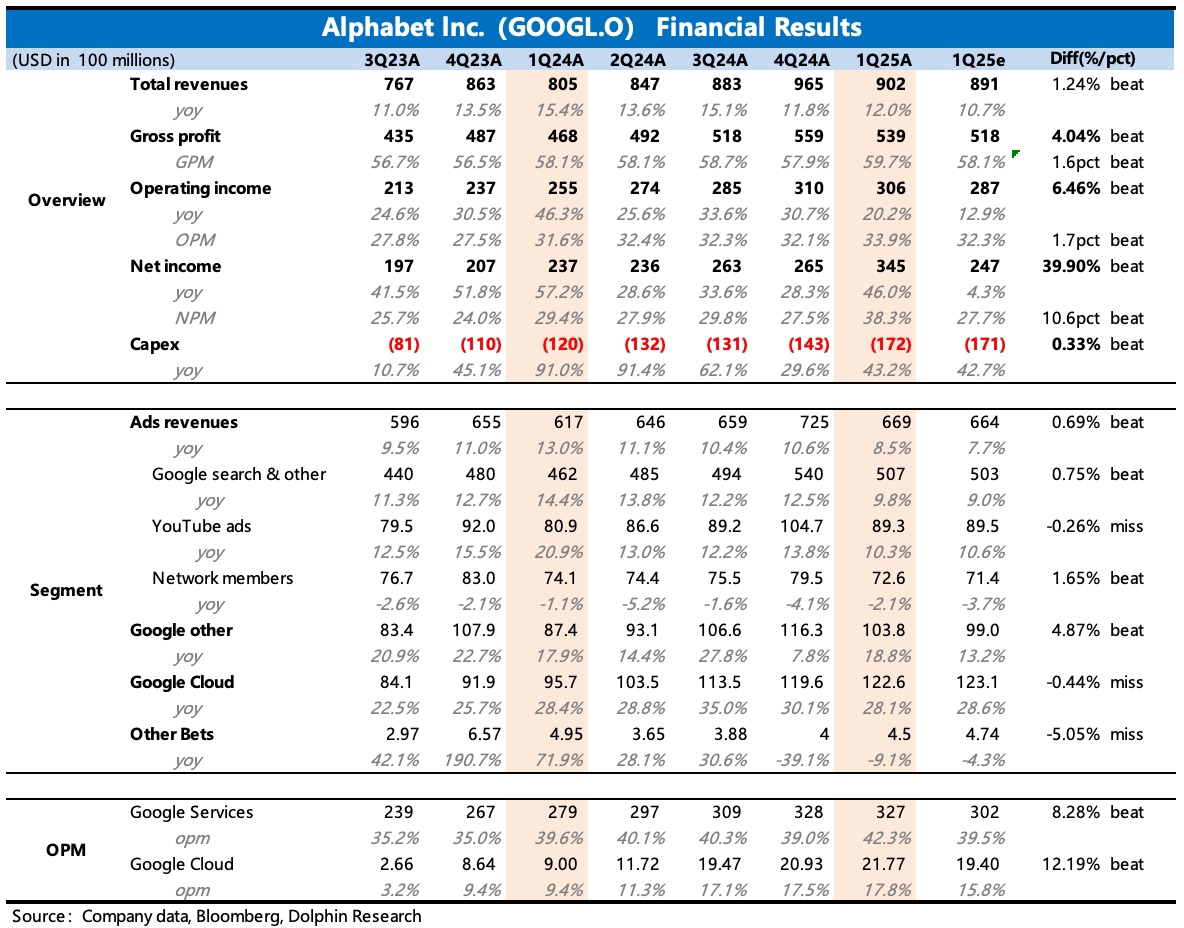

$Alphabet - C(GOOG.US)1Q25 Quick Interpretation: Against a backdrop of cautious sentiment, the advertising giant's Q1 performance was significantly stronger than conservative expectations, particularly in terms of profitability. With the tariff war temporarily de-escalating and showing signs of easing, this could alleviate some of the current tension:

1. Q1 operating margin continued to rise sequentially to 34%, with no immediate signs of pressure from increased spending (the significant beat in net profit was mainly driven by investment gains).

2. Although revenue also slightly exceeded expectations (primarily from search ads), the trend of slowing growth remains unbroken. This merely reflects the marginal weakening of U.S. consumer spending since mid-February and adjustments in merchants' ad budgets. As we enter Q2, the impact of the tariff threat remains uncertain—it’s too early to extrapolate linearly from Q1 results. Since Google doesn’t provide earnings guidance, this earnings call will be crucial.

According to Dolphin Research, institutional expectations for Google’s Q2 and full-year 2025 have been revised downward by about 1-2% for revenue and 3-5% for operating profit compared to last quarter. The focus of adjustments is on ads, but given that search ads—which account for over half of revenue—are performance-based, advertisers typically prioritize cutting brand ads and budgets on smaller platforms before considering reductions on major platforms’ performance ads. Thus, YouTube, with its brand ad exposure, may be more sensitive to macro conditions than search ads despite its massive traffic and short-video offerings.

3. Cloud business growth met high expectations. Thanks to AI, the market remains confident in its momentum. However, the GCP Next conference in mid-April noted some cooling demand from clients due to the broader environment, warranting caution.

4. Macro uncertainties and this year’s high investment pressure on profits make management’s commitment to shareholder returns more impactful amid historically low static valuations—the company announced an additional $70B buyback authorization. Combined with $10B in dividends, the full-year shareholder yield has risen to 4% following the significant market cap adjustment.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.