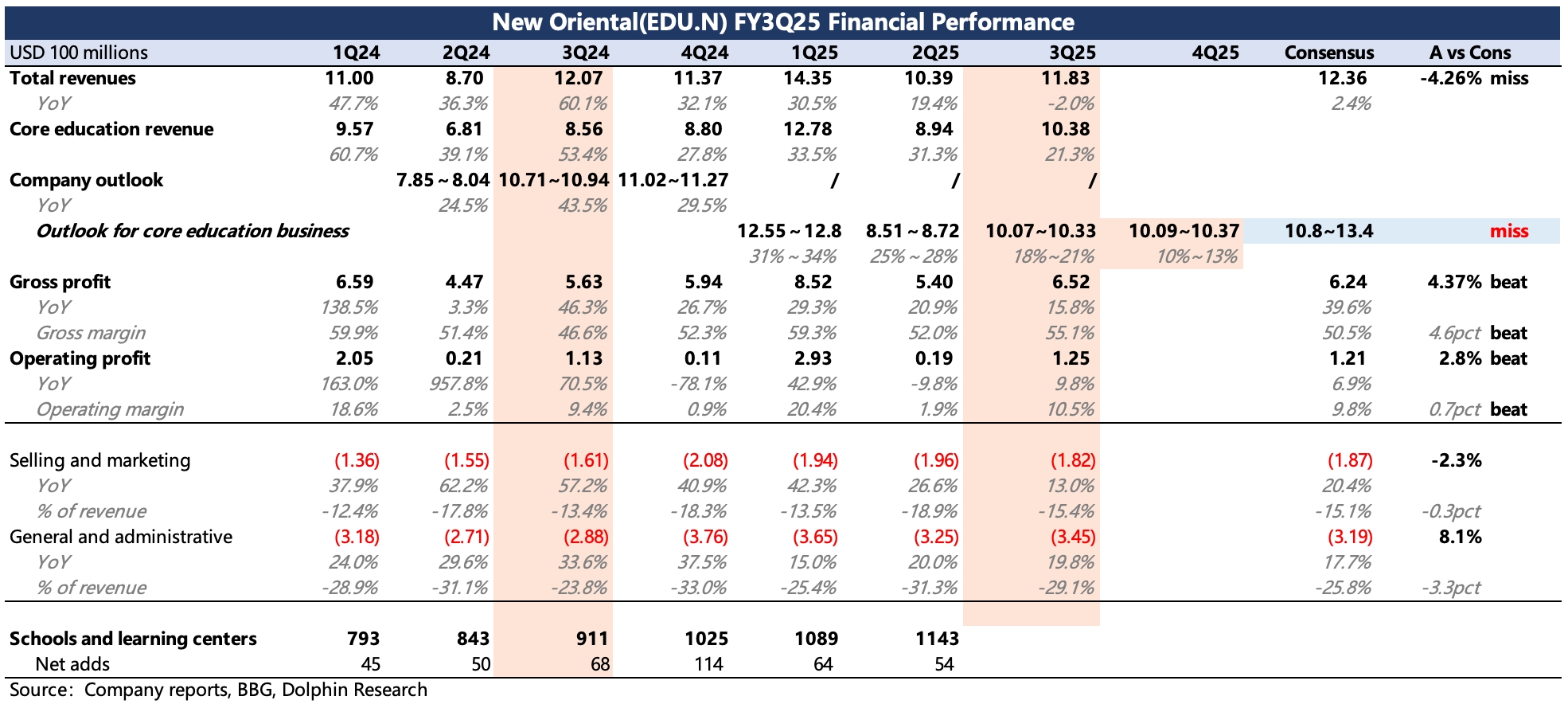

$New Oriental EDU & Tech(EDU.US) Quick Interpretation of 3Q25FY: The performance of 3Q25, corresponding to the peak season from December 2024 to February 2025, generally met expectations. Last month, the company had already guided the market to lower expectations (Bloomberg consensus expectations were somewhat lagging). However, during this round of trade war tensions, the study abroad business, which accounts for nearly a quarter of revenue, faced direct impact, exacerbating the slowdown in demand. Therefore, for this quarter's performance, the focus is mainly on management's guidance for the next quarter.

The reality is that management's guidance for Q4 core learning business revenue is weak, with an expected year-on-year growth of 10-13% (12%-15% growth in RMB terms), falling short of market expectations (most institutions had expected 11-12 billion in late March, with year-on-year growth exceeding 25%). The high institutional expectations were partly due to the low base last year and partly because they did not anticipate the unusually intense tariff confrontation. Although no breakdown was provided, Dolphin Research estimates that the pressure on the study abroad business was the main factor. Generally, test preparation demand precedes study abroad consulting services, and Q3 test preparation revenue growth had already slowed to 7%, indicating that study abroad demand has continued to slow since the beginning of the year.

Other businesses also experienced varying degrees of slowdown. Apart from new businesses, which remain relatively buoyant (slowing naturally to 35% on a high base), high school subject tutoring and adult English (college test preparation) growth also slowed to around 15%-17%.

For specific outlooks on segmented businesses and whether the pace of capacity expansion will be significantly adjusted amid increasing revenue growth pressure, you can pay attention to the upcoming earnings call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.