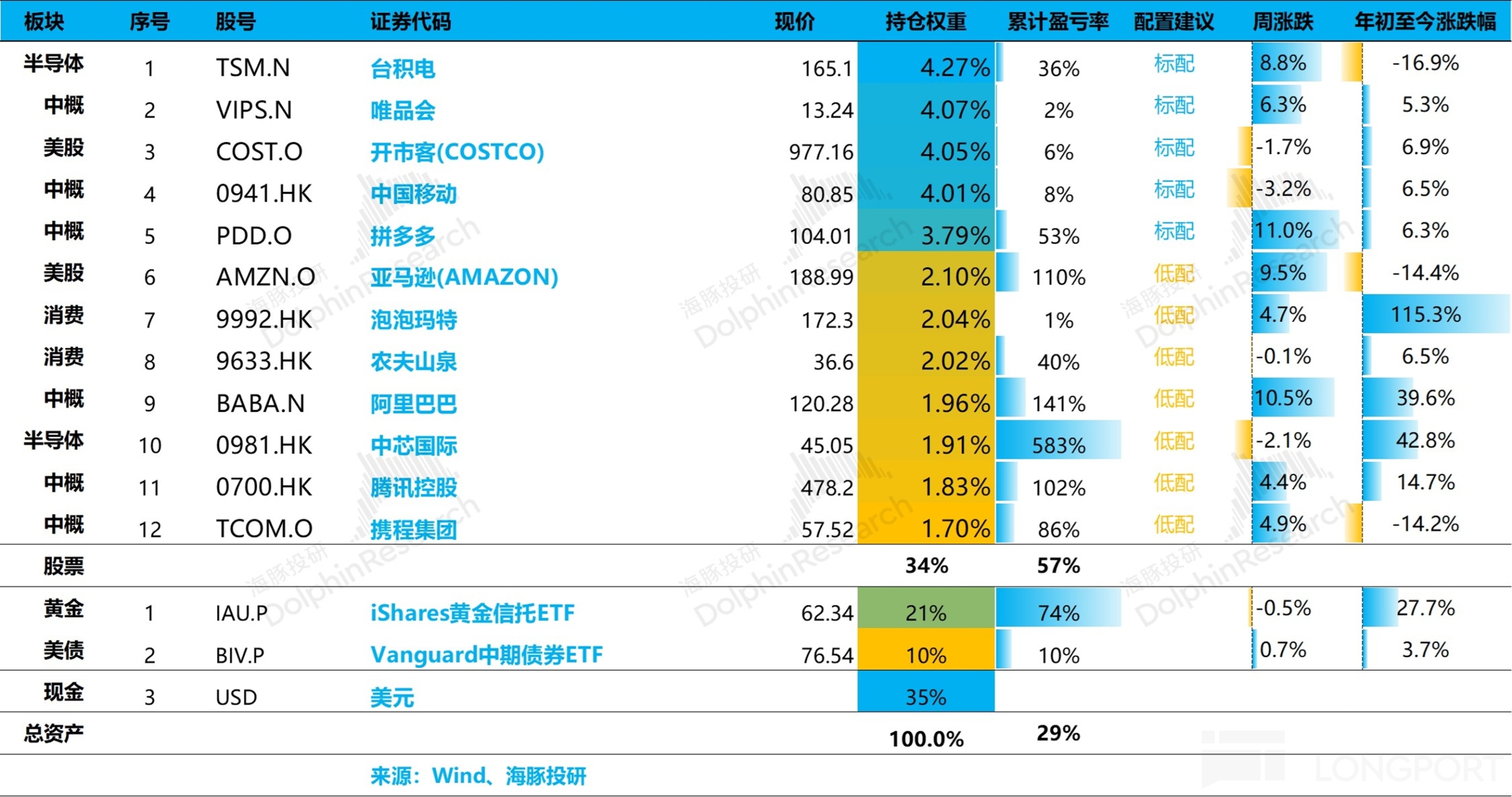

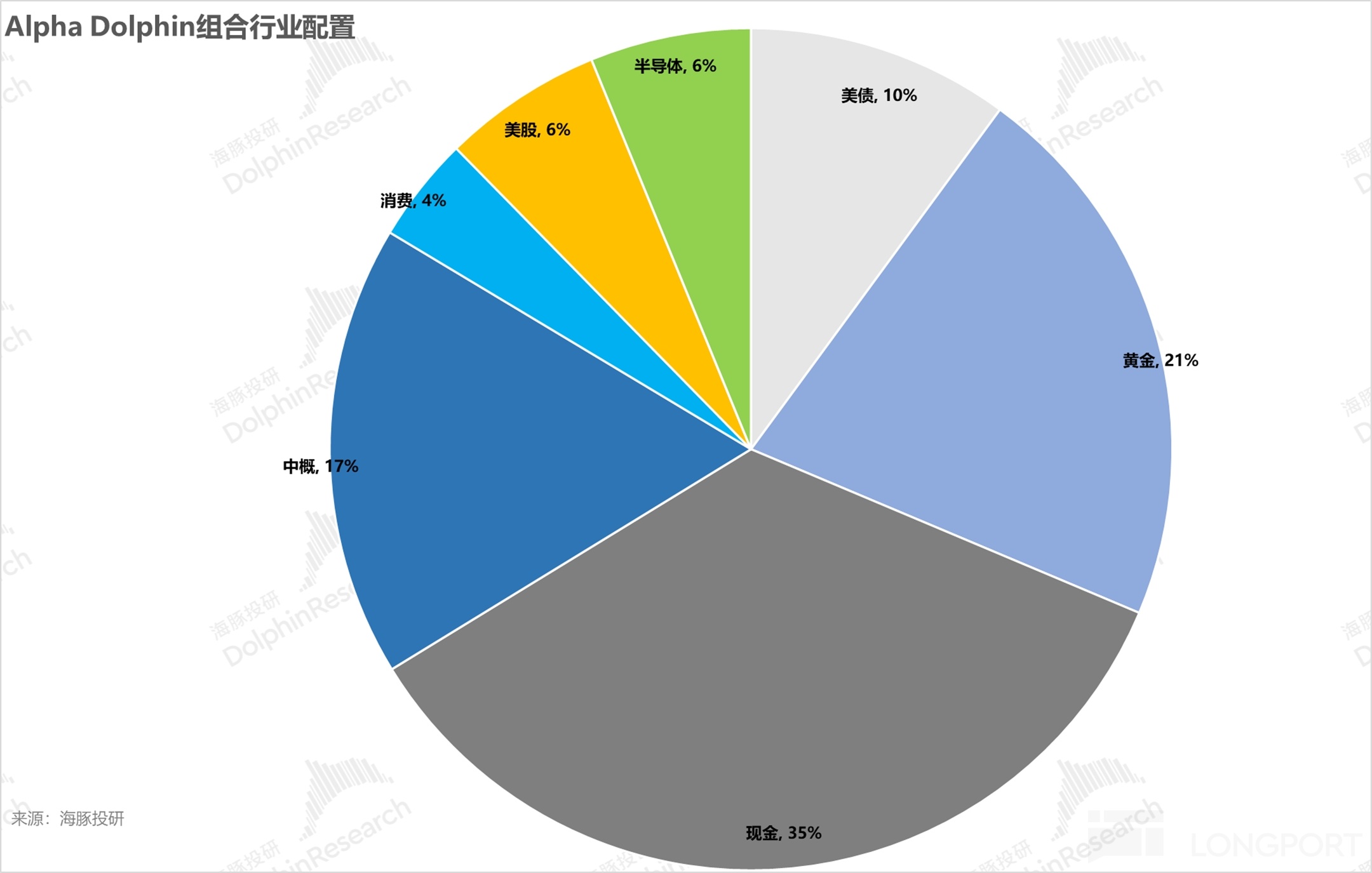

The Alpha Dolphin virtual portfolio holds a total of 10 stocks and equity ETFs, with one standard allocation and the rest under-allocated. The assets outside of equities are mainly distributed in gold, U.S. Treasuries, and U.S. dollar cash. Currently, the overall portfolio is lightly positioned to cope with tariff uncertainties while closely monitoring the safety margins of high-quality assets that may decline.

As of last weekend, the asset allocation and equity asset holding weights of Alpha Dolphin are as follows:

VII. This week's focus:

After the holiday, Hong Kong and A-share assets enter the first quarter earnings release period, while some U.S. stocks also enter the earnings season. The upcoming quarterly performance may not be as important; more attention will be on how companies forecast their upcoming performance under tariff uncertainties and how they respond to potential tariff risks, as well as how these guidelines affect the risk appetite of funds.

Risk disclosure and statement of this article: Dolphin Research Disclaimer and General Disclosure

For recent articles from Dolphin Research weekly report, please refer to:

“This is the most down-to-earth, Dolphin Investment Portfolio has started”

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.