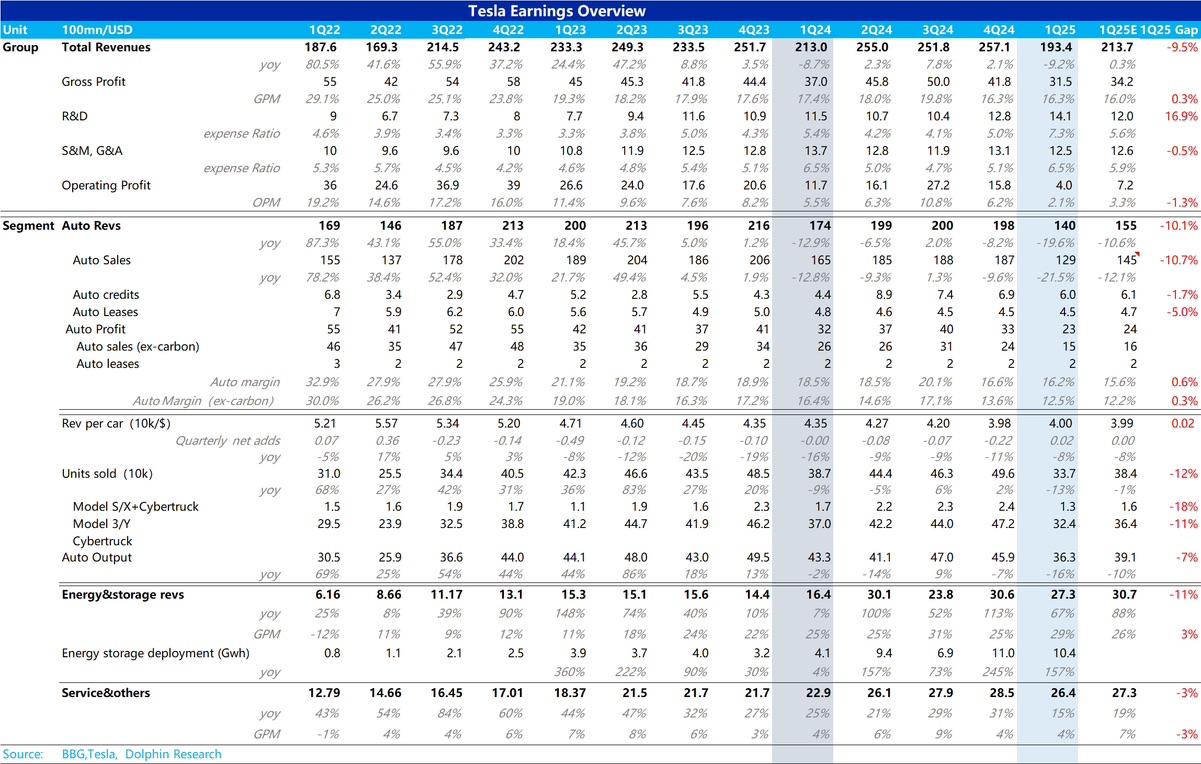

$Tesla(TSLA.US)Quick Interpretation: Overall, Tesla delivered a seemingly disappointing report this time. In terms of top-line revenue, Q1 total revenue was $19.34 billion, lower than Dolphin Research's consensus expectation of $21.4 billion and some major banks' expectations of $20 billion. However, in terms of gross margin, Tesla's Q1 gross margin was 16.3%, slightly higher than the market expectation of 16%.

As for the market's most concerned car sales business, Q1 total revenue was $14 billion, lower than the market expectation of $15.5 billion. However, after Dolphin Research analyzed the pure car sales price (excluding carbon credit impacts), they found the corresponding car sales price was $40,000, up from $39,800 in the previous quarter. Dolphin Research believes this is acceptable, mainly due to the higher starting price of the new Model Y Juniper, which partially offset discounts and incentives for inventory Model Y vehicles.

The gross margin for the pure car sales business (excluding carbon credit impacts) reached 12.5%, down 1.1 percentage points from the previous quarter. However, due to the low sales volume in Q1 and the impact of Model Y Juniper's production launch, the market had already anticipated this, with the consensus expectation at 12.2%. Some major banks were even more pessimistic, expecting it to drop to 11%-12%, so this performance exceeded market expectations.

Additionally, since Q1 is typically the bottom for car sales, Dolphin Research focuses on several key issues:

1) Will the budget Model 2.5 still be released?

Based on the current earnings report, it seems the budget Model 2.5 will still be produced in the first half of 2025. Pay attention to whether the earnings call provides more details about this model.

2) Will the 2025 sales forecast still maintain year-over-year growth?

Currently, Tesla has not reiterated its guidance for year-over-year sales growth in 2025. Tesla stated it will provide guidance in Q2. Since 2025 car sales are closely tied to the production and sales plan for the Model 2.5, Dolphin Research believes this model's planning is crucial.

3) Is Robotaxi progressing as planned?

It appears Robotaxi is still on track for a pilot launch in Texas in June.

4) Is Optimus on schedule according to previous guidance?

For details, please follow Dolphin Research's upcoming earnings analysis.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.