$Intel(INTC.US) Quick Interpretation: After changing its CEO, the company once again adjusted its financial reporting standards this quarter, with network and edge businesses no longer being disclosed separately. Intel's proprietary product business is divided into two major categories: Client Computing and Data Center & AI.

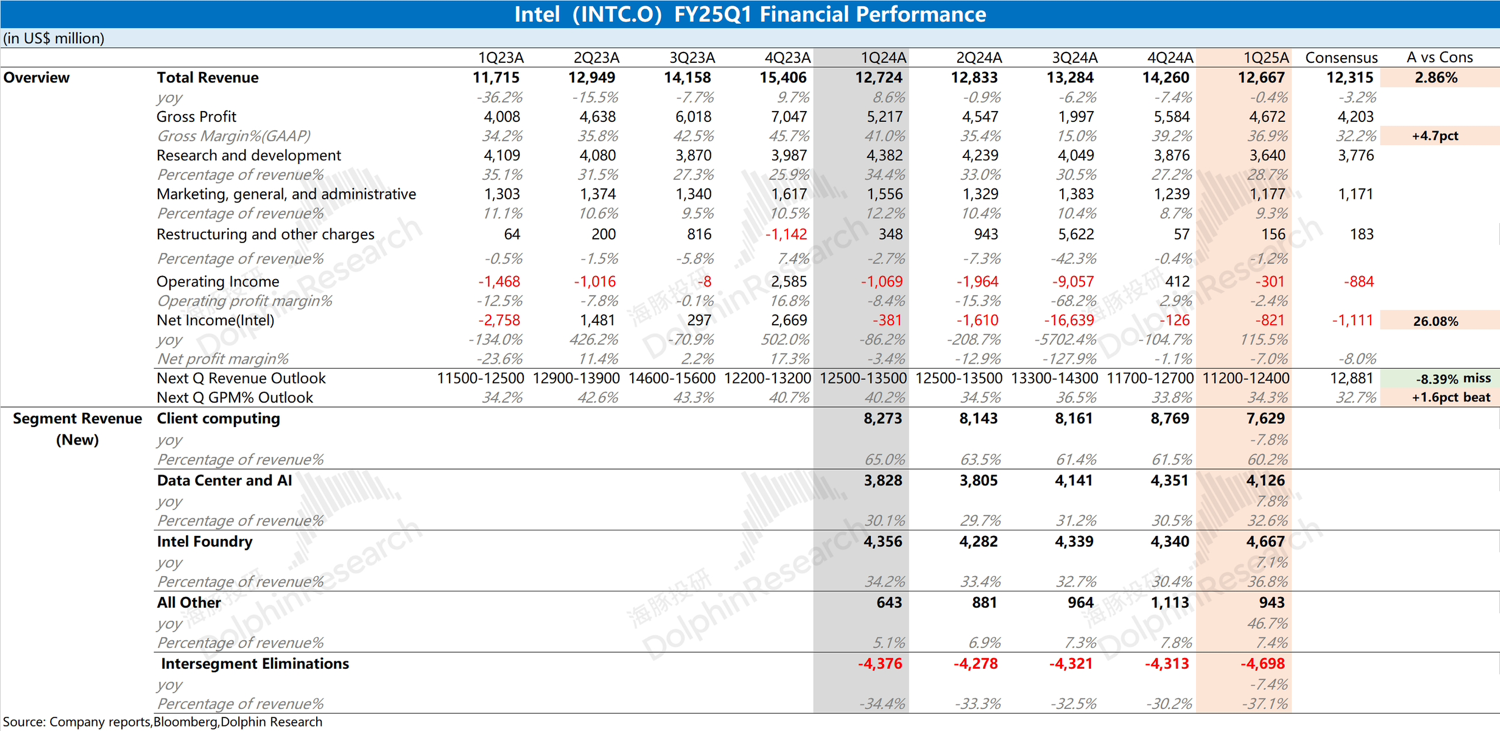

The company's financial results this quarter were decent, with revenue close to the upper end of previous guidance, and gross margin exceeding guidance by about 3 percentage points, mainly driven by the improvement in gross margin of the Data Center & AI business.

In terms of specific businesses, the company has restructured its operations into two main segments: Client Computing and Data Center & AI, which are also the company's primary revenue sources. Of the company's current quarterly revenue of $12.67 billion, Intel's proprietary products contributed $11.75 billion, indicating that the company's external foundry business remains quite limited.

Although the quarterly data was decent, the company's guidance for the next quarter remains weak. The company's revenue guidance for the next quarter is $11.2-12.4 billion (a year-on-year decline of 3.4%-12.7%), with a gross margin of around 34.3% (a year-on-year decline of 1.1 percentage points). Based on the guidance, the company's overall performance next quarter remains sluggish.

Overall, after changing its CEO, the company not only adjusted its business and team but also clarified its future focus on Client Computing, Data Center & AI, and 18A process R&D and production. Among these, Client Computing is aimed at consolidating traditional strengths, while Data Center & AI and 18A are intended to tap into the company's growth potential. Currently, the company's focus is on internal business restructuring, and there are no immediate signs of improvement in performance.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.