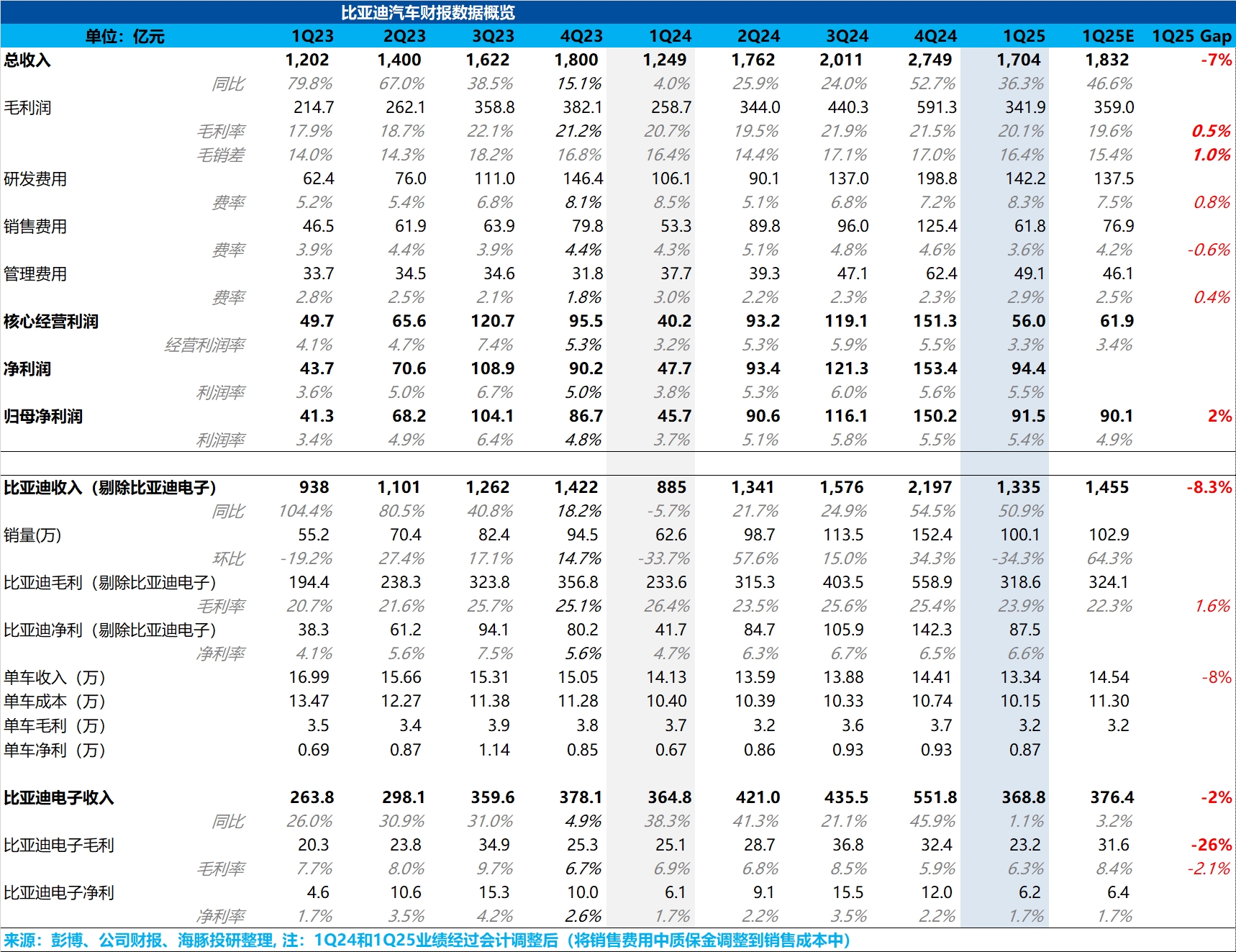

$BYD COMPANY(01211.HK) Earnings Quick Interpretation: Overall, Dolphin Research believes BYD delivered a solid performance, although at first glance, vehicle sales revenue fell short of expectations, dragging down the top-line total revenue. However, Dolphin Research thinks the market had overly high expectations for BYD's vehicle sales revenue per unit. While Q1 saw a boost from overseas expansion, with overseas sales reaching a new high (likely the core reason for market expectations of sequential price increases this quarter), Dolphin Research learned that BYD was still primarily clearing old inventory in Q1 with significant price cuts. Additionally, the actual launch of smart-driving models was delayed, so the vehicle sales price was within Dolphin Research's expectations.

What surprised Dolphin Research was the Q1 vehicle gross margin, which reached 24%. Due to accounting adjustments (moving warranty reserves from sales expenses to cost of sales, naturally lowering gross margin), Dolphin Research believes gross-to-sales spread is a more appropriate metric.

In Q1 this year, the gross-to-sales spread hit 16.4%, matching Q1 last year! (Recall that last year's Q1 vehicle gross margin far exceeded analyst expectations.) Sequentially, despite the strong sales push in Q4, it only declined by 0.6 percentage points, reflecting the continued strength of supply chain premium pricing + high vertical integration + high-margin overseas expansion. Meanwhile, in terms of core net profit per vehicle and net profit attributable to shareholders, although BYD had already issued preliminary guidance, the actual figures still slightly exceeded expectations, primarily due to high automotive gross margins and strict control over sales expenses.

With Q1's inventory clearance cycle behind, Q2 will focus on smart-driving model sales. Dolphin Research believes BYD's vehicle sales fundamentals are highly likely to continue improving in Q2 (especially given the strong cost-cutting capabilities observed in Q1). Stay tuned for further earnings commentary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.