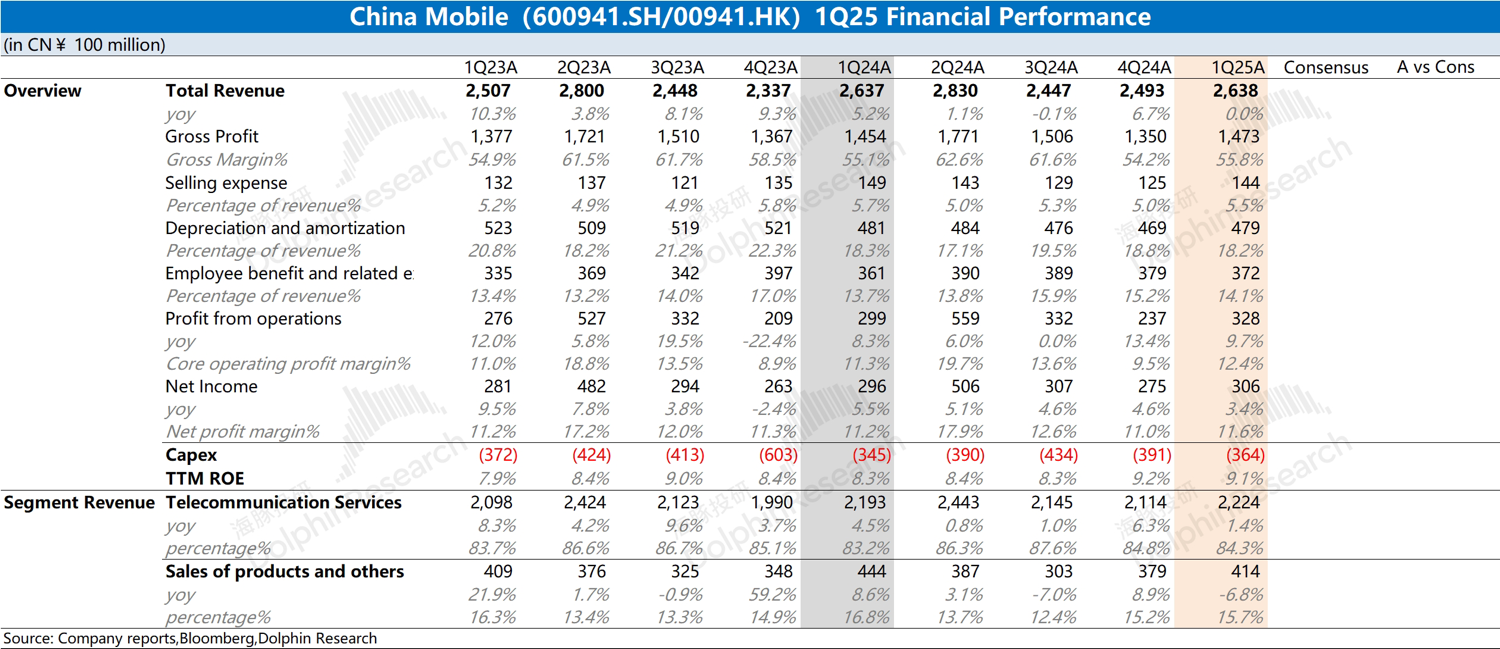

$中国移动(600941.SH)火线速读:财报依然稳健。公司本季度的收入同比持平,而利润端的增长,主要受公司毛利率提升和费用率回落的影响。公司当前用户数已经超过 10 亿,其中 5G 用户数达到了 5.78 亿。

个人市场是公司的基本盘,贡献了公司整体收入的一半以上。受人均资费下滑的影响,海豚君预估公司本季度的个人通讯业务收入同比下滑 1%。公司整体收入的能实现持平,主要得益于家庭、政企等市场通讯业务增长的带动。

在业绩端稳健发挥的同时,市场对公司的关注点主要在于资本开支和分红回购情况。公司本季度的资本开支约为 364 亿元,同比增长 5.5%。结合全年指引看,公司预期 2025 年资本开支 1512 亿元,同比下滑 7.8%。虽然一季度资本开支有所增长,但全年公司资本开支仍然是收缩的趋势,这将有利于减轻公司费用端的压力,提升利润端的表现。至于分红回归方面,公司通常会在二三季度进行,海豚君认为公司仍将继续保持着较高的股息支付率。

公司本次业绩中虽然小有瑕疵,但整体依然稳健。随着公司资本开支的收缩,利润端有望继续释放。在当前不稳定的市场环境下,凭借着 “稳稳当当” 的利润和较高的股息支付率,中国移动都将是分红逻辑下的选择之一。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。